qs 5 plz

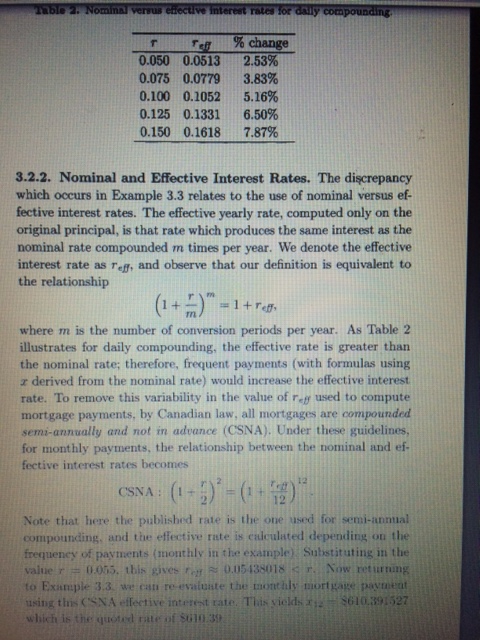

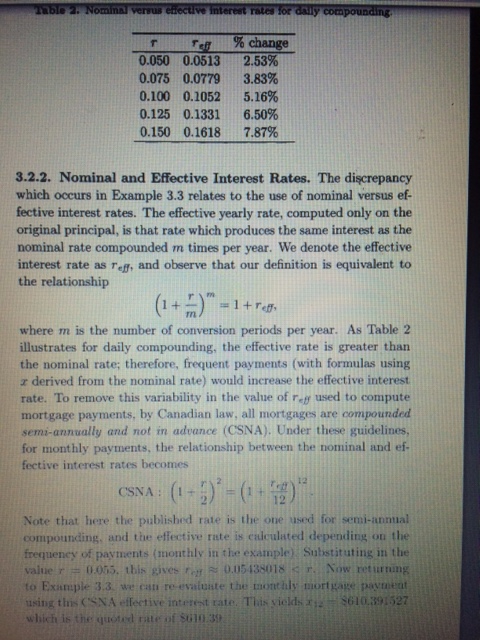

1 / 1 You must submit everything as a SINGLE Word or PDF file. If you want to write on paper and then take a photo, just paste that ph/ so into a Word document and upload that. Make sure the photo is upright, and clear and easy to read. stions (page 43] In equation (3.4), what are the units of Po, m, and ? How does P depend on m? Sketch what you think the relationship might look like. Verify your answer using Maple or other graphing software (assume some reasonable values for Po and r to accomplish this) - (page 44] Describe in words what P(i+1) = PO(1 + r) - X is saying; explain each term. 5. (page 45] Fill in the blanks (using words): Equation (3.8) is the in terms of written 4. (page 46] What do they mean by 'variability of re/? What does 'not in advance' mean exactly (i.e. as opposed to what)? 5. (page 46] Reproduce the re-calculation of the monthly payment using the CSNA (ie start by re-computing res, then the monthly payment to obtain 5610.39] 6. What did you find most interesting helpful to your understanding of the problem in the chapter 7. What did you find most confusing difficult? blo 2. Nomina verrus etioctlve interest rates for daily compounding 0.050 0.0513 0.075 0.0779 0.100 0.1052 0.125 0.1331 0.150 0.1618 % change 2.53% 3.83% 5.26% 6.50% 7.87% 3.2.2. Nominal and Effective Interest Rates. The discrepancy which occurs in Example 3.3 relates to the use of nominal versus ef- fective interest rates. The effective yearly rate, computed only on the original principal, is that rate which produces the same interest as the nominal rate compounded m times per year. We denote the effective interest rate as rell, and observe that our definition is equivalent to the relationship I treti where m is the number of conversion periods per year. As Table 2 illustrates for daily compounding, the effective rate is greater than the nominal rate; therefore, frequent payments (with formulas using z derived from the nominal rate) would increase the effective interest rate. To remove this variability in the value of rey used to compute mortgage payments, by Canadian law, all mortgages are compounded semi-annually and not in advance (CSNA). Under these guidelines, for monthly payments, the relationship between the nominal and ef- fective interest rates becomes 12 CSNA: 12 Note that here the published rate is the one used for semi-annual compounding, and the effective rute in ciuculated depending on the frequeney of payments (monthly in the example) Substituting in the value 0.055, this gives 0.05138018 S T Now returning to Example 3.3. we can re-evaluate the monthly mortgage payment using this CSNA effective interest rate. This wields 112 $610.391527 which is the quote rute of $6103 1 / 1 You must submit everything as a SINGLE Word or PDF file. If you want to write on paper and then take a photo, just paste that ph/ so into a Word document and upload that. Make sure the photo is upright, and clear and easy to read. stions (page 43] In equation (3.4), what are the units of Po, m, and ? How does P depend on m? Sketch what you think the relationship might look like. Verify your answer using Maple or other graphing software (assume some reasonable values for Po and r to accomplish this) - (page 44] Describe in words what P(i+1) = PO(1 + r) - X is saying; explain each term. 5. (page 45] Fill in the blanks (using words): Equation (3.8) is the in terms of written 4. (page 46] What do they mean by 'variability of re/? What does 'not in advance' mean exactly (i.e. as opposed to what)? 5. (page 46] Reproduce the re-calculation of the monthly payment using the CSNA (ie start by re-computing res, then the monthly payment to obtain 5610.39] 6. What did you find most interesting helpful to your understanding of the problem in the chapter 7. What did you find most confusing difficult? blo 2. Nomina verrus etioctlve interest rates for daily compounding 0.050 0.0513 0.075 0.0779 0.100 0.1052 0.125 0.1331 0.150 0.1618 % change 2.53% 3.83% 5.26% 6.50% 7.87% 3.2.2. Nominal and Effective Interest Rates. The discrepancy which occurs in Example 3.3 relates to the use of nominal versus ef- fective interest rates. The effective yearly rate, computed only on the original principal, is that rate which produces the same interest as the nominal rate compounded m times per year. We denote the effective interest rate as rell, and observe that our definition is equivalent to the relationship I treti where m is the number of conversion periods per year. As Table 2 illustrates for daily compounding, the effective rate is greater than the nominal rate; therefore, frequent payments (with formulas using z derived from the nominal rate) would increase the effective interest rate. To remove this variability in the value of rey used to compute mortgage payments, by Canadian law, all mortgages are compounded semi-annually and not in advance (CSNA). Under these guidelines, for monthly payments, the relationship between the nominal and ef- fective interest rates becomes 12 CSNA: 12 Note that here the published rate is the one used for semi-annual compounding, and the effective rute in ciuculated depending on the frequeney of payments (monthly in the example) Substituting in the value 0.055, this gives 0.05138018 S T Now returning to Example 3.3. we can re-evaluate the monthly mortgage payment using this CSNA effective interest rate. This wields 112 $610.391527 which is the quote rute of $6103