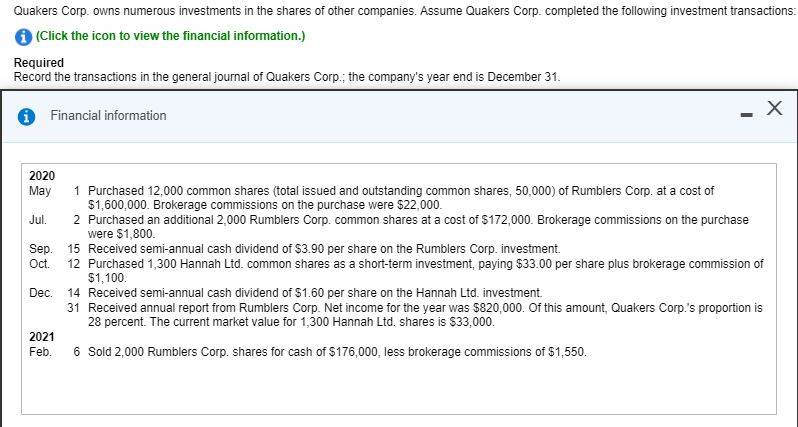

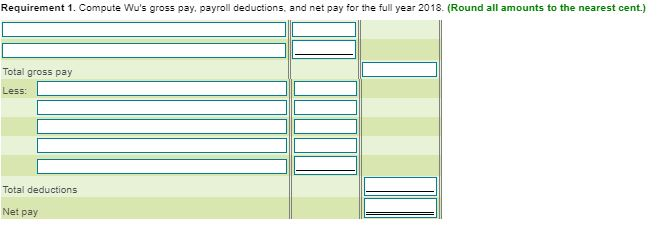

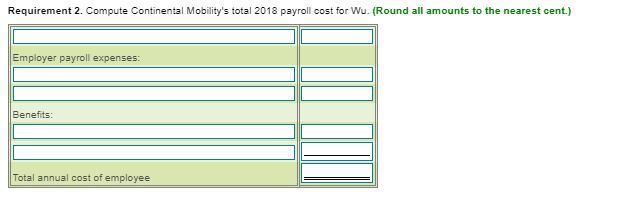

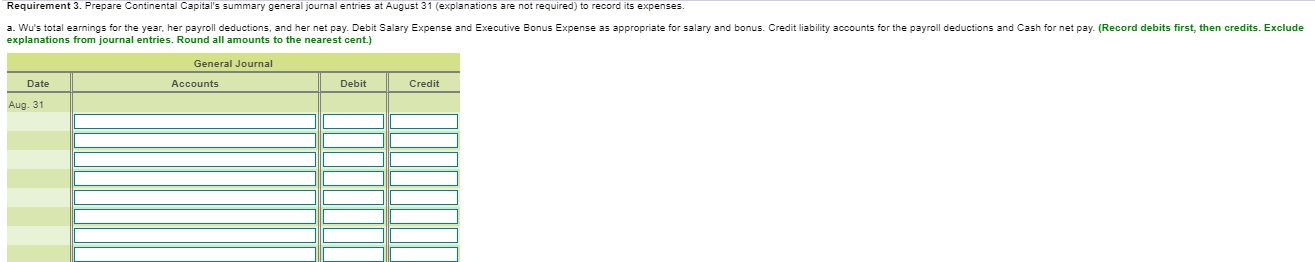

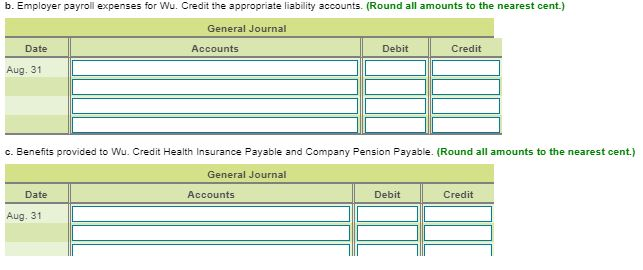

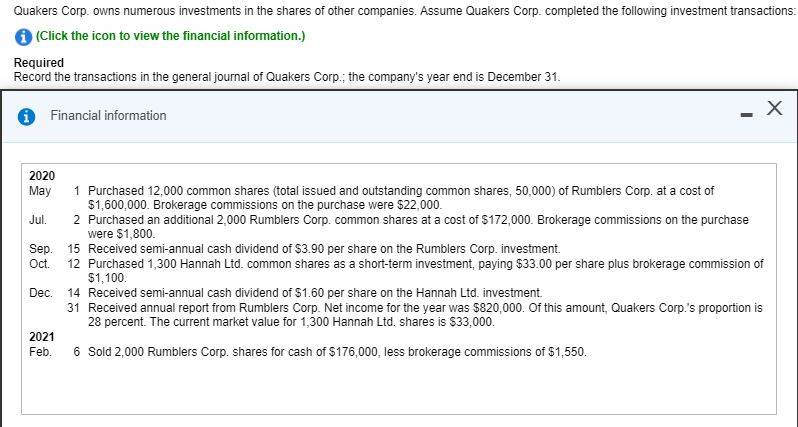

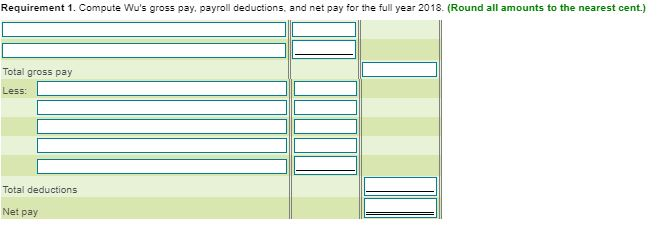

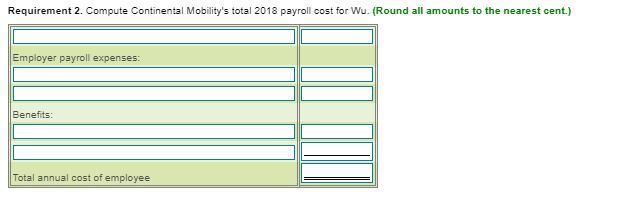

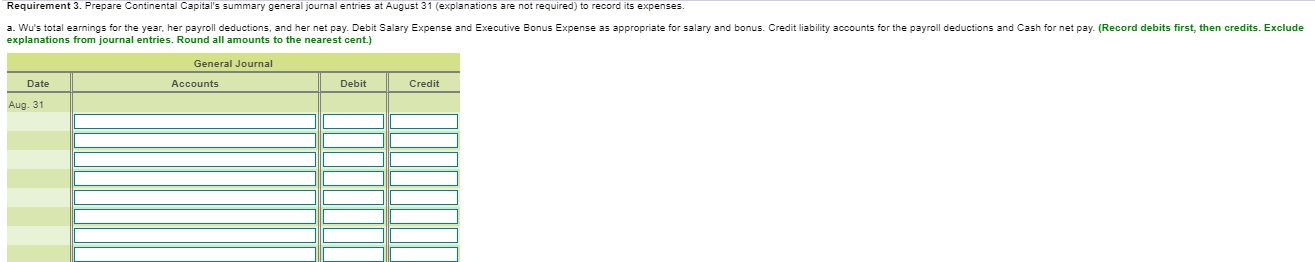

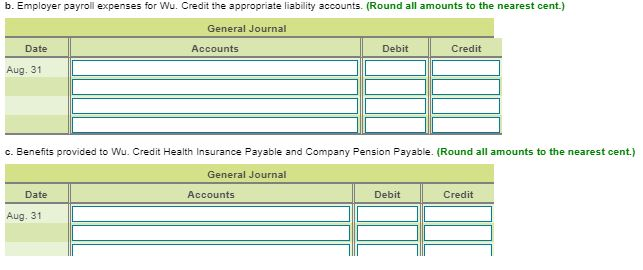

Quakers Corp. owns numerous investments in the shares of other companies. Assume Quakers Corp. completed the following investment transactions: (Click the icon to view the financial information.) Required Record the transactions in the general journal of Quakers Corp.; the company's year end is December 31. x Financial information 2020 May 1 Purchased 12,000 common shares (total issued and outstanding common shares, 50,000) of Rumblers Corp. at a cost of $1,600,000. Brokerage commissions on the purchase were $22,000. Jul. 2 Purchased an additional 2.000 Rumblers Corp. common shares at a cost of $172,000. Brokerage commissions on the purchase were $1,800 Sep. 15 Received semi-annual cash dividend of $3.90 per share on the Rumblers Corp. investment Oct. 12 Purchased 1,300 Hannah Ltd. common shares as a short-term investment, paying $33.00 per share plus brokerage commission of $1,100. Dec. 14 Received semi-annual cash dividend of $1.60 per share on the Hannah Ltd. investment 31 Received annual report from Rumblers Corp. Net income for the year was $820,000. Of this amount, Quakers Corp.'s proportion is 28 percent. The current market value for 1,300 Hannah Ltd. shares is $33,000. 