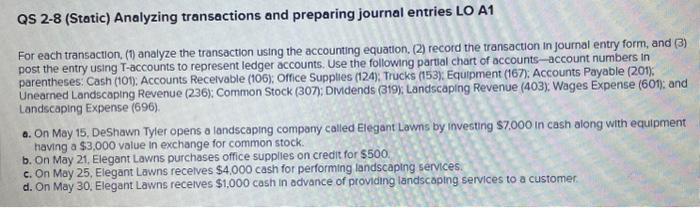

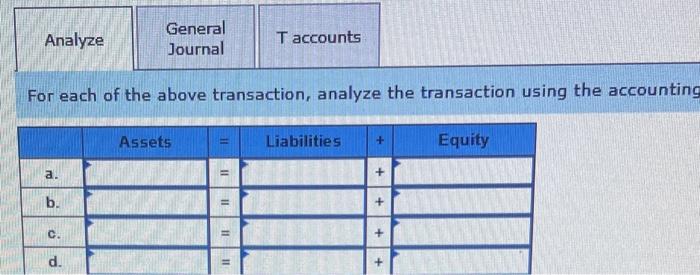

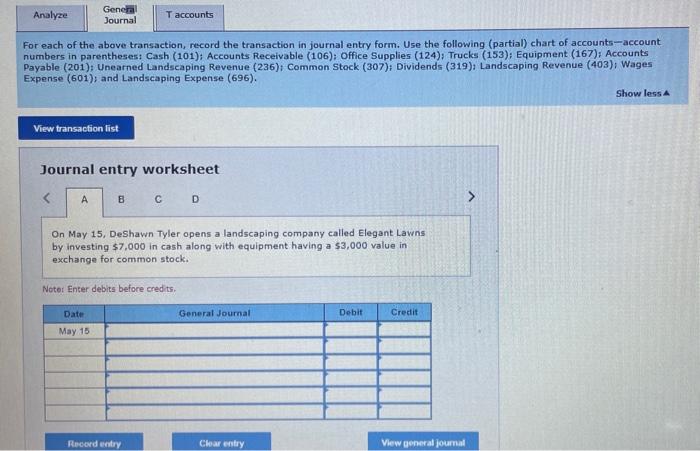

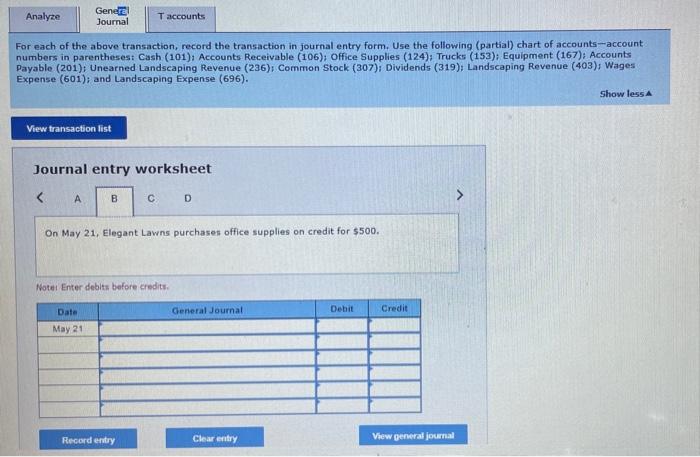

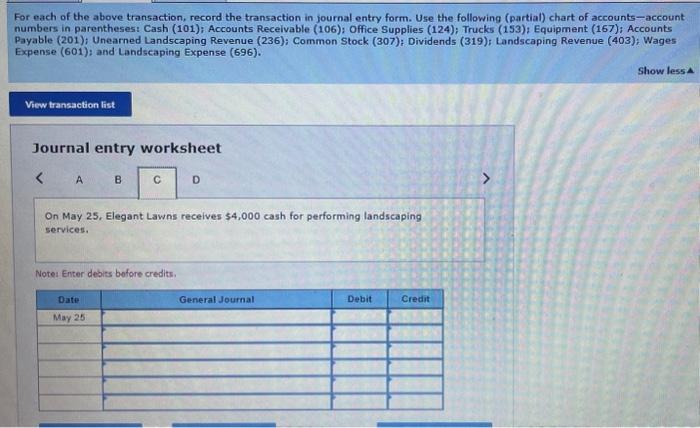

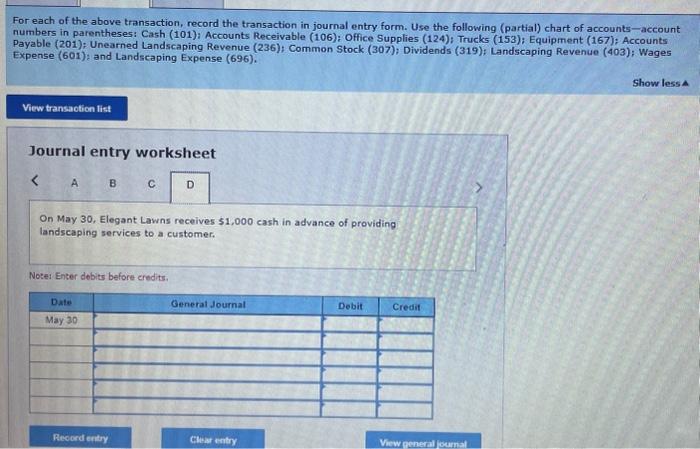

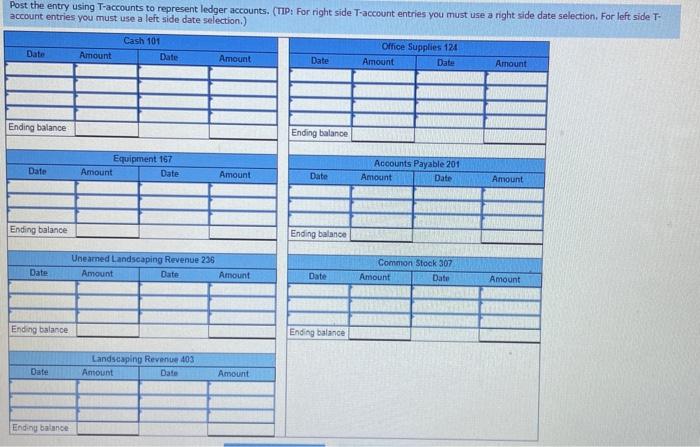

QS 2-8 (Static) Analyzing transactions and preparing journal entries LO A1 For each transaction, (1) analyze the transaction using the accounting equation, (2) record the transaction in journal entry form, and (3) post the entry using T-accounts to represent ledger accounts. Use the following partal chart of accounts-account numbers in parentheses: Cash (101); Accounts Recelvable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236): Common Stock (307): Dividends (319); Landscaping Revenue (403); Wages Expense (601); and Landscaping Expense (696). a. On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $7,000 in cash along with equipment having a $3,000 value in exchange for common stock. b. On May 21, Elegant Lawns purchases office supplies on credit for $500. c. On May 25, Elegant Lawns recelves $4,000 cash for performing landscaping services. d. On May 30, Elegant Lawns recetves $1,000 cash in advance of providing iandscaping services to a customer. For each of the above transaction, analyze the transaction using the accounting For each of the above transaction, record the transaction in journal entry form. Use the following (partial) chart of accounts-account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); Common Stock (307); Dividends (319); Landscaping Revenue (403); Wages Expense (601); and Landscaping Expense (696). Show lers A Journal entry worksheet On May 15, Deshawn Tyler opens a landscaping company