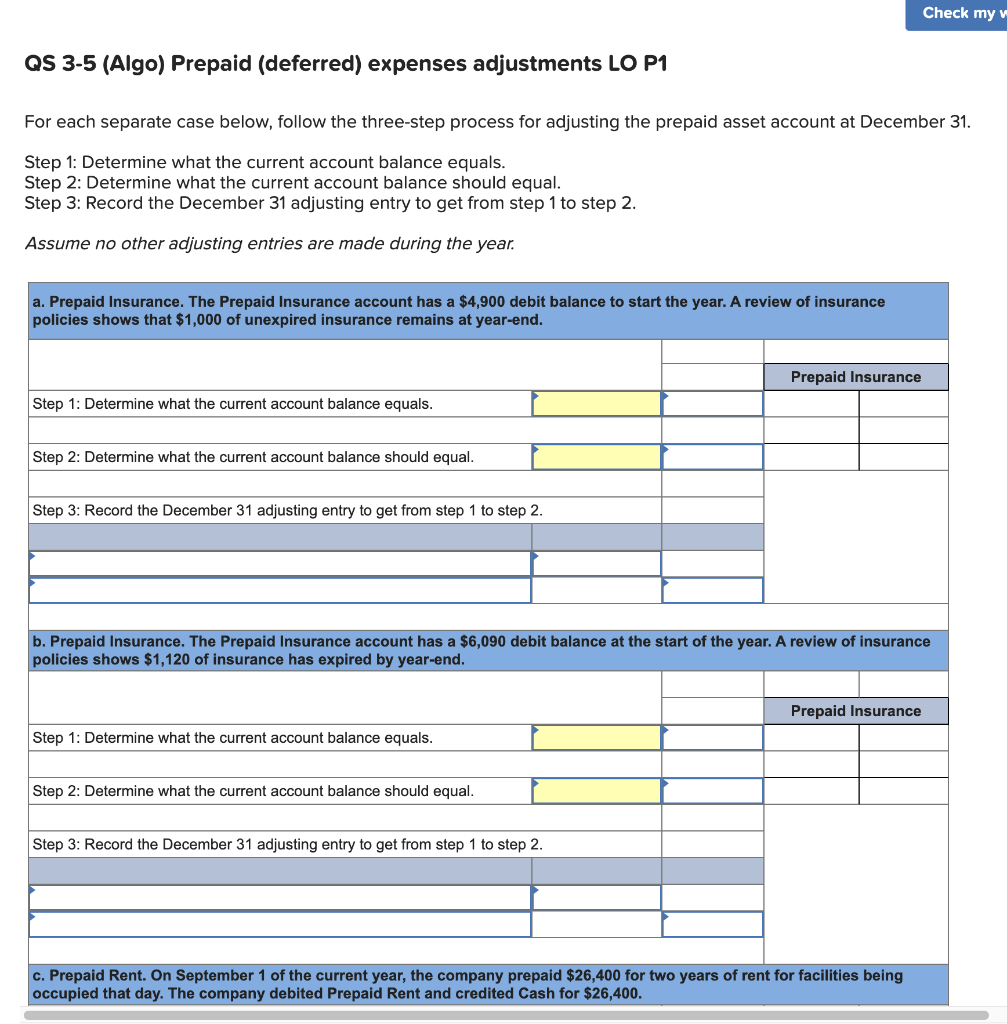

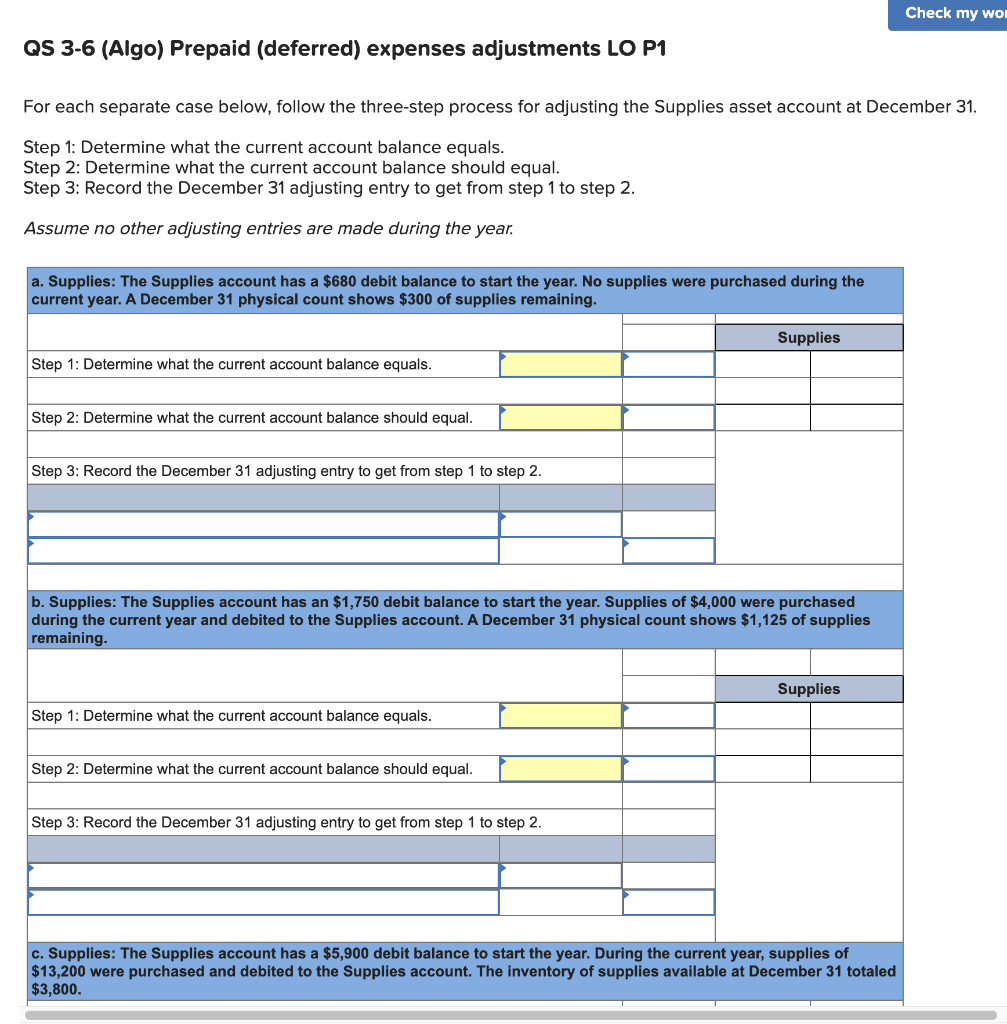

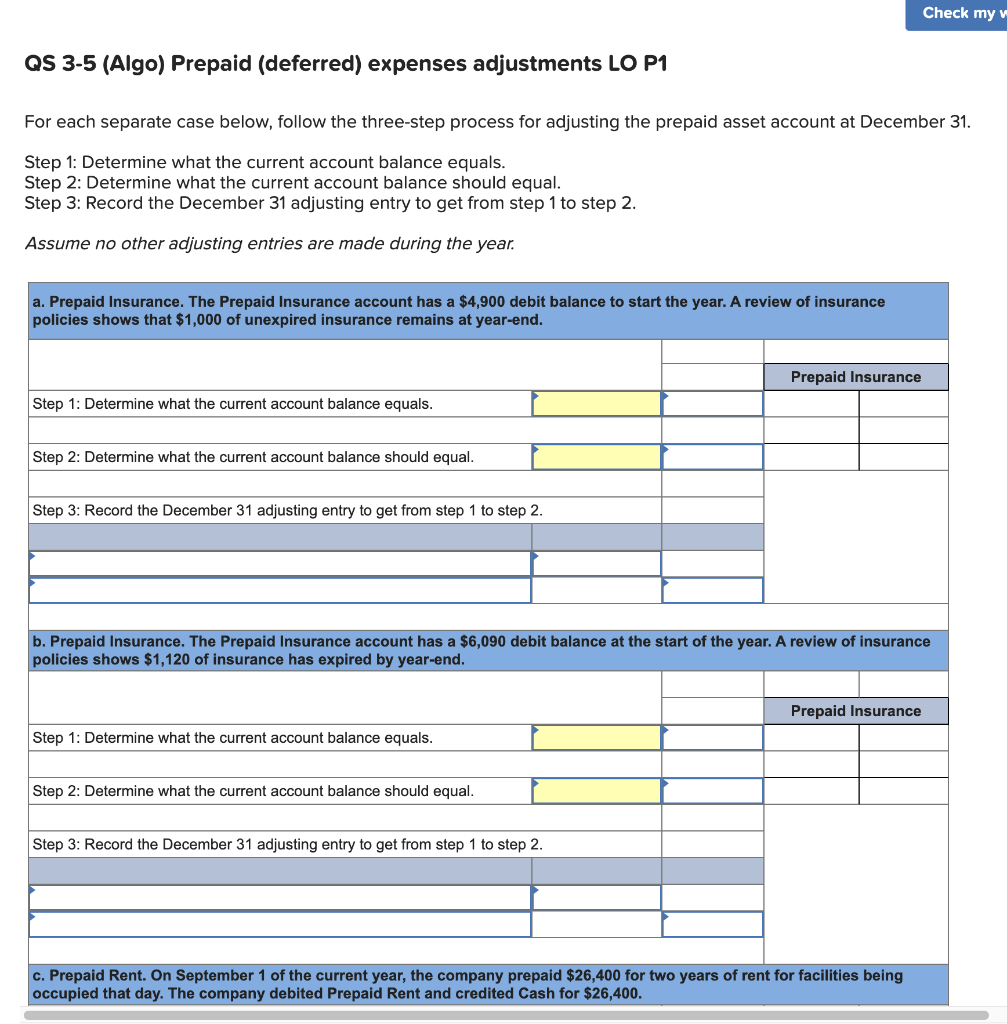

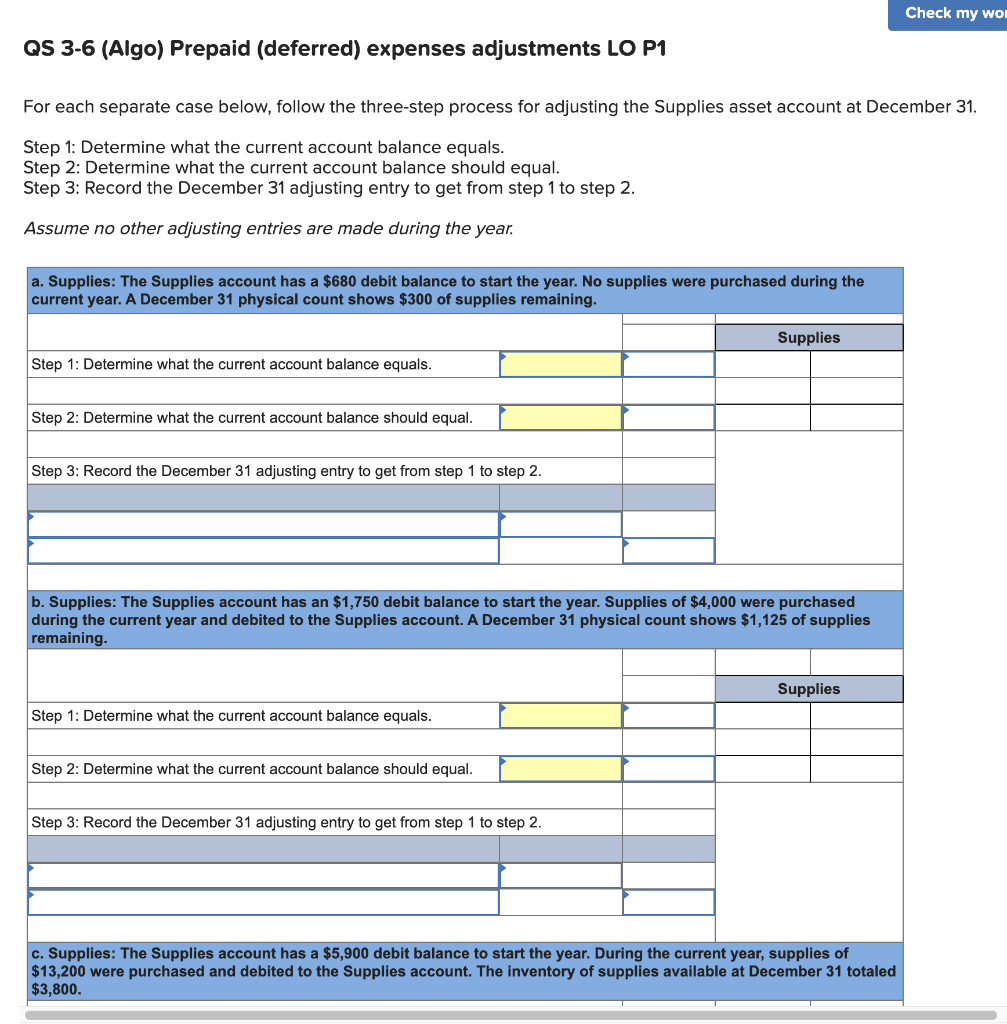

QS 3-5 (Algo) Prepaid (deferred) expenses adjustments LO P1 For each separate case below, follow the three-step process for adjusting the prepaid asset account at December 31 . Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Prepaid Insurance. The Prepaid Insurance account has a $4,900 debit balance to start the year. A review of insurance policies shows that $1,000 of unexpired insurance remains at year-end. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. b. Prepaid Insurance. The Prepaid Insurance account has a $6,090 debit balance at the start of the year. A review of insurance policies shows $1,120 of insurance has expired by year-end. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. c. Prepaid Rent. On September 1 of the current year, the company prepaid $26,400 for two years of rent for facilities being occupied that day. The company debited Prepaid Rent and credited Cash for $26,400. QS 3-6 (Algo) Prepaid (deferred) expenses adjustments LO P1 For each separate case below, follow the three-step process for adjusting the Supplies asset account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Supplies: The Supplies account has a $680 debit balance to start the year. No supplies were purchased during the current year. A December 31 physical count shows $300 of supplies remaining. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. b. Supplies: The Supplies account has an $1,750 debit balance to start the year. Supplies of $4,000 were purchased during the current year and debited to the Supplies account. A December 31 physical count shows $1,125 of supplies remaining. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. c. Supplies: The Supplies account has a $5,900 debit balance to start the year. During the current year, supplies of $13,200 were purchased and debited to the Supplies account. The inventory of supplies available at December 31 totaled $3,800