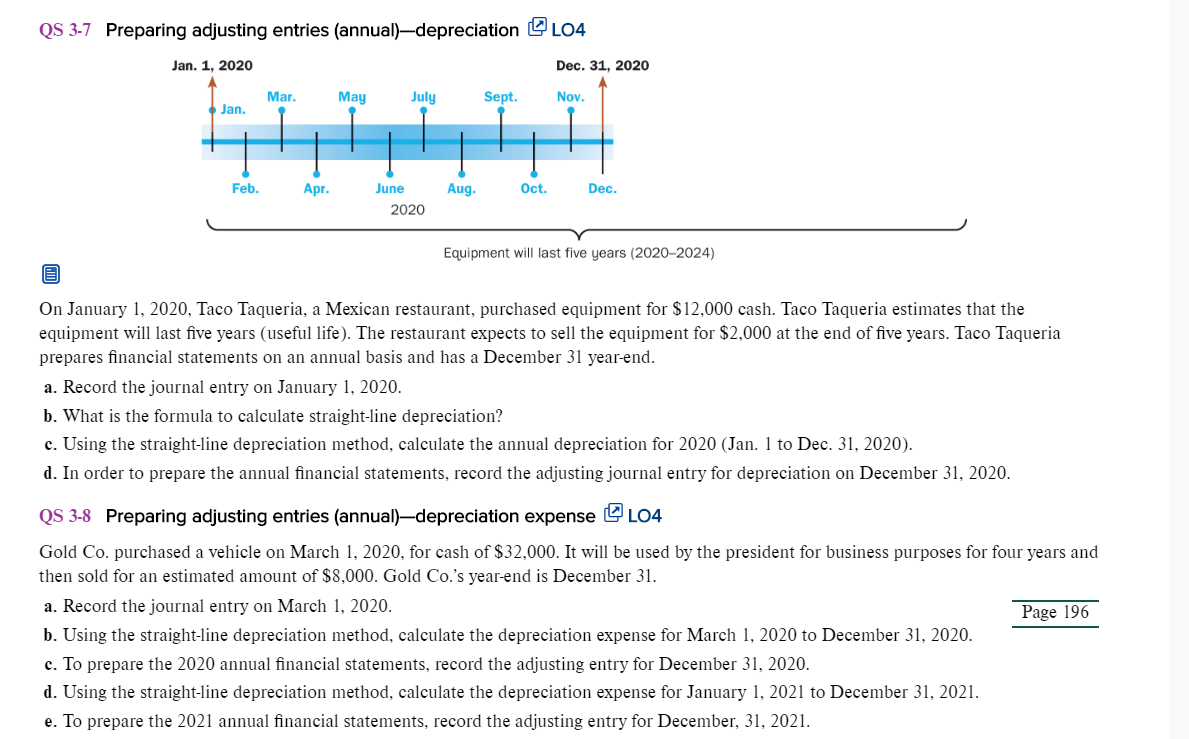

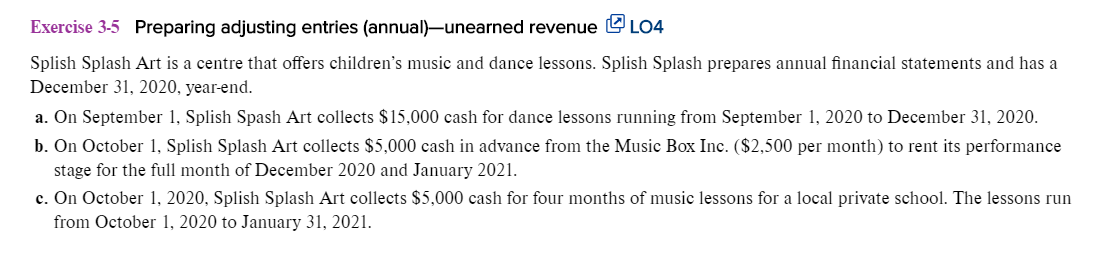

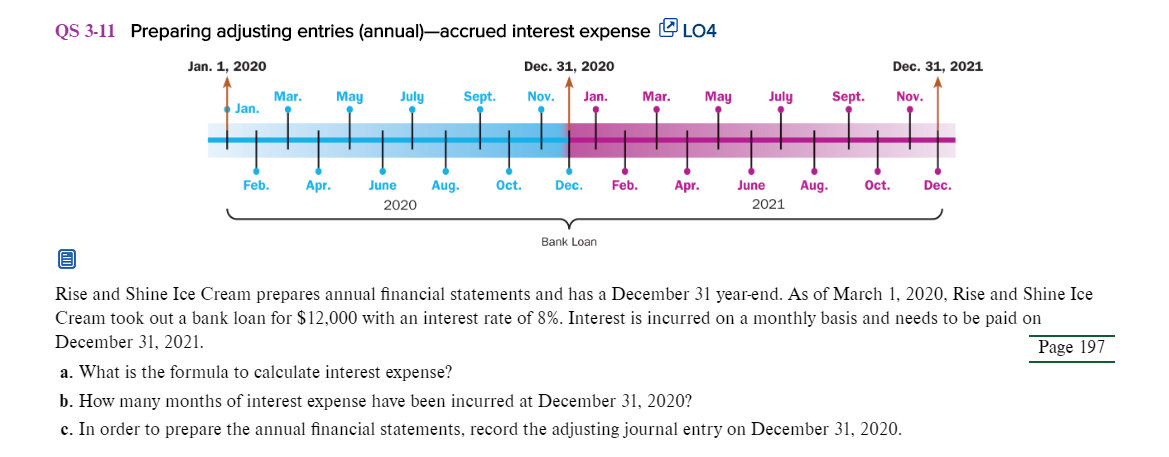

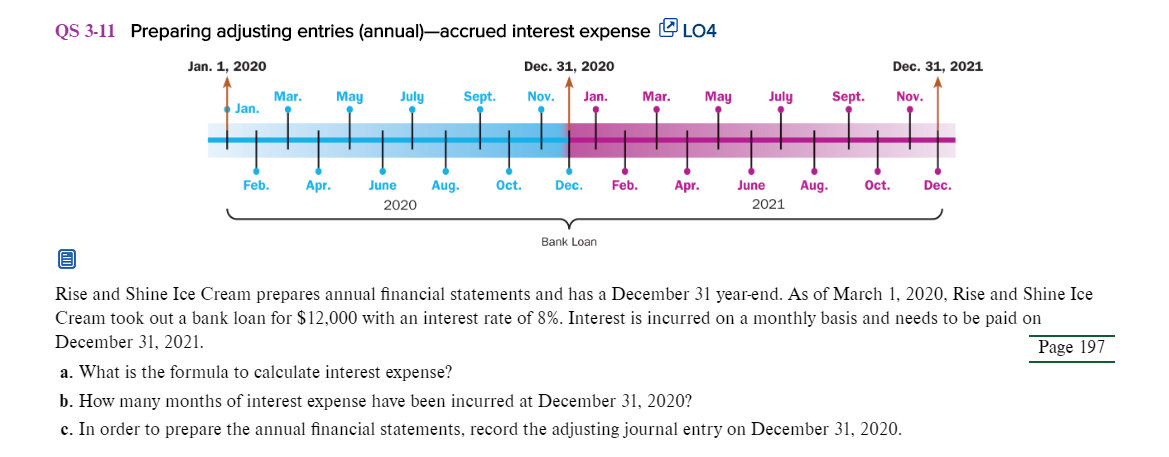

QS 3-7 Preparing adjusting entries (annual)-depreciation 104 Jan. 1, 2020 Dec. 31, 2020 Mar. May July Sept. Nov. Jan. Feb. Apr. Aug. Oct. Dec. June 2020 Equipment will last five years (2020-2024) E On January 1, 2020, Taco Taqueria, a Mexican restaurant, purchased equipment for $12,000 cash. Taco Taqueria estimates that the equipment will last five years (useful life). The restaurant expects to sell the equipment for $2,000 at the end of five years. Taco Taqueria prepares financial statements on an annual basis and has a December 31 year-end. a. Record the journal entry on January 1, 2020. b. What is the formula to calculate straight-line depreciation? c. Using the straight-line depreciation method, calculate the annual depreciation for 2020 (Jan. 1 to Dec. 31, 2020). d. In order to prepare the annual financial statements, record the adjusting journal entry for depreciation on December 31, 2020. QS 3-8 Preparing adjusting entries (annual)-depreciation expense L04 Gold Co. purchased a vehicle on March 1, 2020, for cash of $32,000. It will be used by the president for business purposes for four years and then sold for an estimated amount of $8,000. Gold Co.'s year-end is December 31. a. Record the journal entry on March 1, 2020. Page 196 b. Using the straight-line depreciation method, calculate the depreciation expense for March 1, 2020 to December 31, 2020. c. To prepare the 2020 annual financial statements, record the adjusting entry for December 31, 2020. d. Using the straight-line depreciation method, calculate