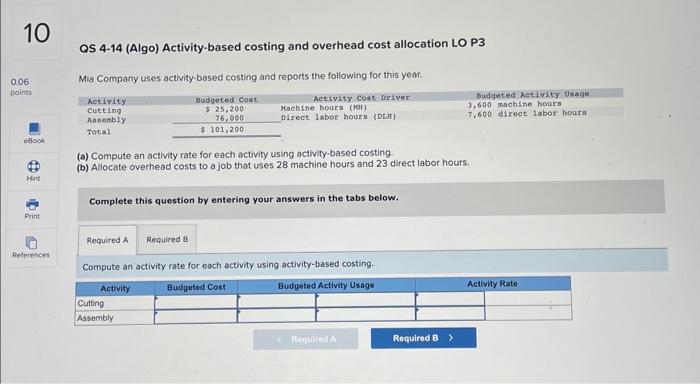

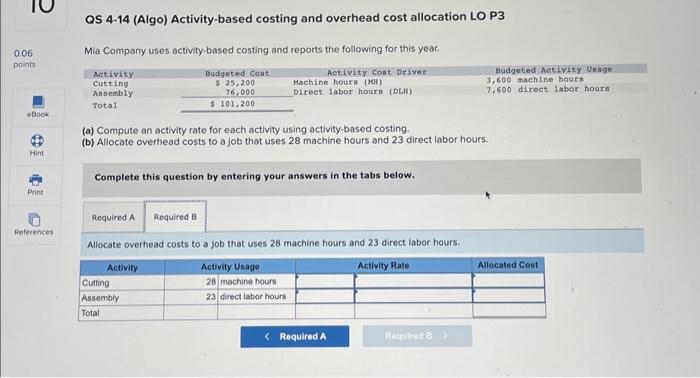

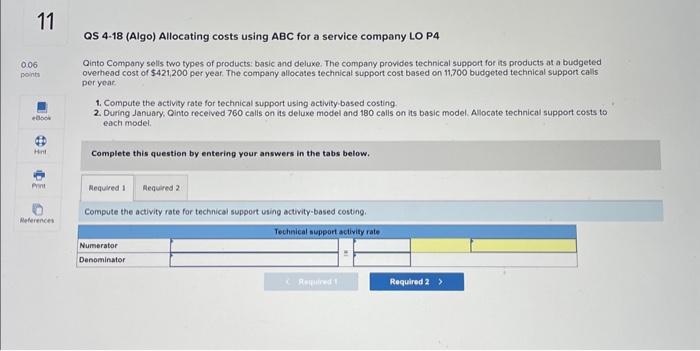

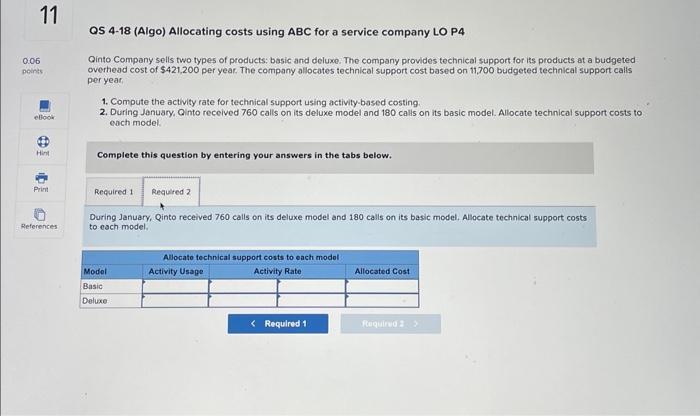

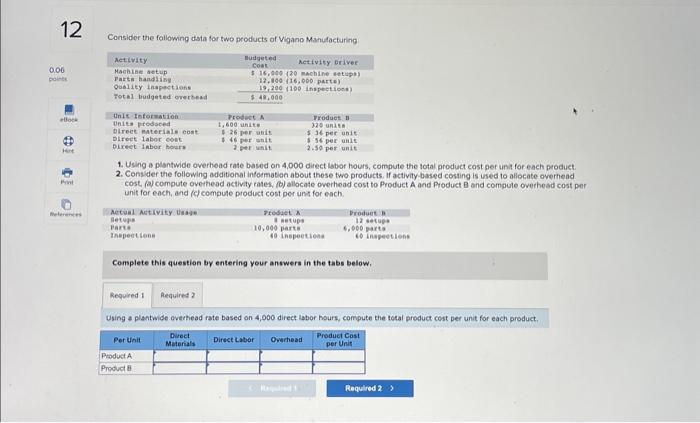

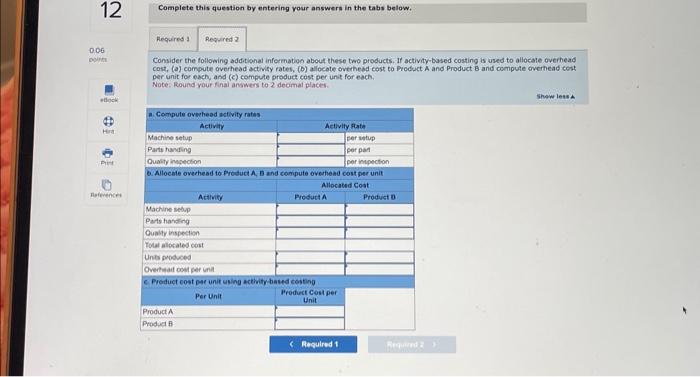

QS 4-14 (Algo) Activity-based costing and overhead cost allocation LO P3 Mia Company uses activity-based costing and reports the following for this year. (a) Compute an activity rate for each activity using activity-based costing. (b) Allocate overhead costs to a job that uses 28 machine hours and 23 direct labor hours. Complete this question by entering your answers in the tabs below. Compute an activity rate for each activity using activity-based costing. QS 4-18 (Algo) Allocating costs using ABC for a service company LO P4 Qinto Company selis two types of products: basic and deluxe. The company provides technical support for its products at a budgeted overhead cost of $421,200 per year. The company allocates technical support cost based on 11,700 budgoted technical support calis per year 1. Compute the activity rate for technical support using activity based costing. 2. During January. Ointo received 760 calls on its deluxe model and 180 calls on its basic model. Allocate technical support costs to each model. Complete this question by entering your answers in the tabs below. Compute the activity rate for technical support using activity-based costing. Complete this question by entering your answers in the tabs below. Consider the following additional information about these two products. If activity based costing is used to allocale overhead cost, (a) compute overhead activisy rates, (b) allocote overhesd cost to product A and Product B and compute overthead cost per unit for each, and (c) compule product cost per unt for each. Note: Round your final answers to 2 decimal places. OS 4-14 (Algo) Activity-based costing and overhead