qs25-1 and qs25-5 For these two separate cases, identify each item as a sunk cost, a relevant cost, or a relevant revenue. 1. A company

qs25-1 and qs25-5

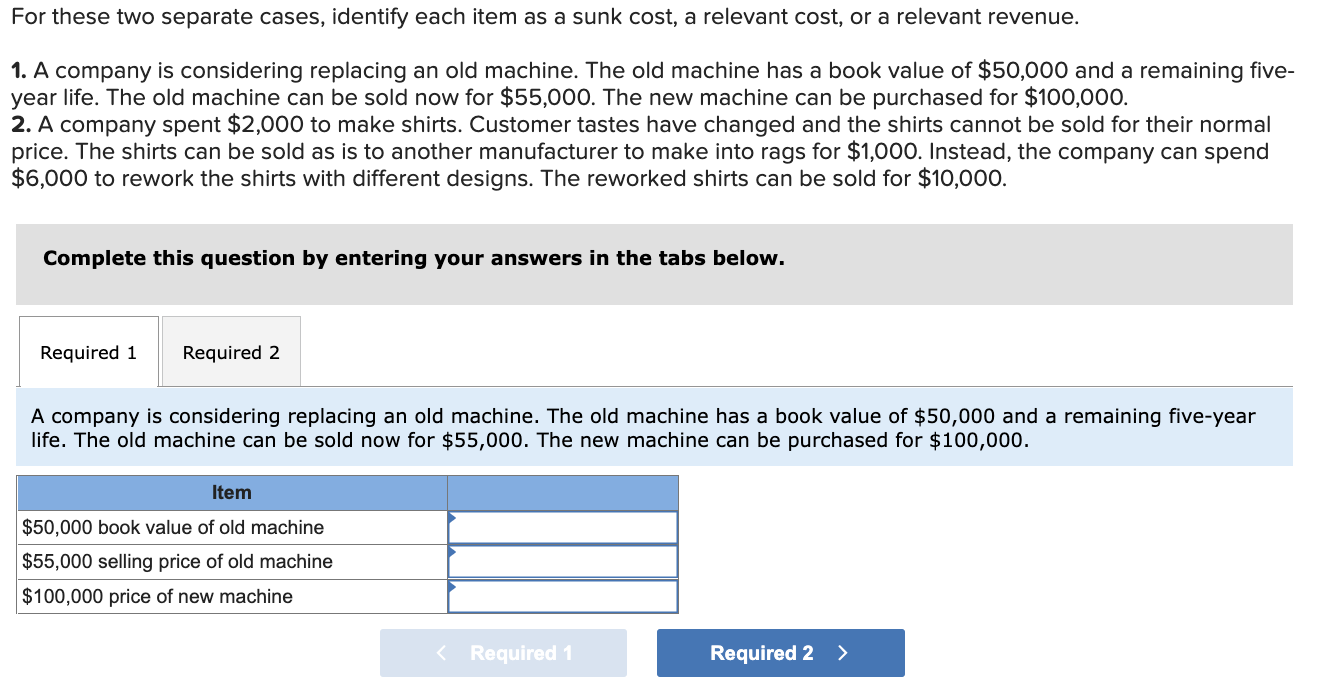

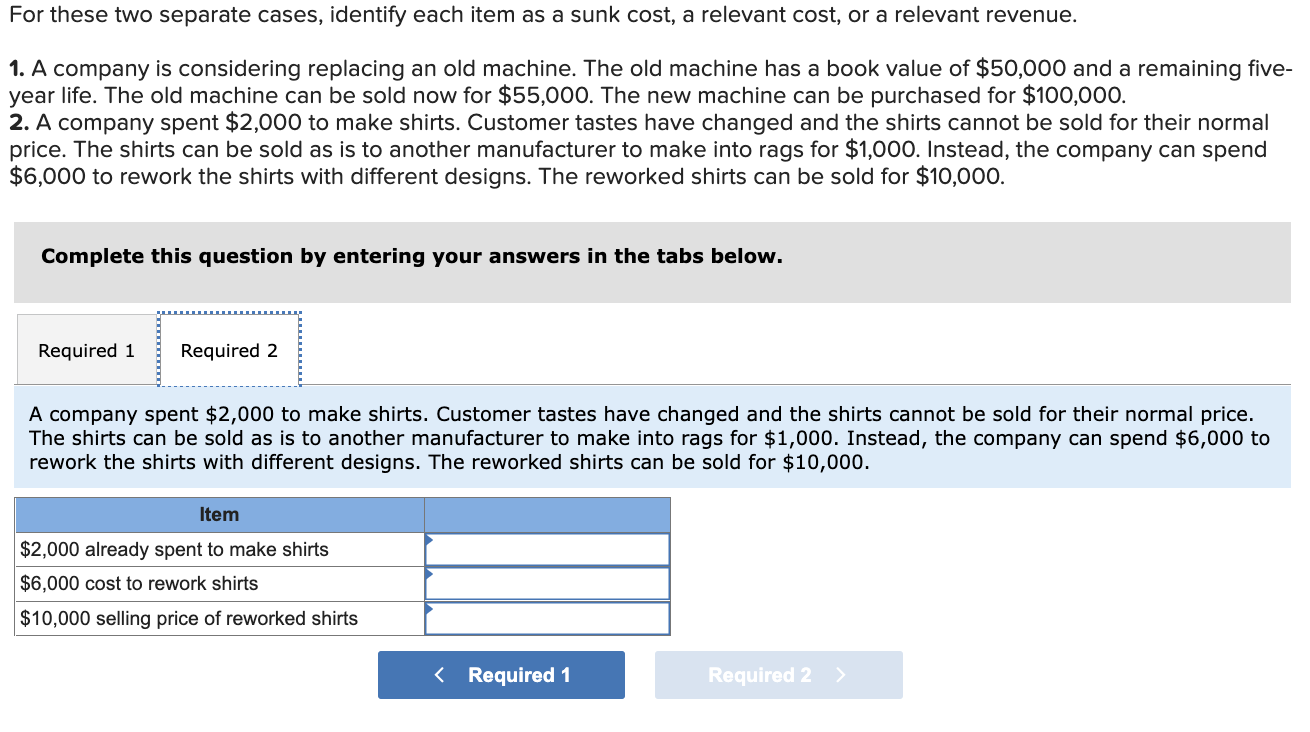

For these two separate cases, identify each item as a sunk cost, a relevant cost, or a relevant revenue. 1. A company is considering replacing an old machine. The old machine has a book value of $50,000 and a remaining five-year life. The old machine can be sold now for $55,000. The new machine can be purchased for $100,000. 2. A company spent $2,000 to make shirts. Customer tastes have changed and the shirts cannot be sold for their normal price. The shirts can be sold as is to another manufacturer to make into rags for $1,000. Instead, the company can spend $6,000 to rework the shirts with different designs. The reworked shirts can be sold for $10,000.

For these two separate cases, identify each item as a sunk cost, a relevant cost, or a relevant revenue. 1. A company is considering replacing an old machine. The old machine has a book value of $50,000 and a remaining five- year life. The old machine can be sold now for $55,000. The new machine can be purchased for $100,000. 2. A company spent $2,000 to make shirts. Customer tastes have changed and the shirts cannot be sold for their normal price. The shirts can be sold as is to another manufacturer to make into rags for $1,000. Instead, the company can spend $6,000 to rework the shirts with different designs. The reworked shirts can be sold for $10,000. Complete this question by entering your answers in the tabs