Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Qu estion in Financial Planning ok), come up with intermediate and long-term portfolios using Vanguard Mutual Funds (https://investor.vanguard.com/mutual-funds/list#/mutual-funds/asset-class/month-end-returns). guard page titled Since Inception. e when

Qu

estion in Financial Planning

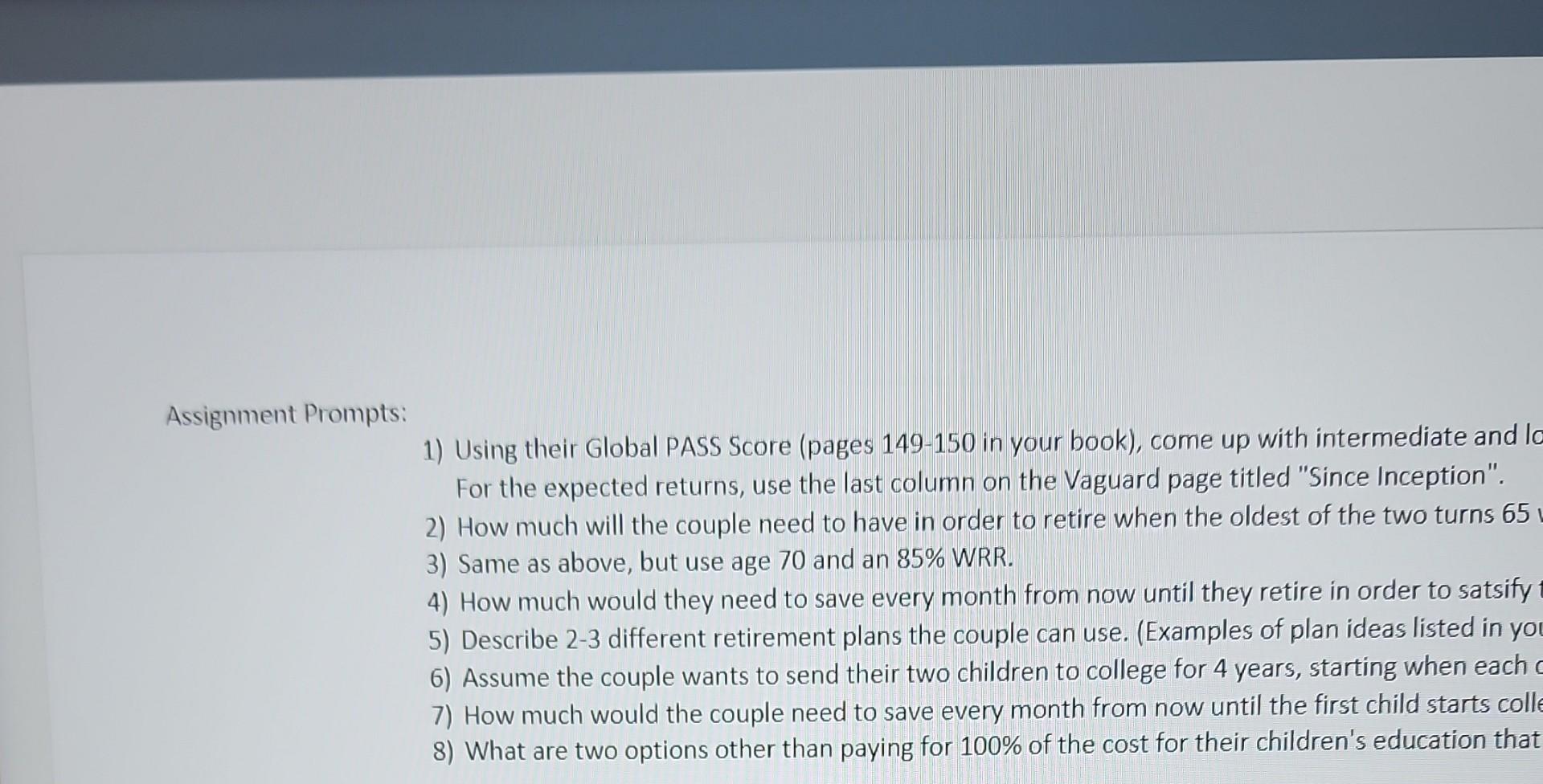

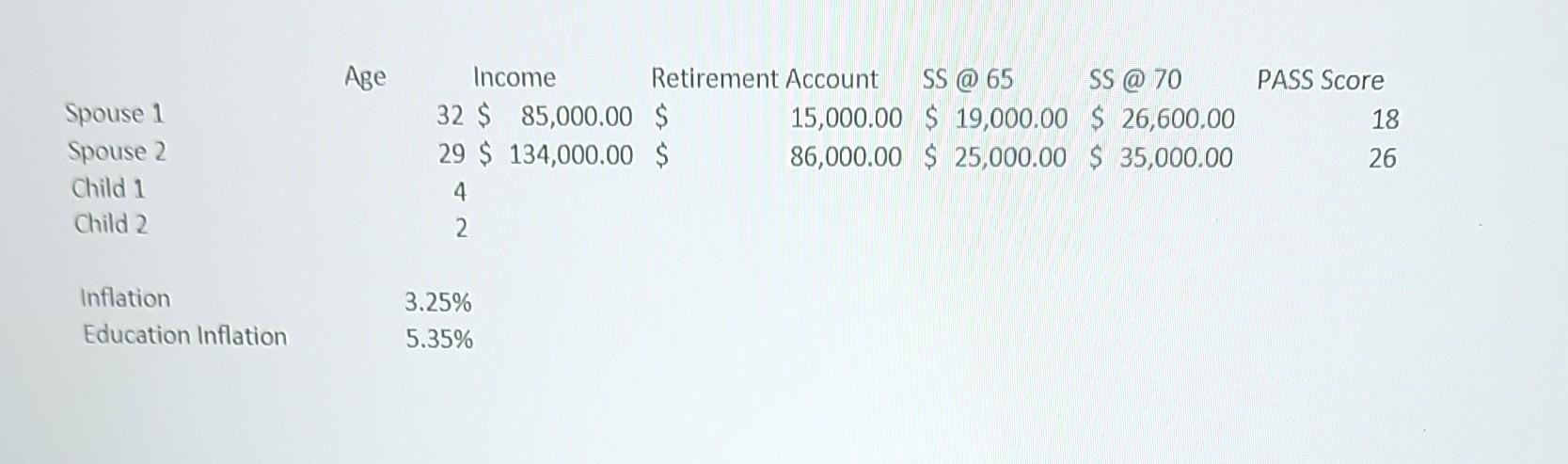

ok), come up with intermediate and long-term portfolios using Vanguard Mutual Funds (https://investor.vanguard.com/mutual-funds/list#/mutual-funds/asset-class/month-end-returns). guard page titled "Since Inception". e when the oldest of the two turns 65 with a 90% WRR? now until they retire in order to satsify the numbers found in 2 and 3 (basic annuity method)? Second, do the same, but for capital preservation method. use. (Examples of plan ideas listed in your chapter). college for 4 years, starting when each child turns 18 . Calculate the expected cost of both public and private universities when each child turns 18 . ch from now until the first child starts college in order to have enough to fund te education of both children? Do one each for public and private universities. the cost for their children's education that you would recommend they use? It can be a mix of the choices. 1) Using their Global PASS Score (pages 149-150 in your book), come up with intermediate and Ic For the expected returns, use the last column on the Vaguard page titled "Since Inception". 2) How much will the couple need to have in order to retire when the oldest of the two turns 65 3) Same as above, but use age 70 and an 85% WRR. 4) How much would they need to save every month from now until they retire in order to satsify 5) Describe 2-3 different retirement plans the couple can use. (Examples of plan ideas listed in yo 6) Assume the couple wants to send their two children to college for 4 years, starting when each 7) How much