Answered step by step

Verified Expert Solution

Question

1 Approved Answer

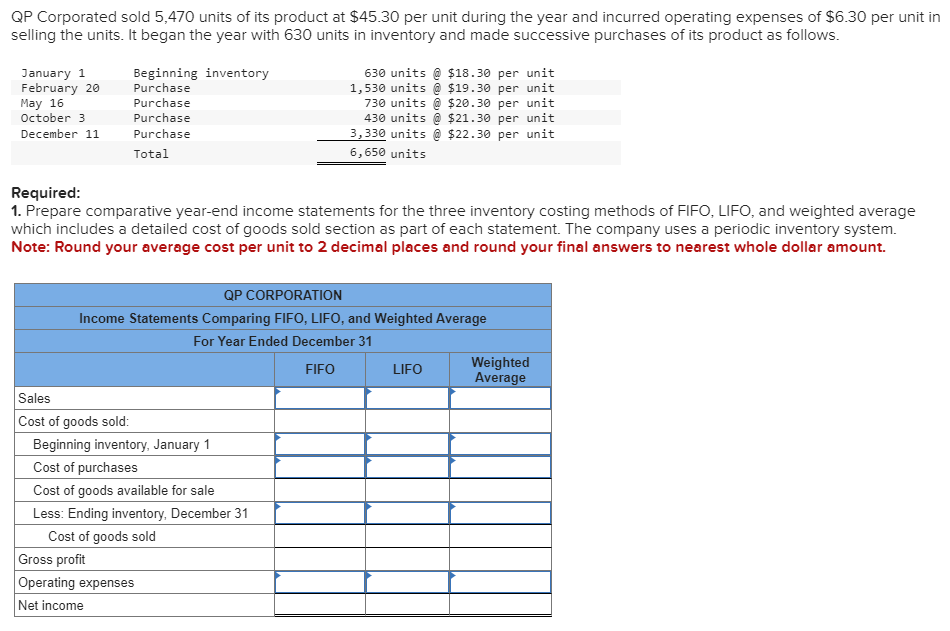

QP Corporated sold 5,470 units of its product at $45.30 per unit during the year and incurred operating expenses of $6.30 per unit in

QP Corporated sold 5,470 units of its product at $45.30 per unit during the year and incurred operating expenses of $6.30 per unit in selling the units. It began the year with 630 units in inventory and made successive purchases of its product as follows. January 1 Beginning inventory February 20 May 16 Purchase Purchase Purchase Purchase Total October 3 December 11 630 units @ $18.30 per unit 1,530 units @ $19.30 per unit 730 units @ $20.30 per unit 430 units @ $21.30 per unit 3,330 units @ $22.30 per unit 6,650 units Required: 1. Prepare comparative year-end income statements for the three inventory costing methods of FIFO, LIFO, and weighted average which includes a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system. Note: Round your average cost per unit to 2 decimal places and round your final answers to nearest whole dollar amount. QP CORPORATION Income Statements Comparing FIFO, LIFO, and Weighted Average For Year Ended December 31 Sales Cost of goods sold: Beginning inventory, January 1 Cost of purchases Cost of goods available for sale Less: Ending inventory, December 31 Cost of goods sold Gross profit Operating expenses Net income FIFO Weighted LIFO Average

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the comparative yearend income statements for FIFO LIFO and weighted average inventory co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started