Answered step by step

Verified Expert Solution

Question

1 Approved Answer

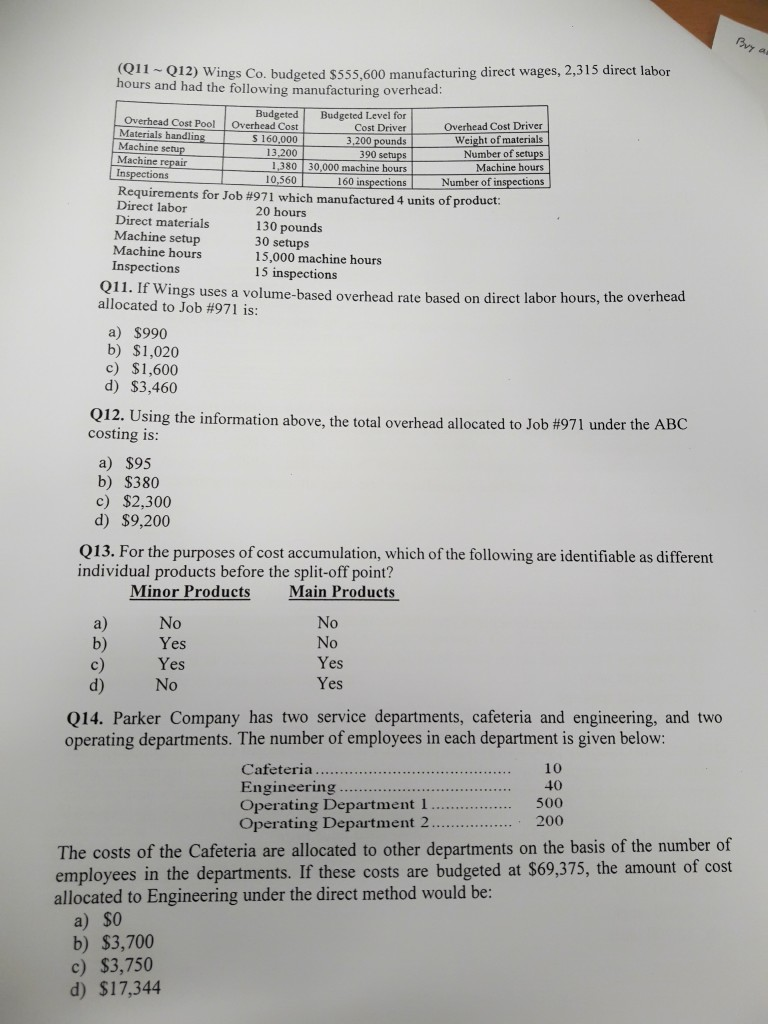

(Ql1 Q12) Wings Co. budgeted $555.600 manufacturing direct wages, 2,315 direct labor hours and had the following manufacturing overhead: Budgeted Level for OverheadC S 160,000

(Ql1 Q12) Wings Co. budgeted $555.600 manufacturing direct wages, 2,315 direct labor hours and had the following manufacturing overhead: Budgeted Level for OverheadC S 160,000 Overhead Cost Pool Materials handling Machine setup Overhead Cost Driver Weight of materials Number of setups Machine hours 3,200 pounds 390 setups 30,000 machine hours 13,200 repair Inspections 1,380 10,560 160 inspections for Job # 971 which manufactured 4 units of product: Number of inspections Requireme Direct labor Direct materials Machine setup Machine hours 20 hours 130 pounds setups ,000 machine hours 15 inspections Inspections Q11. If Wings uses a volume-based overhead rate based on direct labor hours, the overhead allocated to Job # 971 is: a) $990 b) $1,020 c) $1,600 d) $3,460 Q12. Using the information above, the total overhead allocated to Job # 971 under the ABC costing is: a) 5 b) $380 c) $2,300 d) $9,200 Q13. For the purposes of cost accumulation, which of the following are identifiable as different individual products before the split-off point? Main Products Minor Products a) b) c) d) No No No Yes Yes Yes Yes No Q14. Parker Company has two service departments, cafeteria and engineering, and two operating departments. The number of employees in each department is given below: Cafeteria Engineering Operating Department 1 Operating Department 2 10 40 500 200 The costs of the Cafeteria are allocated to other departments on the basis of the number of employees in the departments. If these costs are budgeted at $69,375, the amount of cost allocated to Engineering under the direct method would be: a) $0 b) $3,700 c) $3,750 d) $17,344 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started