would the couple need to save every month from now until the first child starts coll 8) What are two options other than paying for 100% of the cost for their children's education that ok), come up with intermediate and long-term portfolios using Vanguard Mutual Funds (https://investor.vanguard.com/mutual-funds/list#/mutual-funds/asset-class/month-end-returns). guard page titled "Since Inception". e when the oldest of the two turns 65 with a 90% WRR? now until they retire in order to satsify the numbers found in 2 and 3 (basic annuity method)? Second, do the same, but for capital preservation method. use. (Examples of plan ideas listed in your chapter). college for 4 years, starting when each child turns 18 . Calculate the expected cost of both public and private universities when each child turns 18 . ch from now until the first child starts college in order to have enough to fund te education of both children? Do one each for public and private universities. the cost for their children's education that you would recommend they use? It can be a mix of the choices. 1) Using their Global PASS Score (pages 149-150 in your book), come up with intermediate and Ic For the expected returns, use the last column on the Vaguard page titled "Since Inception". 2) How much will the couple need to have in order to retire when the oldest of the two turns 65 3) Same as above, but use age 70 and an 85% WRR. 4) How much would they need to save every month from now until they retire in order to satsify 5) Describe 2-3 different retirement plans the couple can use. (Examples of plan ideas listed in yo 6) Assume the couple wants to send their two children to college for 4 years, starting when each 7) How much would the couple need to save every month from now until the first child starts coll 8) What are two options other than paying for 100% of the cost for their children's education that

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started