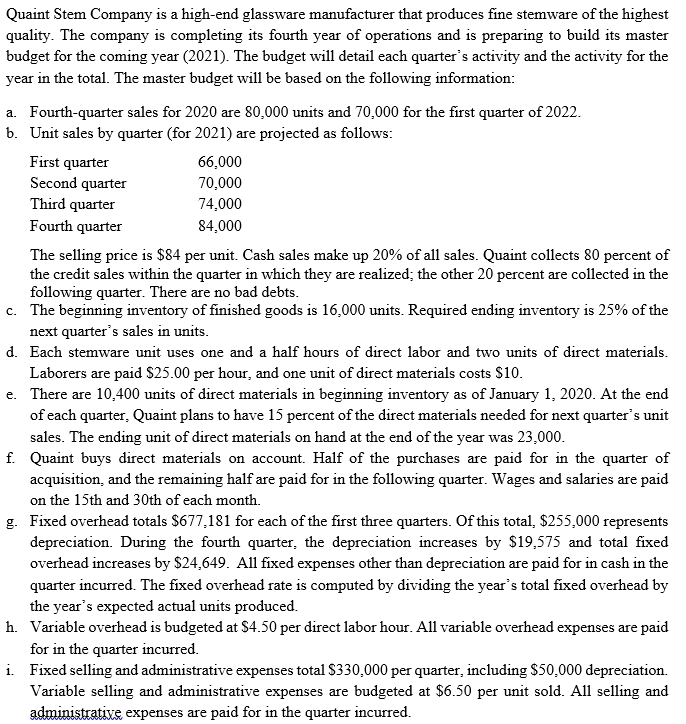

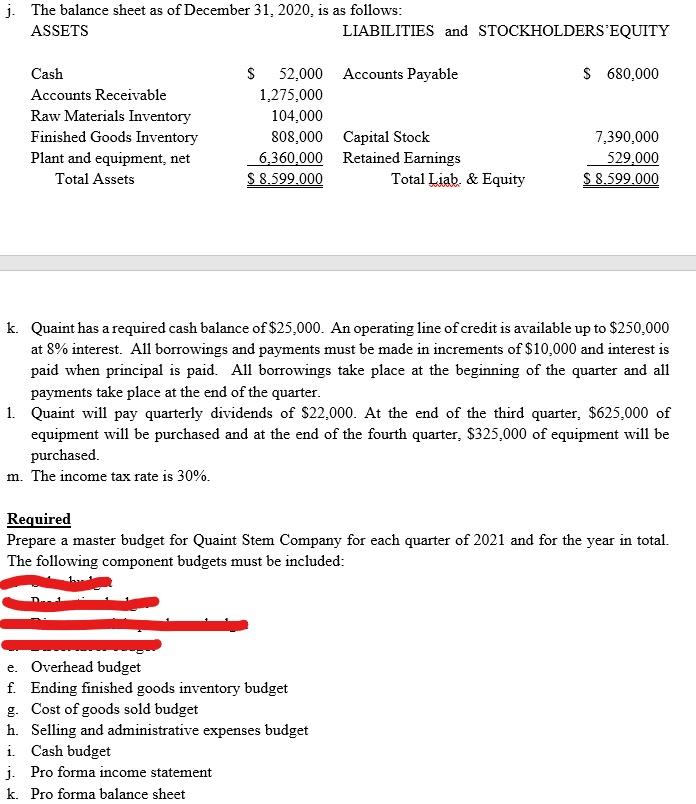

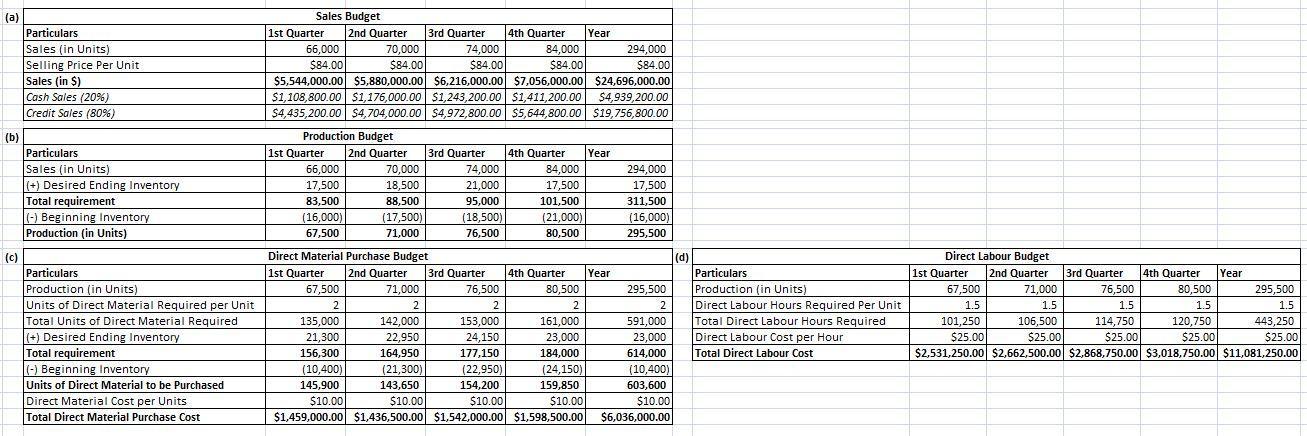

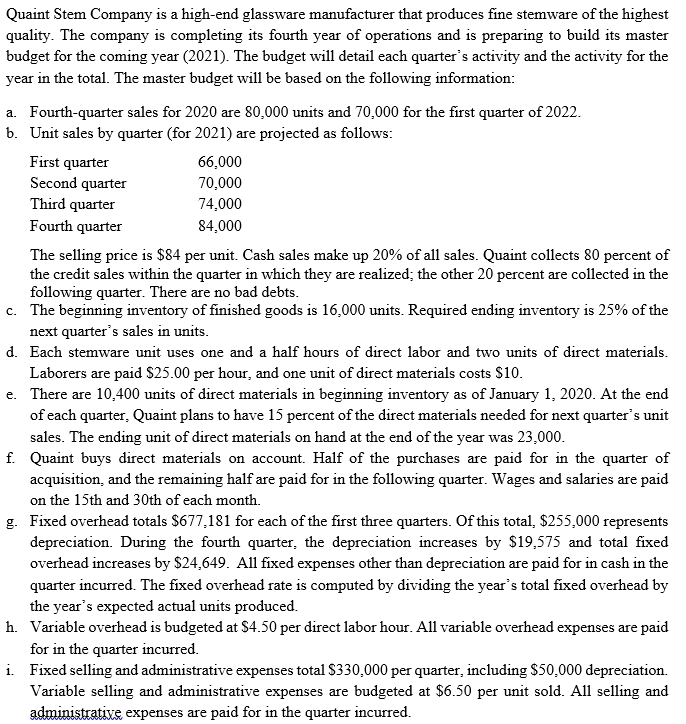

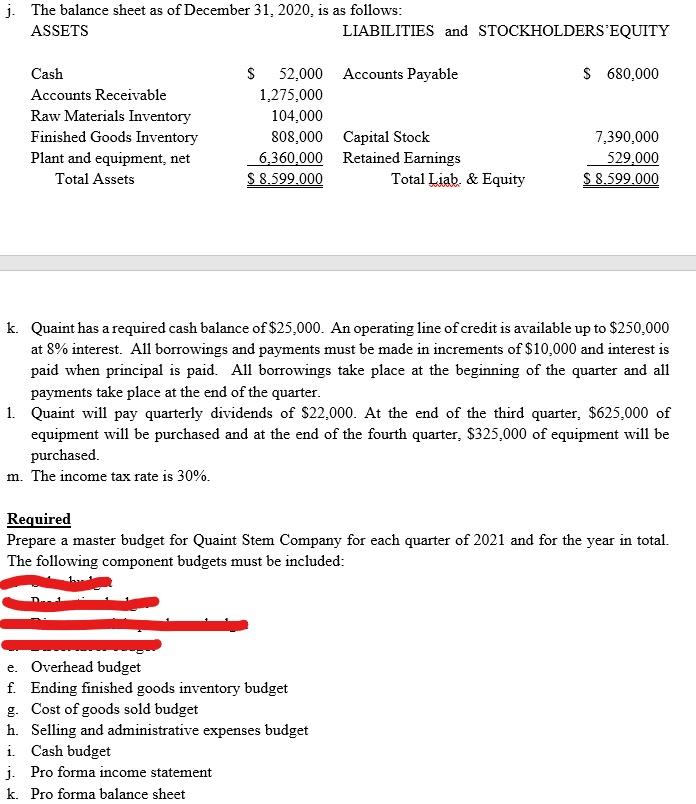

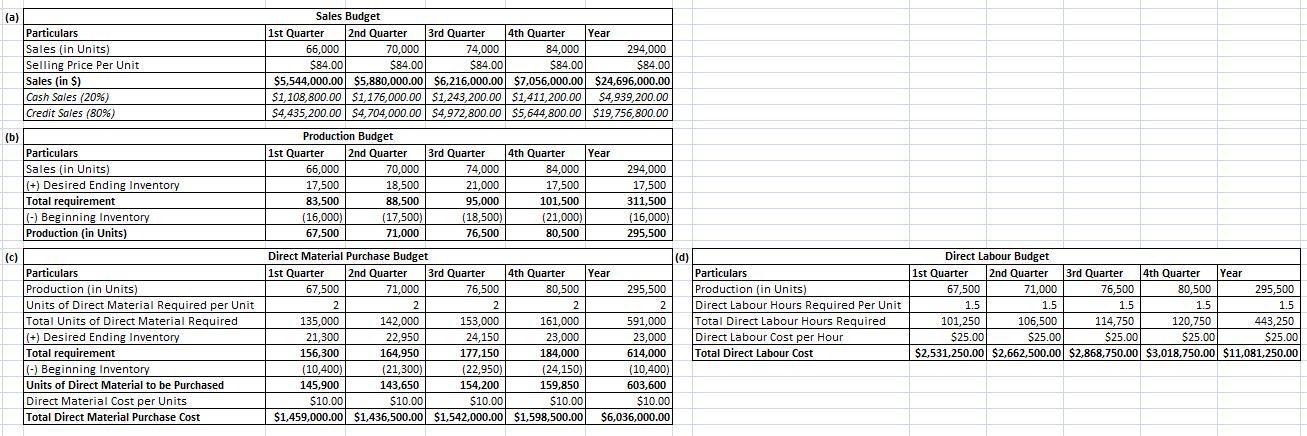

Quaint Stem Company is a high-end glassware manufacturer that produces fine stemware of the highest quality. The company is completing its fourth year of operations and is preparing to build its master budget for the coming year (2021). The budget will detail each quarter's activity and the activity for the year in the total. The master budget will be based on the following information: a. Fourth-quarter sales for 2020 are 80.000 units and 70.000 for the first quarter of 2022. b. Unit sales by quarter (for 2021) are projected as follows: First quarter 66,000 Second quarter 70,000 Third quarter 74,000 Fourth quarter 84,000 The selling price is $84 per unit. Cash sales make up 20% of all sales. Quaint collects 80 percent of the credit sales within the quarter in which they are realized; the other 20 percent are collected in the following quarter. There are no bad debts. c. The beginning inventory of finished goods is 16,000 units. Required ending inventory is 25% of the next quarter's sales in units. d. Each stemware unit uses one and a half hours of direct labor and two units of direct materials. Laborers are paid $25.00 per hour, and one unit of direct materials costs $10. e. There are 10.400 units of direct materials in beginning inventory as of January 1, 2020. At the end of each quarter, Quaint plans to have 15 percent of the direct materials needed for next quarter's unit sales. The ending unit of direct materials on hand at the end of the year was 23,000. f. Quaint buys direct materials on account. Half of the purchases are paid for in the quarter of acquisition, and the remaining half are paid for in the following quarter. Wages and salaries are paid on the 15th and 30th of each month. g. Fixed overhead totals $677,181 for each of the first