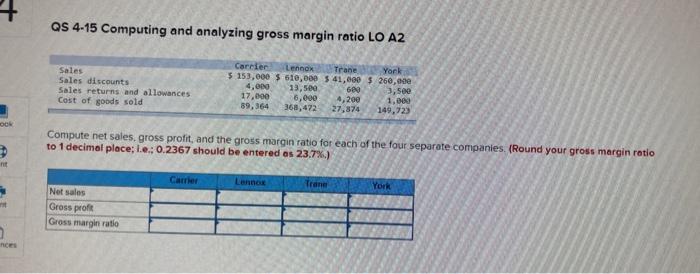

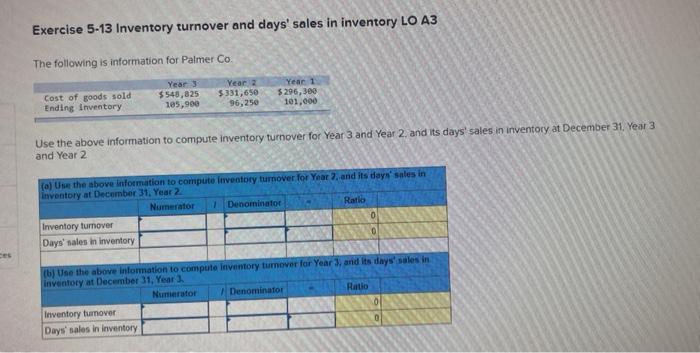

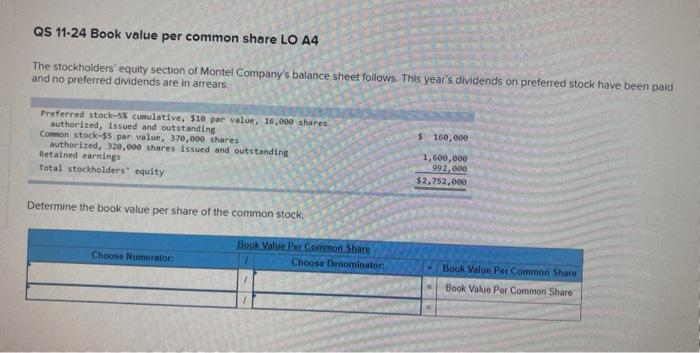

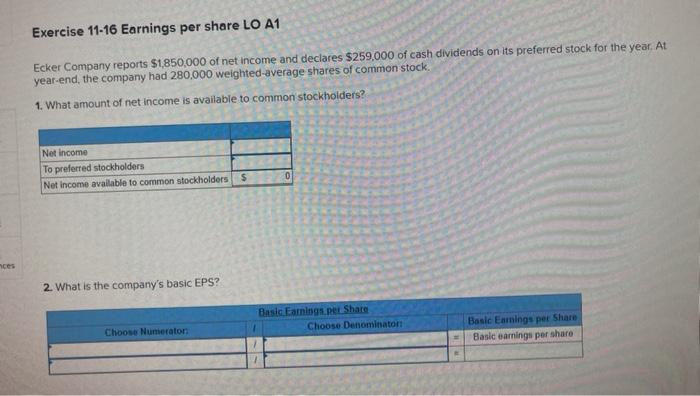

+ QS 4-15 Computing and analyzing gross margin ratio LO A2 Sales Sales discounts Sales returns and allowances Cost of goods sold Carrier Lennox Trane York $ 153,000 $ 610,000 5 41,000 $ 260,00 4,000 13,500 60 3, see 17,000 6,000 4,200 1.000 89,364 368,472 27,874 149,723 OOK Compute net sales, gross profit, and the gross margin ratio for each of the four separate companies. (Round your gross margin ratio to 1 decimal place; Le: 0.2367 should be entered os 23.7%) Carrier Lennox Trane York Net sales Gross proft Gross margin ratio RES Exercise 5-13 Inventory turnover and days' sales in inventory LO A3 The following is information for Palmer Co. Cost of goods sold Ending Inventory Year 3 $548,825 105,900 Year 2 $331,650 96,250 Year 1 $296,300 101,000 Use the above information to compute inventory turnover for Year 3 and Year 2. and its days' sales in inventory at December 31 Year 3 and Year 2 Ratio (a) Use the above information to compute Inventory turnover for Year 2, and its days' sales in Inventory at December 31. Year 2 Numerator 1 Denominator Inventory turnover 0 Days' sales In Inventory (6) Use the above information to compute Inventory turnover for Year, and its days' sales in Inventory at December 31, Year. Numerator Denominator Ratio Inventory turnover 0 Days' sales in inventory 0 QS 11-24 Book value per common share LO A4 The stockholders' equity section of Montel Company's balance sheet follows. This year's dividends on preferred stock have been paid and no preferred dividends are in arrears. Preferred stock-5% cumulative, $10 par value, 16,000 shares authorized, issued and outstanding Connon stock-55 par value, 370,000 shares authorized, 320,000 shares issued and outstanding Retained earnings Total stockholders' equity $ 160,000 1,600,000 992,000 $2,752,000 Determine the book value per share of the common stock, Choose Numerator Book Value Per Common Share Choose Denominator: Book Value Per Common Share Book Value Per Common Share Exercise 11-16 Earnings per share LO A1 Ecker Company reports $1850,000 of net income and declares $259,000 of cash dividends on its preferred stock for the year. At year-end, the company had 280,000 weighted average shares of common stock 1. What amount of net income is available to common stockholders? Net Income To preferred stockholders Net Income available to common stockholders $ 0 nces 2. What is the company's basic EPS? Basic Earnings per Share Choose Denominaton Choose Numeraton Basic Earnings per Share Basic earnings per share