Question

Q.No.4 Mr. Ali compared his cash book with bank statement and found some discrepancies notably as follows: Mr. Ali Paid in the bank through cheques

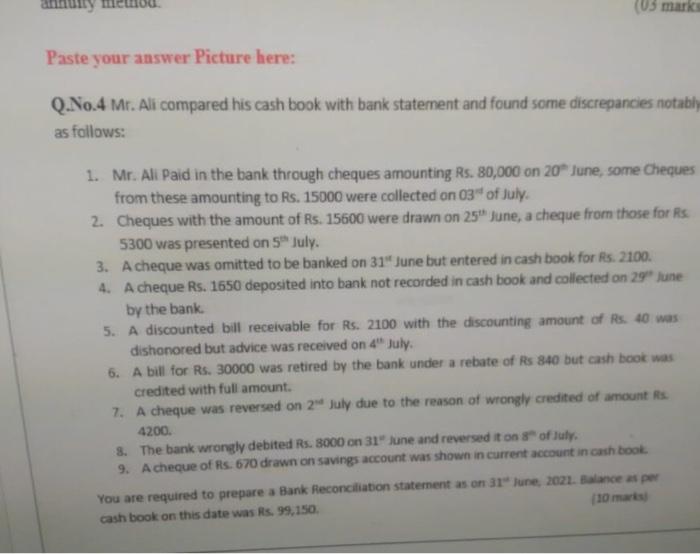

Q.No.4 Mr. Ali compared his cash book with bank statement and found some discrepancies notably as follows:

Mr. Ali Paid in the bank through cheques amounting Rs. 80,000 on 20th June, some Cheques from these amounting to Rs. 15000 were collected on 03rd of July.

Cheques with the amount of Rs. 15600 were drawn on 25th June, a cheque from those for Rs. 5300 was presented on 5th July.

A cheque was omitted to be banked on 31st June but entered in cash book for Rs. 2100.

A cheque Rs. 1650 deposited into bank not recorded in cash book and collected on 29th June by the bank.

A discounted bill receivable for Rs. 2100 with the discounting amount of Rs. 40 was dishonored but advice was received on 4th July.

A bill for Rs. 30000 was retired by the bank under a rebate of Rs 840 but cash book was credited with full amount.

A cheque was reversed on 2nd July due to the reason of wrongly credited of amount Rs. 4200.

The bank wrongly debited Rs. 8000 on 31st June and reversed it on 8th of July.

A cheque of Rs. 670 drawn on savings account was shown in current account in cash book.

You are required to prepare a Bank Reconciliation statement as on 31st June, 2021. Balance as per cash book on this date was Rs. 99,150. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started