three quarters. Of this total, $255,000 represents depreciation. During the fourth quarter, the depreciation increases by $19,575 and total fixed overhead increases by $24,649. All fixed expenses other than depreciation are paid for in cash in the quarter incurred. The fixed overhead rate is computed by dividing the year's total fixed overhead by the year's expected actual units produced. h. Variable overhead is budgeted at $4.50 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred. i. Fixed selling and administrative expenses total $330.000 per quarter, including $50,000 depreciation. Variable selling and administrative expenses are budgeted at $6.50 per unit sold. All selling and administrative expenses are paid for in the quarter incurred. j. The balance sheet as of December 31, 2020. is as follows: ASSETS LIABILITIES and STOCKHOLDERS'EQUITY $ 680,000 Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Plant and equipment, net Total Assets S 52.000 Accounts Payable 1,275,000 104,000 808,000 Capital Stock 6,360,000 Retained Earnings $ 8.599.000 Total Liab. & Equity 7,390,000 529.000 $ 8.599.000 k. Quaint has a required cash balance of $25,000. An operating line of credit is available up to $250.000 at 8% interest. All borrowings and payments must be made in increments of $10,000 and interest is paid when principal is paid. All borrowings take place at the beginning of the quarter and all payments take place at the end of the quarter. 1. Quaint will pay quarterly dividends of $22,000. At the end of the third quarter, $625,000 of equipment will be purchased and at the end of the fourth quarter, $325,000 of equipment will be purchased. m. The income tax rate is 30%. Required Prepare a master budget for Quaint Stem Company for each quarter of 2021 and for the year in total. The following component budgets must be included: e. Overhead budget f. Ending finished goods inventory budget g. Cost of goods sold budget h. Selling and administrative expenses budget i Cash budget j. Pro forma