Answered step by step

Verified Expert Solution

Question

1 Approved Answer

qnswer the three questions You found a 10-year bond that you feel fits in your portfolio very well. Its par value is $100, has a

qnswer the three questions

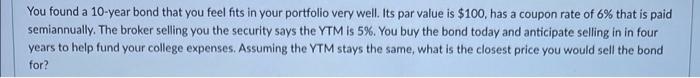

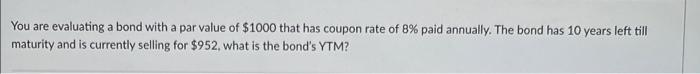

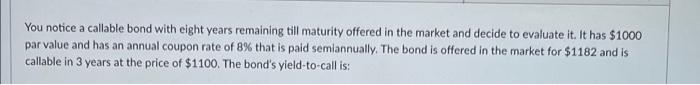

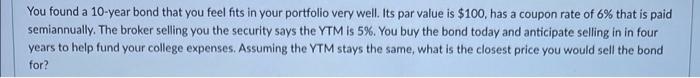

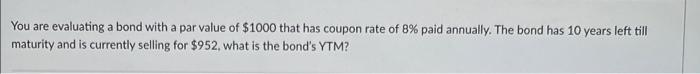

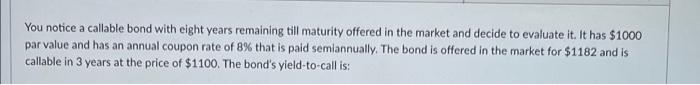

You found a 10-year bond that you feel fits in your portfolio very well. Its par value is $100, has a coupon rate of 6% that is paid semiannually. The broker selling you the security says the YTM is 5%. You buy the bond today and anticipate selling in in four years to help fund your college expenses. Assuming the YTM stays the same, what is the closest price you would sell the bond for? You are evaluating a bond with a par value of $1000 that has coupon rate of 8% paid annually. The bond has 10 years left till maturity and is currently selling for $952, what is the bond's YTM? You notice a callable bond with eight years remaining till maturity offered in the market and decide to evaluate it. It has $1000 par value and has an annual coupon rate of 8% that is paid semiannually. The bond is offered in the market for $1182 and is callable in 3 years at the price of $1100. The bond's yield-to-call is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started