Answered step by step

Verified Expert Solution

Question

1 Approved Answer

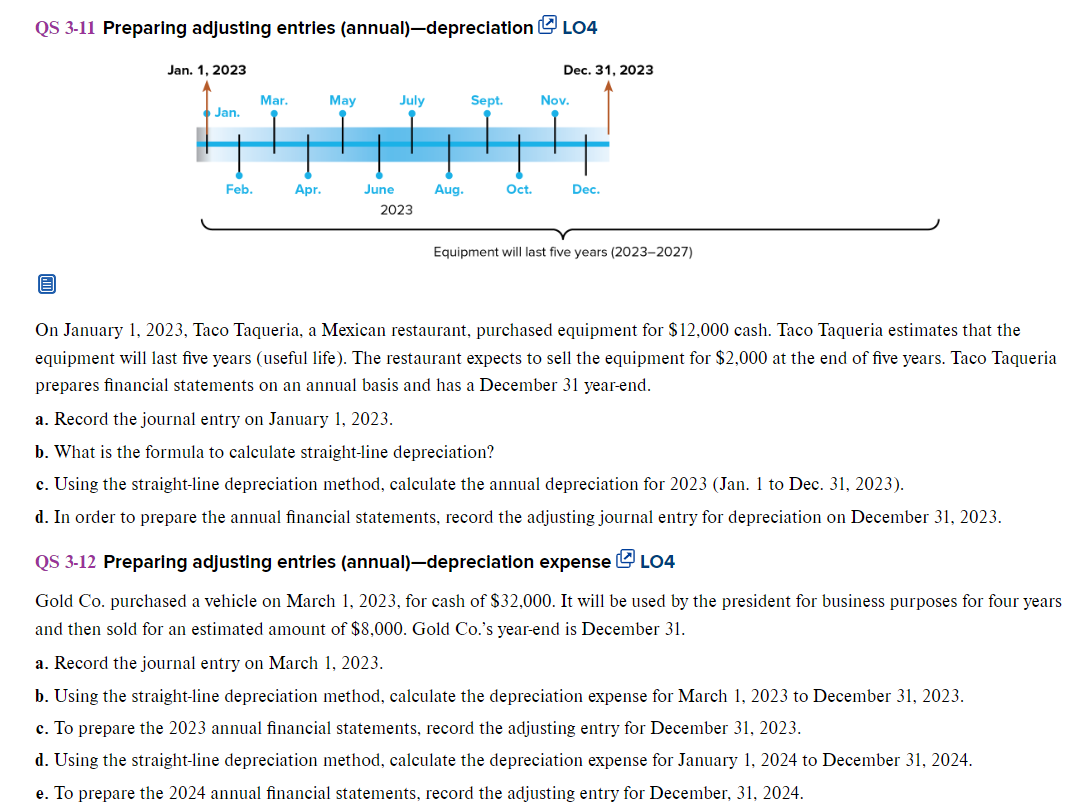

QS 3-11 Preparing adjusting entries (annual)-depreciation LO4 Jan. 1, 2023 Dec. 31, 2023 Mar. May July Sept. Nov. Jan. Feb. Apr. June Aug. Oct.

QS 3-11 Preparing adjusting entries (annual)-depreciation LO4 Jan. 1, 2023 Dec. 31, 2023 Mar. May July Sept. Nov. Jan. Feb. Apr. June Aug. Oct. Dec. 2023 Equipment will last five years (2023-2027) On January 1, 2023, Taco Taqueria, a Mexican restaurant, purchased equipment for $12,000 cash. Taco Taqueria estimates that the equipment will last five years (useful life). The restaurant expects to sell the equipment for $2,000 at the end of five years. Taco Taqueria prepares financial statements on an annual basis and has a December 31 year-end. a. Record the journal entry on January 1, 2023. b. What is the formula to calculate straight-line depreciation? c. Using the straight-line depreciation method, calculate the annual depreciation for 2023 (Jan. 1 to Dec. 31, 2023). d. In order to prepare the annual financial statements, record the adjusting journal entry for depreciation on December 31, 2023. QS 3-12 Preparing adjusting entries (annual)-depreciation expense Gold Co. purchased a vehicle on March 1, 2023, for cash of $32,000. It will be used by the president for business purposes for four years and then sold for an estimated amount of $8,000. Gold Co.'s year-end is December 31. a. Record the journal entry on March 1, 2023. b. Using the straight-line depreciation method, calculate the depreciation expense for March 1, 2023 to December 31, 2023. c. To prepare the 2023 annual financial statements, record the adjusting entry for December 31, 2023. d. Using the straight-line depreciation method, calculate the depreciation expense for January 1, 2024 to December 31, 2024. e. To prepare the 2024 annual financial statements, record the adjusting entry for December, 31, 2024. General Journal Date Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

QS 311 cost of equipment 12000 Useful Life 5 years Residual Value 2000 a Journal entry to be rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427458c2149_980150.pdf

180 KBs PDF File

66427458c2149_980150.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started