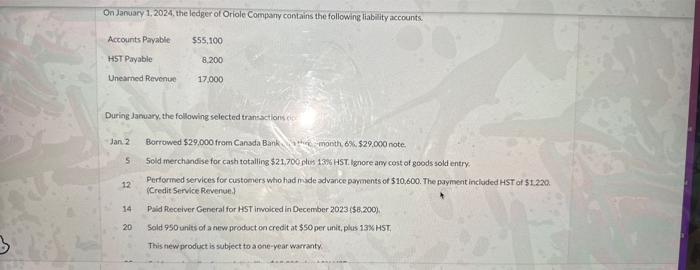

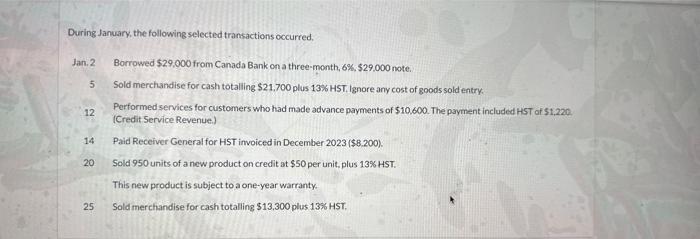

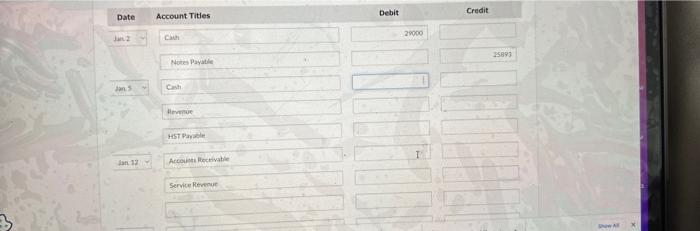

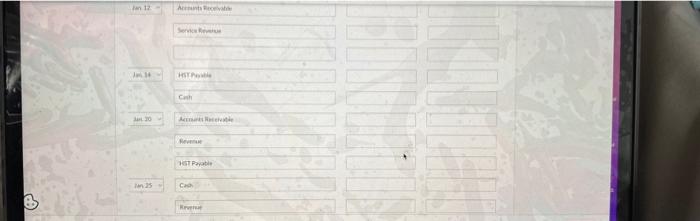

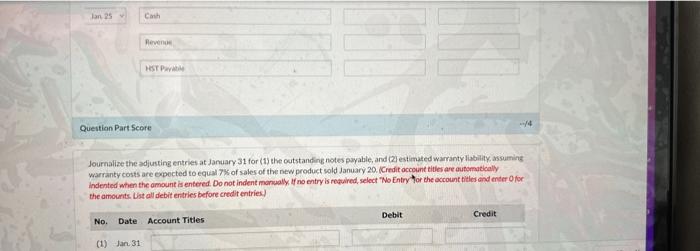

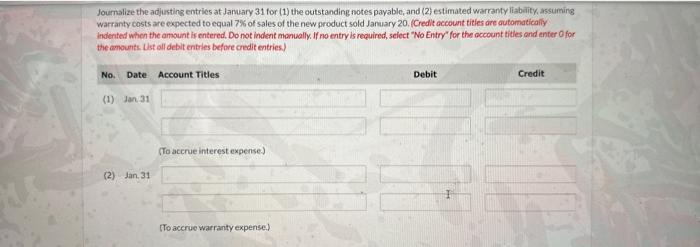

Qn January 1, 2024, the ledger of Oriole Company contains the following liabi ity accounts. During Jamuary, the following selected transactions cip Jan 2 Borrowed 529,000 from Cansda Bank 4 thicesmonth, 6%,$29,000 note 5. Sold merchandise for cash totalling $21,700 olus 1306H5. lenore any cost of goods sold entry. 12. Performed services for customers whio had made odvance paiments of $10,600. The paymeat incideded HST af $1.220. (Credit Service Revenue. 14 Paid Receiver General for HST invoiced in December 2023 (\$5,200), 20 Sold 950 units of a newe product on credit at $50 per unit, plas 13WHST. This new product is subject to a one-year warranty. During January, the following selected transactions occurred, Jan.2 Borrowed $29,000 from Canada Bank on a three-month, 6%,$29,000 note. 5 Sold merchandise for cash totaliing $21,700 plus 13% HST, Ignore any cost of goods sold entry. 12 Performed services for customers who had made advance payments of $10,600. The payment included HST of $1,220. (Credit Service Revenue.) 14 Paid Receiver General for HST invoiced in December 2023 (\$8.200). 20 Sold 950 units of a new product on credit at $50 per unit, plus 13% HST. This new product is subject to a one-year warranty. 25 Sold merchandise for cash totalling $13.300 plus 13% HST. Himpiue Hist parasolet Account lectivabie Service Remone Journalize the adjusting entries at January 31 for (1) khe cutstanding notes payable, and (2) estimated warranty liability, assuming warranty costs are expected to equal 7 of sales of the new product sold January 20 . Credit occount titles are outomatically indented when the amount is entered. Do not indent manualy if no entry is roquired, select "No Entry thor che account hities and enter 0 for. the amounts Ust all debit entries before credit entries) Journalize the adjusting entries at Jamuary 31 for (1) the outstanding notes payable, and (2) estimated warranty liabality, assuming warranty costs are expected to equal 7% of sales of the new product sold January 20 . (Credit account tities are automatically: indented when the amount is entered, Do not indent montally. If no entry is required, seiect "No Entry" for the occount tidles and enter 0 for the amounts (ist all debit entries before credit entries.)