Answered step by step

Verified Expert Solution

Question

1 Approved Answer

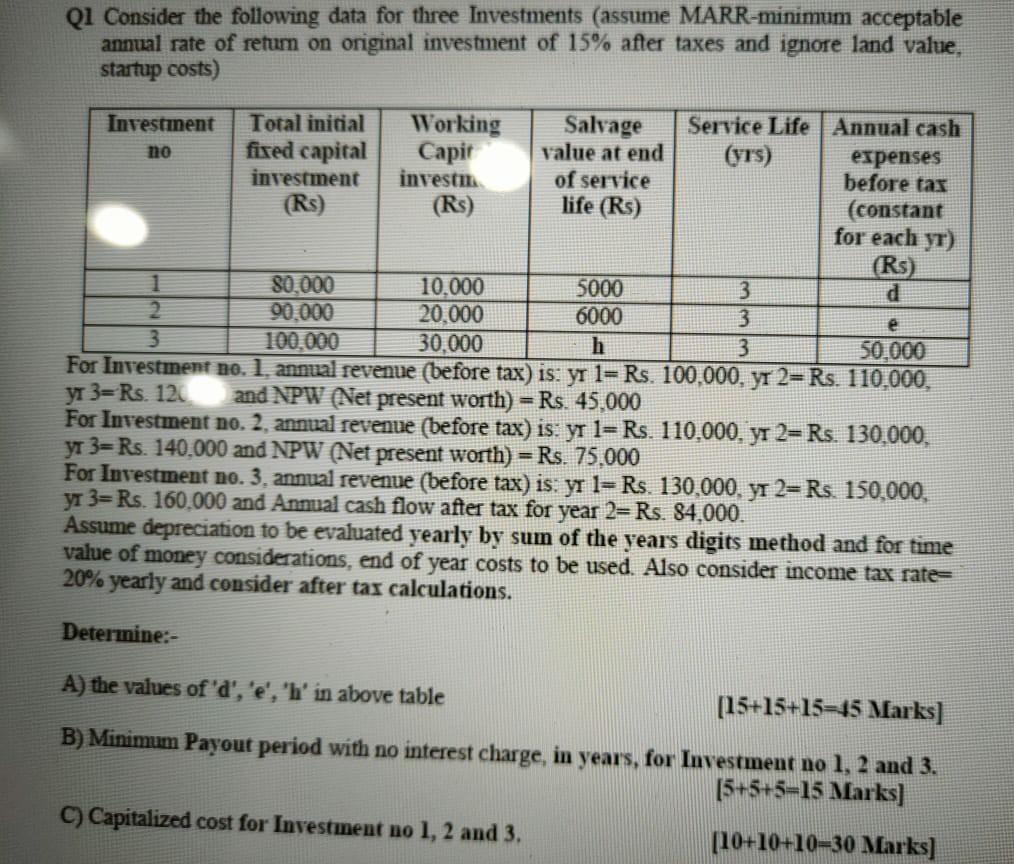

QI Consider the following data for three Investments (assume MARR-minimum acceptable annual rate of retum on original investment of 15% after taxes and ignore land

QI Consider the following data for three Investments (assume MARR-minimum acceptable annual rate of retum on original investment of 15% after taxes and ignore land value. startup costs) e Investment Total initial Working Salvage Service Life Annual cash no fired capital Capit value at end (yrs) expenses investment investi of service before tas (Rs) (Rs) life (Rs) (constant for each yr) (Rs) 1 80,000 10.000 5000 3 d 2 90.000 20.000 6000 3 3 100,000 30.000 h 3 50.000 For Investment no. 1. annual revenue (before tax) is: yr 1= Rs. 100.000, yr 2=Rs. 110.000, y 3= Rs. 12 and NPW (Net present worth) = Rs. 45.000 For Investment no. 2, annual revenue (before tax) is: yr 1= Rs. 110.000.y 2= Rs. 130.000, yr 3=Rs. 140.000 and NPW (Net present worth) = Rs. 75.000 For Investment no. 3. annual revenue (before tax) is: yr 1= Rs. 130,000. y 2= Rs. 150,000, yr 3= Rs. 160.000 and Annual cash flow after tax for year 2= Rs. 84.000. Assume depreciation to be evaluated yearly by sum of the years digits method and for time value of money considerations, end of year costs to be used. Also consider income tax rate 20% yearly and consider after tax calculations. Determine:- A) the values of 'd', 'e', 'l' in above table [15+15+15=45 Marks] B) Minimum Payout period with no interest charge, in years, for Investment no 1, 2 and 3. [5+5+5=15 Marks] C) Capitalized cost for Investment no 1, 2 and 3. [10+10+1030 Marks] QI Consider the following data for three Investments (assume MARR-minimum acceptable annual rate of retum on original investment of 15% after taxes and ignore land value. startup costs) e Investment Total initial Working Salvage Service Life Annual cash no fired capital Capit value at end (yrs) expenses investment investi of service before tas (Rs) (Rs) life (Rs) (constant for each yr) (Rs) 1 80,000 10.000 5000 3 d 2 90.000 20.000 6000 3 3 100,000 30.000 h 3 50.000 For Investment no. 1. annual revenue (before tax) is: yr 1= Rs. 100.000, yr 2=Rs. 110.000, y 3= Rs. 12 and NPW (Net present worth) = Rs. 45.000 For Investment no. 2, annual revenue (before tax) is: yr 1= Rs. 110.000.y 2= Rs. 130.000, yr 3=Rs. 140.000 and NPW (Net present worth) = Rs. 75.000 For Investment no. 3. annual revenue (before tax) is: yr 1= Rs. 130,000. y 2= Rs. 150,000, yr 3= Rs. 160.000 and Annual cash flow after tax for year 2= Rs. 84.000. Assume depreciation to be evaluated yearly by sum of the years digits method and for time value of money considerations, end of year costs to be used. Also consider income tax rate 20% yearly and consider after tax calculations. Determine:- A) the values of 'd', 'e', 'l' in above table [15+15+15=45 Marks] B) Minimum Payout period with no interest charge, in years, for Investment no 1, 2 and 3. [5+5+5=15 Marks] C) Capitalized cost for Investment no 1, 2 and 3. [10+10+1030 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started