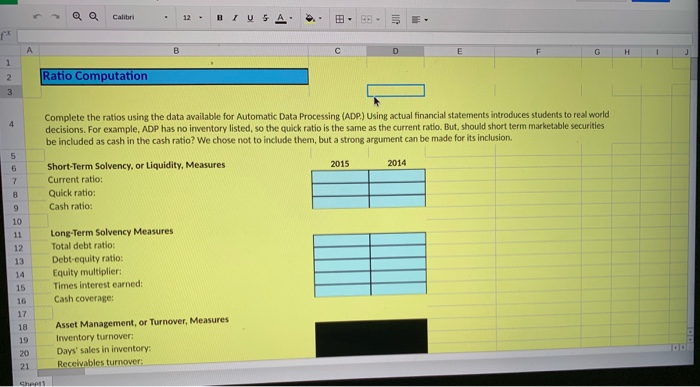

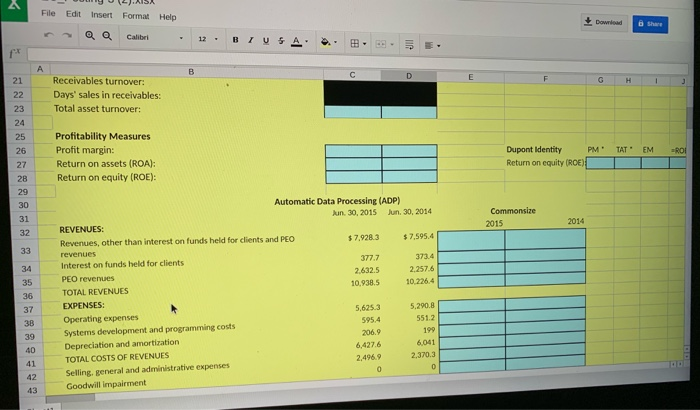

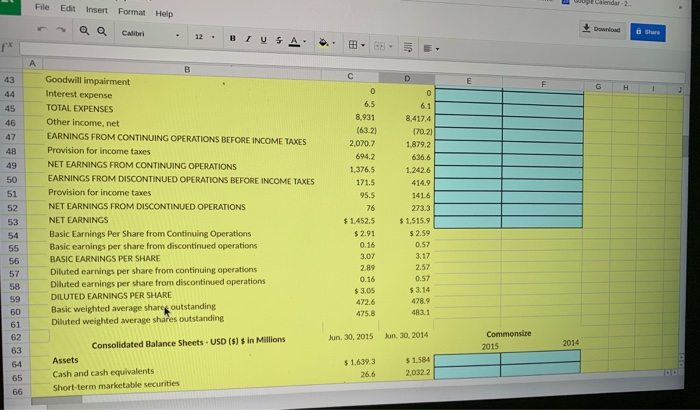

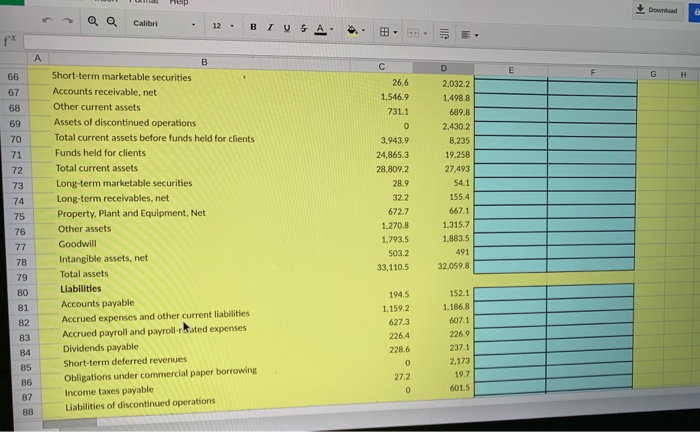

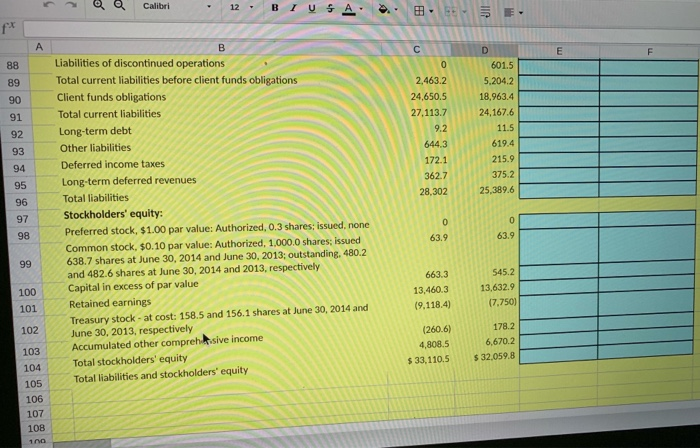

QQ Calibri . 12. B USA - Ratio Computation Complete the ratios using the data available for Automatic Data Processing (ADP) Using actual financial statements introduces students to real world decisions. For example, ADP has no inventory listed, so the quick ratio is the same as the current ratio. But, should short term marketable securities be included as cash in the cash ratio? We chose not to include them, but a strong argument can be made for its inclusion 2015 2014 Short-Term Solvency, or Liquidity, Measures Current ratio: Quick ratio: Cash ratio: Long-Term Solvency Measures Total debt ratio: Debt-equity ratio: Equity multiplier: Times interest earned: Cash coverage: Asset Management, or Turnover, Measures Inventory turnover: Days' sales in inventory: Receivables turnover: File Domy (2).AISA Edit Insert Format Help QQ Calibri . 12. BIUSA... B Download E . Receivables turnover: Days' sales in receivables: Total asset turnover: RO Profitability Measures Profit margin: Return on assets (ROA): Return on equity (ROE): Dupont Identity PMTATEM Return on equity (ROE) Commonsize 2015 2014 Automatic Data Processing (ADP) Jun 30, 2015 Jun 30, 2014 REVENUES: Revenues, other than interest on funds held for clients and PEO $7,928.3 $ 7.595.4 revenues Interest on funds held for clients 377.7 373.4 PEO revenues 2.632.5 2.257.6 TOTAL REVENUES 10.938.5 10.226.4 EXPENSES: 5.625.3 5,290.8 Operating expenses 595.4 5512 Systems development and programming costs 206.9 199 Depreciation and amortization 6,427.6 TOTAL COSTS OF REVENUES 2.4969 2,370.3 Selling, general and administrative expenses Goodwill impairment by Calendar-2 File Edit Insert Format Help Download 6 . E. E F G H I 47 6.5 8.931 (63.2) 2,070.7 694.2 1,376,5 171.5 95.5 Goodwill impairment Interest expense TOTAL EXPENSES Other income, net EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Provision for income taxes NET EARNINGS FROM CONTINUING OPERATIONS EARNINGS FROM DISCONTINUED OPERATIONS BEFORE INCOME TAXES Provision for income taxes NET EARNINGS FROM DISCONTINUED OPERATIONS NET EARNINGS Basic Earnings Per Share from Continuing Operations Basic earnings per share from discontinued operations BASIC EARNINGS PER SHARE Diluted earnings per share from continuing operations Diluted earnings per