Answered step by step

Verified Expert Solution

Question

1 Approved Answer

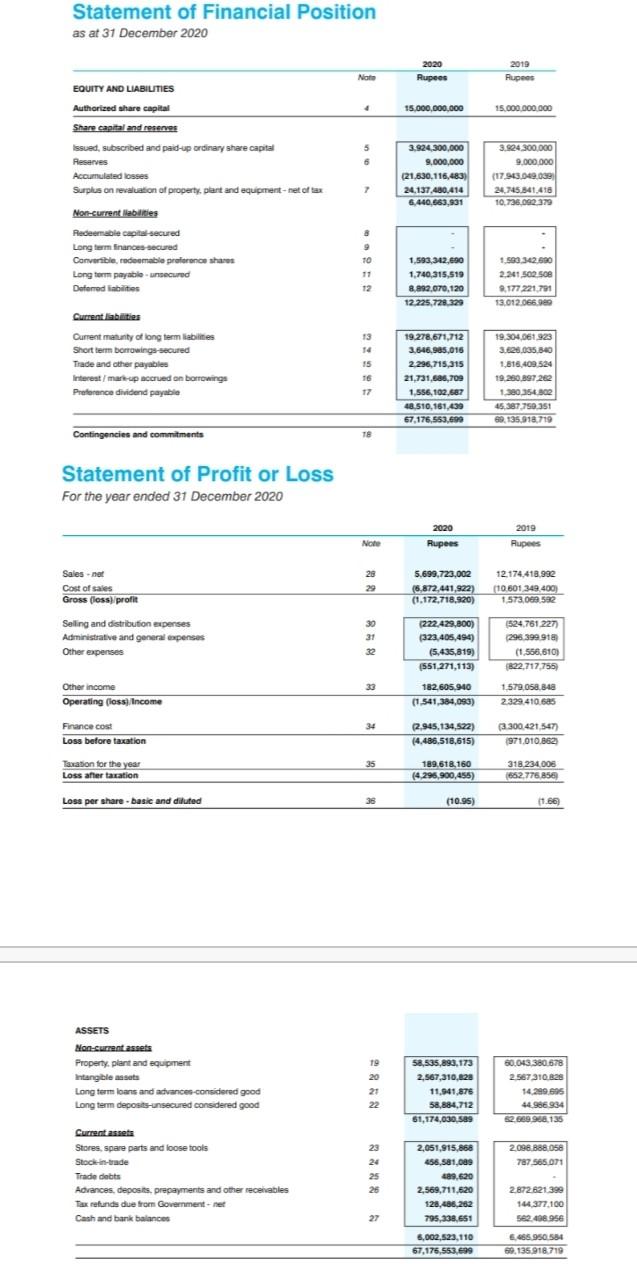

Q.No.1 you are required to perform Vertical analysis for both the statement (provided above). Analyze both the statements, provide interpretation and a comprehensive judgement as

Q.No.1 you are required to perform Vertical analysis for both the statement (provided above). Analyze both the statements, provide interpretation and a comprehensive judgement as if the company is lucrative for the purpose of investment for the investors or not. (Subject Analysis Of Financial Statement)

Statement of Financial Position as at 31 December 2020 2020 Rupees 2019 Rupees Note 15,000,000,000 15.000.000.000 5 EQUITY AND LIABILITIES Authorized share capital Share capital and reserves issued, subscribed and paid up ordinary share capital Reserves Accumulated losses Surplus on evaluation of property, plant and equipment-net of tax Non-current abilities Redeemable capital-secured Long term finances secured Convertible, redeemable preference shares Long term payable recured Deferred abilities 3.924,300,000 9,000,000 (21.630.116,483) 24.137.480.414 6.440,663,931 3.924 300 000 9.000.000 (17.963.049,0391 24,745.841.416 10.736 092 379 7 a 9 TO 150 1420 11 12 1.593,342.600 1,740,315,519 8,892,070, 120 12.225.728.129 2.241 502 508 177 221.791 13.012.0669 13 14 Current liabilities Current many of long term abiities Short term borrowings-secured Trade and other payable Interest markup accrued on borrowings Preference dividend payable 15 TE 19.278,671,712 3,646,985,016 2.296,715,315 21,731,686,709 1.556,102.687 48.510, 161,439 67,176.553.699 19.304.061.923 3.628.035.840 1.816.409 524 19.280.897262 1.380 354.30 45.387.750 351 69. 135.912,719 17 Contingencies and commitments TE Statement of Profit or Loss For the year ended 31 December 2020 2020 Rupees 2019 Rupees Note 28 29 5.699,723,002 (5.872.441.922) (1,172,718,920) 12 174.418.992 (10.601 349.400 1.573,089 592 Sales.net Cost of sales Gross (loss profit ) Selling and distribution expenses Administrative and general expenses Other expenses 39 31 (222.429.800) (323.405,494) (5,435,819) (551.271,113) 1524 761 227) 296 399 918 (1 556,610) 822,717755 33 Other income Operating (loss) Income 182.605.940 (1.541,384,093) 1579 osa 34 2399 410 SAS 34 Finance cost Loss before taxation (2.945,134,522) (4.486.518,615) (3.300 421,547) 971.010.882) 35 Taxation for the year Loss after taxation 189.618.160 (4.295,900,455) 318.234 008 1652.776.855 Losa per share-basic and diluted - (10.95) (1.60) ASSETS Non-surrent assets Property, plant and equipment Intangible assets Long term loans and advances considered good Long term deposts-unsecured considered good 19 20 2+ 22 58,535,893,173 2,567,310,828 11.941.875 58,884,712 61,174,030.589 30.043.380 678 2567310 328 14299 695 44.986 934 52.669.908,135 23 24 2098 888 058 787 565.071 Current assets Stores, spare parts and loose tools Stock-in-trade Tradie debts Advances, deposits prepayments and other rechables Tax refunds due from Government- Cash and bank balances 2,051,915,868 456.581.ca 4,620 2,569,711,620 128.486,262 795,338,651 26 2.872.621.399 144.377.100 562.408.956 27 6,002,523,110 67,175,553,699 5.465 950 584 69,135,918.719Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started