below. Required 1 Required 2 A company is considering replacing an old machine. The old machine has a book value of $50,000 and a remaining five-year life. The old machine can be sold now for $55,000. The new machine can be purchased for $100,000. Item $50,000 book value of old machine $55,000 selling price of old machine $100,000 price of new machine Required 1 Required 2 > For these two separate cases, identify each item as a sunk cost, a relevant cost, or a relevant revenue. 1. A company is considering replacing an old machine. The old machine has a book value of $50,000 and a remaining five- year life. The old machine can be sold now for $55,000. The new machine can be purchased for $100,000. 2. A company spent $2,000 to make shirts. Customer tastes have changed and the shirts cannot be sold for their normal price. The shirts can be sold as is to another manufacturer to make into rags for $1,000. Instead, the company can spend $6,000 to rework the shirts with different designs. The reworked shirts can be sold for $10,000. Complete this question by entering your answers in the tabs below. Required 1 Required 2 A company spent $2,000 to make shirts. Customer tastes have changed and the shirts cannot be sold for their normal price. The shirts can be sold as is to another manufacturer to make into rags for $1,000. Instead, the company can spend $6,000 to rework the shirts with different designs. The reworked shirts can be sold for $10,000. Item $2,000 already spent to make shirts $6,000 cost to rework shirts $10,000 selling price of reworked shirtsStep by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started