called Elegant Lawns by investing $7,000 in cash along with equipment having a 53,000 value in exchange for common stock. Notet Enter debits before credits. For each of the above transaction, record the transaction in journal entry form, Use the following (partial) chart of accounts-account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); Common Stock (307); Dividends (319); Landscaping Revenue (403); Wages Expense (601); and Landscaping Expense (696). Show less a Journal entry worksheet On May 21, Elegant Lawns purchases office supplies on credit for $500. Notei Enter debits before credits. For each of the above transaction, record the transaction in journal entry form. Use the following (partial) chart of accounts-account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); Common Stock (307); Dividends (319); Landscaping Revenue (403); Wages Expense (601); and Landscaping Expense (696). Journal entry worksheet On May 25, Elegant Lawns receives $4,000 cash for performing landscaping services. Note: Enter debiss bofore credits. For each of the above transaction, record the transaction in journal entry form. Use the following (partial) chart of accounts - account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); Common Stock (307); Dividends (319); Landscaping Revenue (403); Wages Expense (601): and Landscaping Expense (696). Journal entry worksheet On May 30 , Elegant Lawns receives 51,000 cash in advance of providing landscaping services to a customer. Notes Enter dobits before credits. Post the entry using T-accounts to represent ledger accounts. (TIP: For right side T-account entries you must use a right side date selection. For left side T. account entries you must use a left side date selection.)