income statement k. Pro forma balance sheet (a) Particulars Sales (in Units) Selling Price Per Unit Sales (in S) Cash Sales (20%) Credit Sales (80%) Sales Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year 66,000 70,000 74,000 84,000 294,000 $84.00 $84.00 $84.00 $84.00 $84.00 $5,544,000.00 $5,880,000.00 $6,216,000.00 $7,056,000.00 $24,696,000.00 $1,108,800.00 $1,176,000.00 $1,243,200.00 $1,411,200.00 $4,939,200.00 S4,435,200.00 $4,704,000.00 $4,972,800.00 $5,644,800.00 $19,756,800.00 Production Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year 66,000 70,000 74,000 84,000 294,000 18,500 21,000 17,500 17,500 83,500 88,500 95,000 101,500 311,500 (16,000) (18,500) (21,000) (16,000) 67,500 71,000 76,500 80,500 295,500 (b) 17,500 Particulars Sales (in Units) (+) Desired Ending Inventory Total requirement (-) Beginning Inventory Production (in Units) (17.500) (c) Particulars Production (in Units) Units of Direct Material Required per Unit Total Units of Direct Material Required (+) Desired Ending Inventory Total requirement (-) Beginning Inventory Units of Direct Material to be purchased Direct Material Cost per Units Total Direct Material Purchase Cost Direct Material Purchase Budget (d) 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Particulars 67,500 71,000 76,500 80,500 295,500 Production in Units) 2 2 2 2 2 Direct Labour Hours Required Per Unit 135,000 142,000 153,000 161,000 591,000 Total Direct Labour Hours Required 21,300 22,950 24,150 23,000 23,000 Direct Labour Cost per Hour 156,300 164,950 177,150 184,000 614,000 Total Direct Labour Cost (10,400) (21,300) (22,950) (24,150) (10,400) 145,900 143,650 154,200 159,850 603,600 $10.00 $10.00 $10.00 $10.00 $10.00 $1,459,000.00 $1,436,500.00 $1,542,000.00 $1,598,500.00 $6,036,000.00 Direct Labour Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year 67,500 71,000 76,500 80,500 295,500 1.5 1.5 1.5 1.5 1.5 101,250 106,500 114,750 120,750 443,250 $25.00 $25.00 $25.00 $25.00 $25.00 $2,531,250.00 $2,662,500.00 $2,868,750.00 $3,018,750.00 $11,081,250.00 (a) Particulars Sales (in Units) Selling Price Per Unit Sales (in S) Cash Sales (20%) Credit Sales (80%) Sales Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year 66,000 70,000 74,000 84,000 294,000 $84.00 $84.00 $84.00 $84.00 $84.00 $5,544,000.00 $5,880,000.00 $6,216,000.00 $7,056,000.00 $24,696,000.00 $1,108,800.00 $1,176,000.00 $1,243,200.00 $1,411,200.00 $4,939,200.00 S4,435,200.00 $4,704,000.00 $4,972,800.00 $5,644,800.00 $19,756,800.00 Production Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year 66,000 70,000 74,000 84,000 294,000 18,500 21,000 17,500 17,500 83,500 88,500 95,000 101,500 311,500 (16,000) (18,500) (21,000) (16,000) 67,500 71,000 76,500 80,500 295,500 (b) 17,500 Particulars Sales (in Units) (+) Desired Ending Inventory Total requirement (-) Beginning Inventory Production (in Units) (17.500) (c) Particulars Production (in Units) Units of Direct Material Required per Unit Total Units of Direct Material Required (+) Desired Ending Inventory Total requirement (-) Beginning Inventory Units of Direct Material to be purchased Direct Material Cost per Units Total Direct Material Purchase Cost Direct Material Purchase Budget (d) 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Particulars 67,500 71,000 76,500 80,500 295,500 Production in Units) 2 2 2 2 2 Direct Labour Hours Required Per Unit 135,000 142,000 153,000 161,000 591,000 Total Direct Labour Hours Required 21,300 22,950 24,150 23,000 23,000 Direct Labour Cost per Hour 156,300 164,950 177,150 184,000 614,000 Total Direct Labour Cost (10,400) (21,300) (22,950) (24,150) (10,400) 145,900 143,650 154,200 159,850 603,600 $10.00 $10.00 $10.00 $10.00 $10.00 $1,459,000.00 $1,436,500.00 $1,542,000.00 $1,598,500.00 $6,036,000.00 Direct Labour Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year 67,500 71,000 76,500 80,500 295,500 1.5 1.5 1.5 1.5 1.5 101,250 106,500 114,750 120,750 443,250 $25.00 $25.00 $25.00 $25.00 $25.00 $2,531,250.00 $2,662,500.00 $2,868,750.00 $3,018,750.00 $11,081,250.00