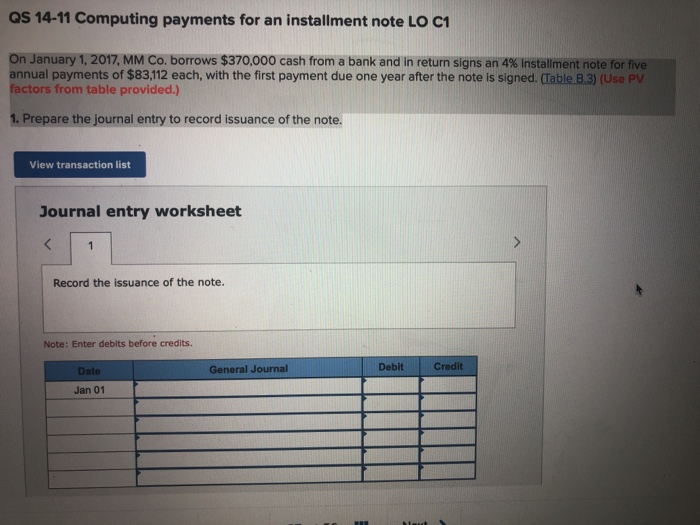

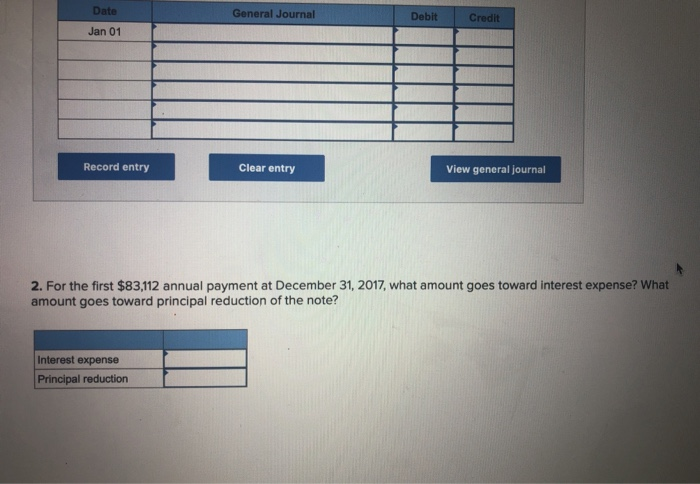

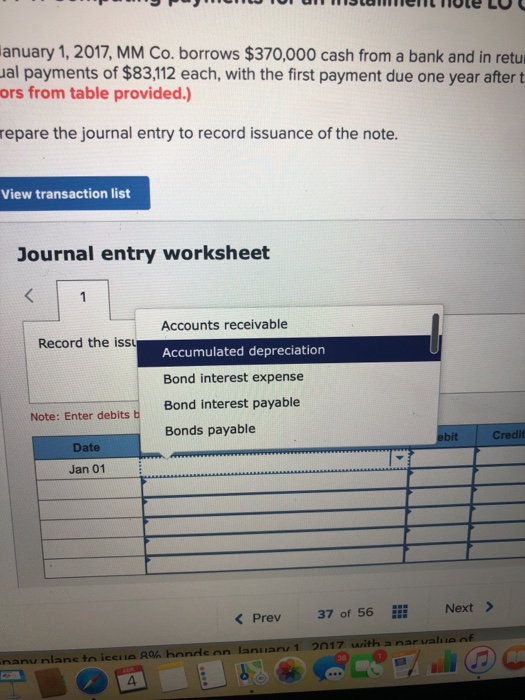

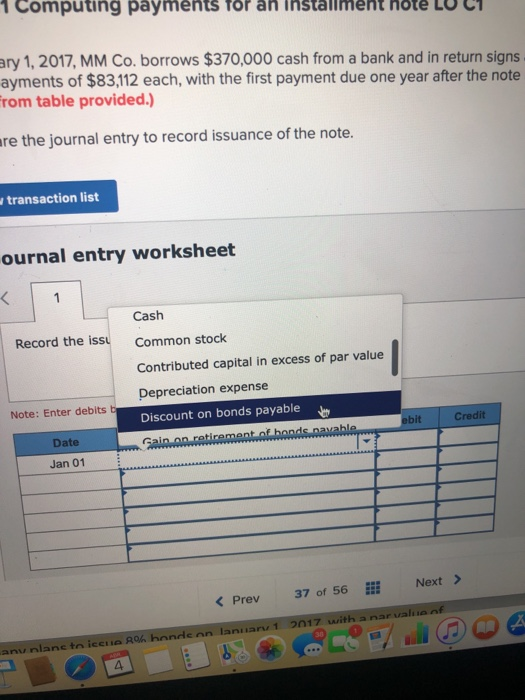

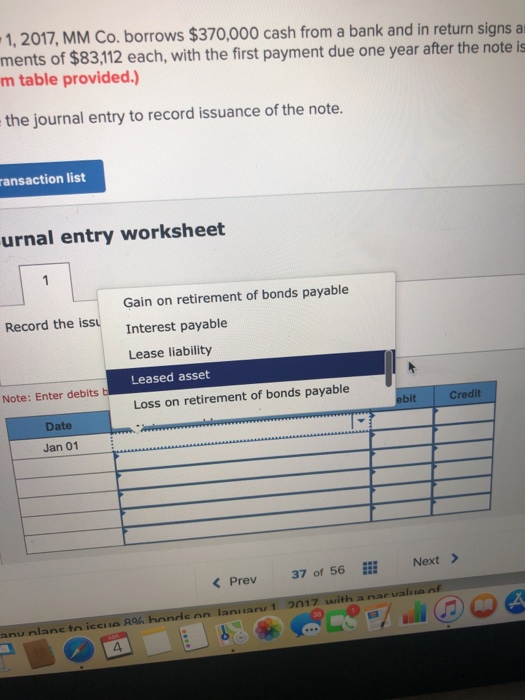

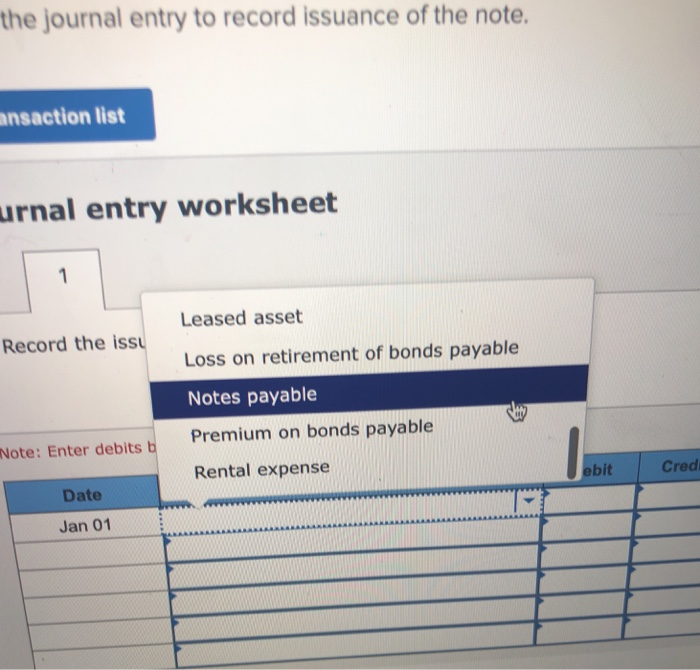

QS 14-11 Computing payments for an installment note LO C1 On January 1, 2017, MM Co. borrows $370,000 cash from a bank and in return signs an 4% installment note for five annual payments of $83,112 each, with the first payment due one year after the note is signed. (Table B.3) (Use PV ctors from table provided.) 1. Prepare the journal entry to record issuance of the note. View transaction list Journal entry worksheet Record the issuance of the note. Note: Enter debits before credits. General Journal DebitCredit Jan 01 Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journal 2. For the first $83,112 annual payment at December 31, 2017, what amount goes toward interest expense? What amount goes toward principal reduction of the note? Interest expense Principal reduction anuary 1, 2017, MM Co. borrows $370,000 cash from a bank and in retur al payments of $83,112 each, with the first payment due one year after t ors from table provided.) repare the journal entry to record issuance of the note. View transaction list Journal entry worksheet Accounts receivable Accumulated depreciation Bond interest expense Bond interest payable Bonds payable Record the issu Note: Enter debits ebit Credit Date Jan 01 nanu nlane to iceua Roh bande on lanuaru1 2017 with anarvalenf 4 Computing payments for ah installment hote Lo CT ary 1, 2017, MM Co. borrows $370,000 cash from a bank and in return signs ayments of $83112 each, with the first payment due one year after the note rom table provided.) re the journal entry to record issuance of the note. transaction list ournal entry worksheet Cash Record the iss Common stock Contributed capital in excess of par value Depreciation expense Discount on bonds payable Note: Enter debits bit Credit Date Jan 01 K Prev 37 of 56 E Next> anu nlane to iceua R0% hande an lanaru 1 017 with a narvaliia nf 1, 2017, MM Co. borrows $370,000 cash from a bank and in return signs a ments of $83,112 each, with the first payment due one year after the note is m table provided.) the journal entry to record issuance of the note. ansaction list urnal entry worksheet Gain on retirement of bonds payable Interest payable Lease liability Leased asset Loss on retirement of bonds payable Record the isS Note: Enter debits it Credit Date Jan 01 Next>