Answered step by step

Verified Expert Solution

Question

1 Approved Answer

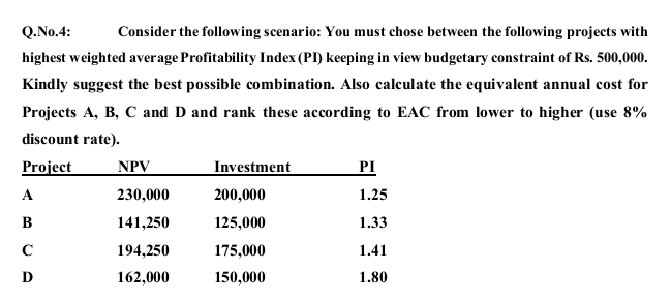

Q.No.4: Consider the following scenario: You must chose between the following projects with highest weighted average Profitability Index (PI) keeping in view budgetary constraint of

Q.No.4: Consider the following scenario: You must chose between the following projects with highest weighted average Profitability Index (PI) keeping in view budgetary constraint of Rs. 500,000. Kindly suggest the best possible combination. Also calculate the equivalent annual cost for Projects A, B, C and D and rank these according to EAC from lower to higher (use 8% discount rate). Project NPV Investment PI 230,000 200,000 1.25 B 141,250 125,000 1.33 194,250 175,000 1.41 162,000 150,000 1.80 D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started