cost allocation LO P3 Mia Company uses activity-based costing and reports the following for this year. (a) Compute an activity rate for each activity using activity-based costing. (b) Allocate overhead costs to a job that uses 28 machine hours and 23 direct labor hours. Complete this question by entering your answers in the tabs below. Allocate overhead costs to a job that uses 28 machine hours and 23 direct labor hours. QS 4-18 (Algo) Allocating costs using ABC for a service company LO P4 Qinto Company sells two types of products; basic and deluxe. The company provides technical support for its products at a budgeted overhead cost of $421,200 per year. The company allocates technical support cost based on 11,700 budgeted technical support calls per year: 1. Compute the activity rate for technical support using activity-based costing. 2. During January, Qinto received 760 calls on its deluxe model and 180 calls on its basic model. Allocate technical support costs to each model. Complete this question by entering your answers in the tabs below. During January, Qinto received 760 calls on its deluxe model and 180 calls on its basic model, Allocate technical support costs to each model. Consider the following dasta for two products of Vigano Manufacturing 1. Using a plantwide overhead rate based on 4,000 direct labor hours, compute the lotal product cost per unh for each product. 2. Consider the following additional information about these two products. If activity based costing is used to allocate overhend cost, (a) compute overhead activity rates, (0) allocate owerhead cost to Product A and Product B and compute overhesd cost per unit for each, and fic compule product cost per unit for each. Complete this question by entering your anwwers in the tabs below. Using a plantwide everhead rate based on 4,000 direce labor hours, compute the total product cost per unit for each product