the depreciation expense for January 1, 2021 to December 31, 2021. e. To prepare the 2021 annual financial statements, record the adjusting entry for December, 31, 2021. Exercise 3-5 Preparing adjusting entries (annual)-unearned revenue 104 Splish Splash Art is a centre that offers children's music and dance lessons. Splish Splash prepares annual financial statements and has a December 31, 2020, year-end. a. On September 1, Splish Spash Art collects $15,000 cash for dance lessons running from September 1, 2020 to December 31, 2020. b. On October 1, Splish Splash Art collects $5,000 cash in advance from the Music Box Inc. ($2,500 per month) to rent its performance stage for the full month of December 2020 and January 2021. c. On October 1, 2020, Splish Splash Art collects $5,000 cash for four months of music lessons for a local private school. The lessons run from October 1, 2020 to January 31, 2021. QS 3-11 Preparing adjusting entries (annual)accrued interest expense 404 Jan. 1, 2020 Dec. 31, 2020 Dec. 31, 2021 Mar. May July Sept. Nov. Jan. Mar. May July Sept. Nov. Jan. Feb. Apr. Aug. Oct. Dec. Feb. Apr. Aug. Oct. June 2020 Dec. June 2021 Bank Loan E Rise and Shine Ice Cream prepares annual financial statements and has a December 31 year-end. As of March 1, 2020, Rise and Shine Ice Cream took out a bank loan for $12,000 with an interest rate of 8%. Interest is incurred on a monthly basis and needs to be paid on December 31, 2021. Page 197 a. What is the formula to calculate interest expense? b. How many months of interest expense have been incurred at December 31, 2020? c. In order to prepare the annual financial statements, record the adjusting journal entry on December 31, 2020