Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quadro S.A. has 1,500,000 1 ordinary shares and 2,285,000 profits attributable to these shares. Quadro has five potentially ordinary shares, as shown in the

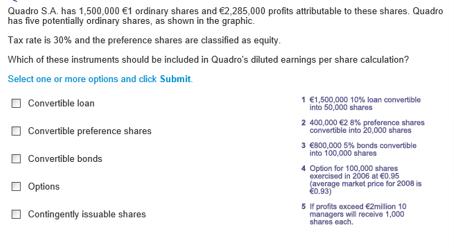

Quadro S.A. has 1,500,000 1 ordinary shares and 2,285,000 profits attributable to these shares. Quadro has five potentially ordinary shares, as shown in the graphic. Tax rate is 30% and the preference shares are classified as equity. Which of these instruments should be included in Quadro's diluted earnings per share calculation? Select one or more options and click Submit Convertible loan Convertible preference shares Convertible bonds Options Contingently issuable shares 1 1,500,000 10% loan convertible into 50,000 shares 2 400,000 28% preference shares convertible into 20,000 shares 3 800,000 5% bonds convertible into 100,000 shares 4 Option for 100,000 shares exercised in 2006 at 0.95 (average market price for 2008 is 0.93) 5 If profits exceed 2million 10 managers will receive 1,000 shares each.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To determine which instruments should be included in Quadros diluted earnings per share EPS calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started