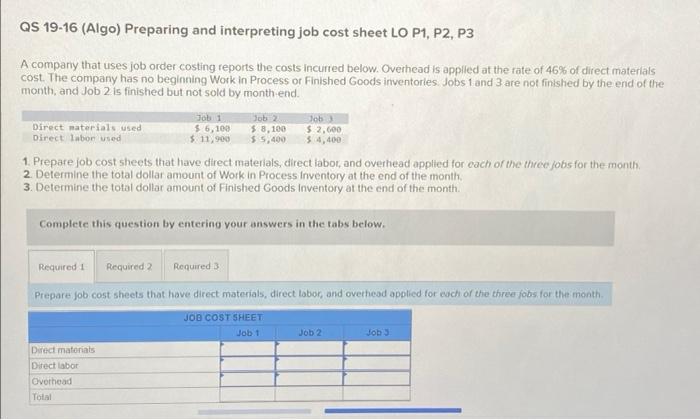

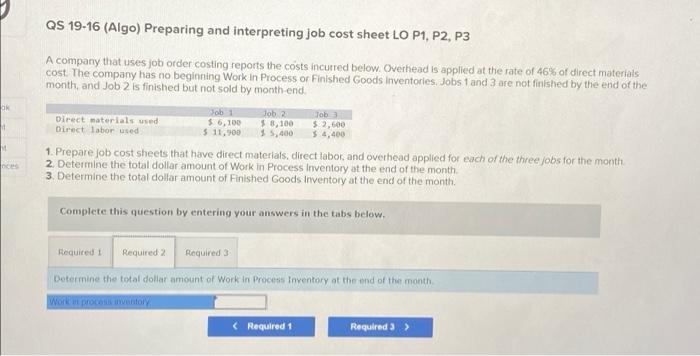

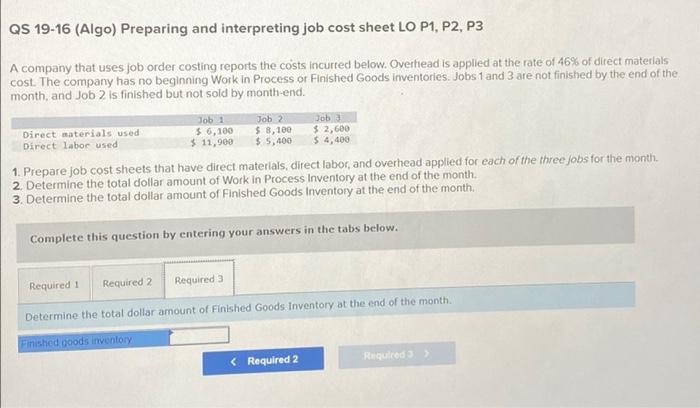

QS 19-16 (Algo) Preparing and interpreting job cost sheet LO P1, P2, P3 A company that uses job order costing reports the costs incurred below. Overhead is applled at the rate of 46% of direct materials cost. The company has no beginning Work in Process or Finished Goods inventories. Jobs 1 and 3 are not finished by the end of the month, and Job 2 is finished but not sold by month end. Job 1 Job Job Direct materials used 36,100 $ 8,100 $ 2,600 Direct labon ved $ 11,900 $ 5,400 $4,400 1. Prepare fob cost sheets that have direct materials, direct labor, and overhead applied for each of the three jobs for the month 2. Determine the total dollar amount of Work in Process Inventory at the end of the month 3. Determine the total dollar amount of Finished Goods inventory at the end of the month. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Prepare job cost sheets that have direct materials, direct lobor, and overhead apolied for each or the three fobs for the month JOB COST SHEET Job 1 Job 2 Job 3 Direct matorials Direct labor Overhead Total QS 19-16 (Algo) Preparing and interpreting job cost sheet LO P1, P2, P3 SH A company that uses job order costing reports the costs incurred below. Overhead is applied at the rate of 46% of direct materials cost. The company has no beginning Work in Process or Finished Goods inventories, Jobs 1 and 3 are not finished by the end of the month and Job 2 is finished but not sold by month-end. Job 1 Job 2 Job Direct materials used $ 6,100 $ 8,100 $2,600 Direct labor used $ 11,900 15,400 5.4.400 1. Prepare Job cost sheets that have direct materials, direct labor and overhead applied for each or the three jobs for the month 2. Determine the total dollar amount of Work in Process Inventory at the end of the month 3. Determine the total dollar amount of Finished Goods Inventory at the end of the month Complete this question by entering your answers in the tabs below. Required Required 2 Required Determine the total dollar amount of Work in Process Inventory at the end of the month Wontent procesory QS 19-16 (Algo) Preparing and interpreting job cost sheet LO P1, P2, P3 A company that uses job order costing reports the costs incurred below. Overhead is applied at the rate of 46% of direct materials cost. The company has no beginning Work in Process or Finished Goods inventories. Jobs 1 and 3 are not finished by the end of the month, and Job 2 is finished but not sold by month-end. Job 1 Job 2 Job Direct materials used $ 6,100 $ 8,100 $ 2,600 Direct labor used $ 11,900 $5,400 $ 4,400 1. Prepare job cost sheets that have direct materials, direct labor, and overhead applied for each of the three jobs for the month 2. Determine the total dollar amount of Work in Process Inventory at the end of the month, 3. Determine the total dollar amount of Finished Goods Inventory at the end of the month, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the total dollar amount of Finished Goods Inventory at the end of the month Finished goods inventory