share from discontinued operations DILUTED EARNINGS PER SHARE Basic weighted average share outstanding Diluted weighted average shares outstanding 0 6.1 8.417.4 (70.2) 1,879.2 636.6 1,242.6 414.9 141.6 273.3 $ 1.515.9 $2.59 $ 1.452.5 $2.91 0.16 0.57 3.07 2.99 0.16 3.17 2.57 $ 3.05 4226 4758 0.57 $ 3.14 4789 483.1 Jun 30, 2015 Jun 30, 2014 Commonside 2015 Consolidated Balance Sheets - USD ($) $ in Millions Assets Cash and cash equivalents Short-term marketable securities $1,639.3 266 $1,584 2,0322 Download QQ Calibri . 12. BI S A .. . 65- 5 E E F G H 26.6 1,546.9 731.1 Short-term marketable securities Accounts receivable, net Other current assets Assets of discontinued operations Total current assets before funds held for clients Funds held for clients Total current assets Long-term marketable securities Long-term receivables, net Property, Plant and Equipment, Net Other assets Goodwill Intangible assets, net Total assets Liabilities Accounts payable Accrued expenses and other current liabilities Accrued payroll and payrollrated expenses Dividends payable Short-term deferred revenues Obligations under commercial paper borrowing Income taxes payable Liabilities of discontinued operations 3.943.9 24,865.3 28,809.2 28.9 32.2 672.7 1,270.8 1,793.5 503.2 33.110.5 2,032.2 1,498.8 689.8 2,430.2 8.235 19.258 27.493 54.1 155.4 667.1 1,315.7 1.883.5 491 32,059.8 1945 1.159.2 627.3 226.4 228.6 152.1 1.186.8 607.1 226.9 237.1 2,173 19.7 601.5 0 27.2 0 7 Calibri . 12. BI USA E F 2,463.2 24,650.5 27,113.7 601.5 5.204.2 18,963.4 24,167.6 11.5 619.4 215.9 375.2 25,389.6 28,302 Liabilities of discontinued operations Total current liabilities before client funds obligations Client funds obligations Total current liabilities Long-term debt Other liabilities Deferred income taxes Long-term deferred revenues Total liabilities Stockholders' equity: Preferred stock, $1.00 par value: Authorized, 0.3 shares: issued, none Common stock, $0.10 par value: Authorized, 1,000.0 shares: Issued 638.7 shares at June 30, 2014 and June 30, 2013; outstanding, 480.2 and 482.6 shares at June 30, 2014 and 2013, respectively Capital in excess of par value Retained earnings Treasury stock - at cost: 158.5 and 156.1 shares at June 30, 2014 and June 30, 2013, respectively Accumulated other comprensive income Total stockholders' equity Total liabilities and stockholders' equity 63.9 663.3 13,460.3 (9,118.4) 545.2 13,632.9 17.750) (260.6) 4,808.5 $ 33, 110.5 178.2 6,670.2 $ 32,059.8 105 106 107 100