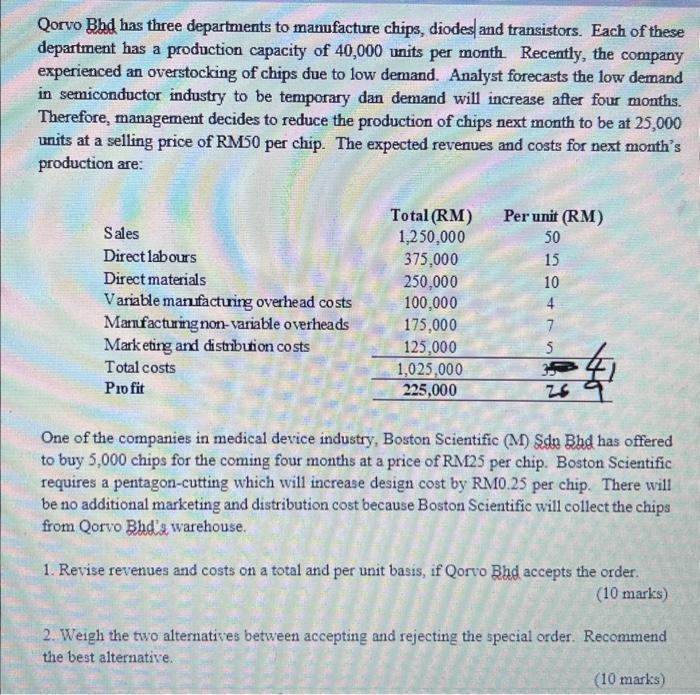

Qorvo Bhd has three departments to manufacture chips, diodes/and transistors. Each of these department has a production capacity of 40,000 units per month. Recently, the company experienced an overstocking of chips due to low demand. Analyst forecasts the low demand in semiconductor industry to be temporary dan demand will increase after four months. Therefore, management decides to reduce the production of chips next month to be at 25,000 units at a selling price of RM50 per chip. The expected revenues and costs for next month's production are: One of the companies in medical device industry, Boston Scientific (M) Sdu Bhd has offered to buy 5,000 chips for the coming four months at a price of RM25 per chip. Boston Scientific requires a pentagon-cutting which will increase design cost by RM0.25 per chip. There will be no additional marketing and distribution cost because Boston Scientific will collect the chips from Qorvo Bhd's warehouse. 1. Revise revenues and costs on a total and per unit basis, if Qorvo Bhd accepts the order. (10 marks) 2. Weigh the two alternatives between accepting and rejecting the special order. Recommend the best alternative. ( 10 marks) 3. Explain two qualitative factors to be taken into consideration before Qorvo Bhd accepts the order. (4 marks) 4. Recently, there was a revision to the analyst's forecast about demand in the semiconductor industry. It is presumed that demand in foreseeable future will remain at 25,000 chips per month. Therefore, Qorvo Bhd plans to develop long-term market for the excess capacity of 15,000 chips by approaching other companies within the medical device industry. Assume that three medical device's companies agreed to enter into a five-year agreement for a supply of 15,000 chips at a price of RM30 per chip. The design cost remains at RM0.25 per chip. On the other hand, if Qorvo Bhd decides to downsize its production capacity to 25,000 units per month, it will be able to save RMB0,000 manufacturing non-variable cost per month and a further savings of RM10,000 in monthly marketing costs. Direct materials, direct labor, and variable manufacturing overhead will accordingly reduce by 37.5%. In addition, the company can rent-out the additional space for RM70,000 per month. a. Investigate whether Qorvo Bhd should accept the additional offer of 15,000 chips per month or downsize its production capacity? (10 marks) b. Recommend the best course of action for Qorvo Bhd. (1 mark) (Total: 35 marks)