2021 Feb. 6 Sold 2,000 Rumblers Corp. shares for cash of $176,000, less brokerage commissions of $1,550. Requirement 1. Compute Wu's gross pay, payroll deductions, and net pay for the full year 2018. (Round all amounts to the nearest cent.) Total gross pay Less: Total deductions Net pay Requirement 2. Compute Continental Mobility's total 2018 payroll cost for Wu. (Round all amounts to the nearest cent.) Employer payroll expenses: Benefits: Total annual cost of employee Requirement 3. Prepare Continental Capital's summary general journal entries at August 31 (explanations are not required) to record its expenses. a. Wu's total earnings for the year, her payroll deductions, and her net pay. Debit Salary Expense and Executive Bonus Expense as appropriate for salary and bonus. Credit liability accounts for the payroll deductions and Cash for net pay. (Record debits first, then credits. Exclude explanations from journal entries. Round all amounts to the nearest cent.) General Journal Accounts Debit Credit Date Aug 31 b. Employer payroll expenses for Wu. Credit the appropriate liability accounts. (Round all amounts to the nearest cent.) General Journal Date Accounts Debit Credit Aug. 31 c. Benefits provided to Wu. Credit Health Insurance Payable and Company Pension Payable. (Round all amounts to the nearest cent.) General Journal Date Accounts Debit Credit Aug. 31