Question

Qualified employees of a city water department participate in a defined benefit pension plan administered by the city. Every year, three events affect both the

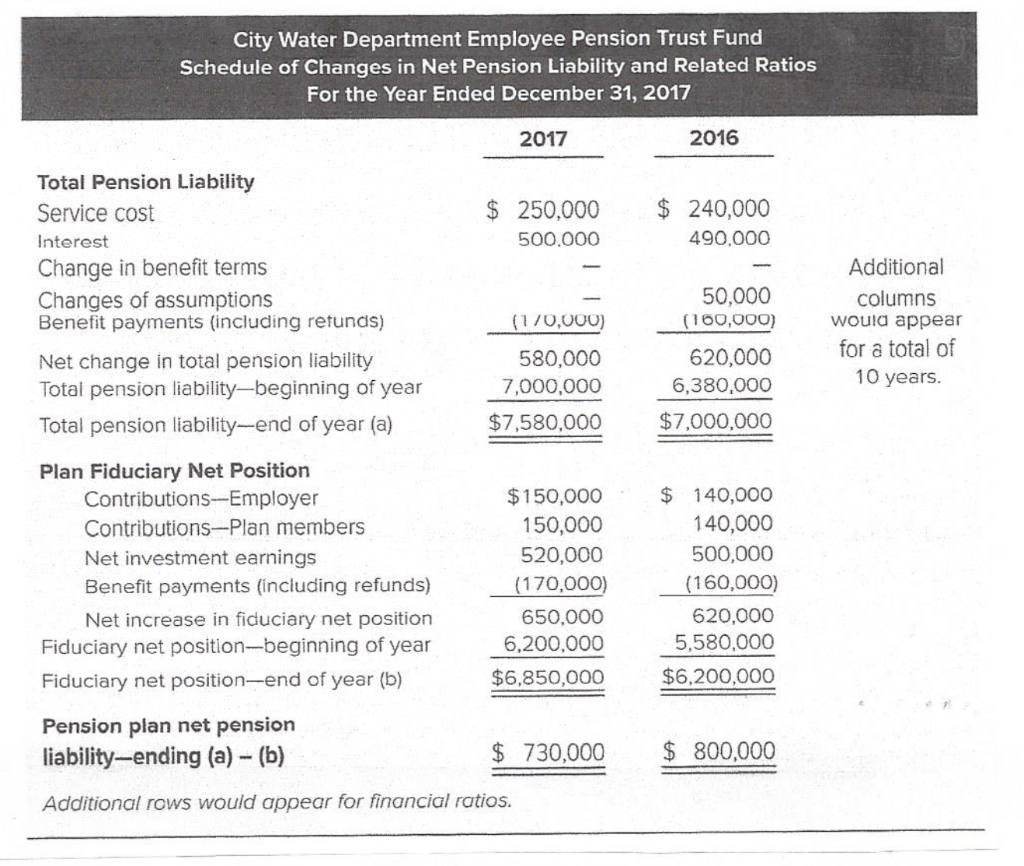

Qualified employees of a city water department participate in a defined benefit pension plan administered by the city. Every year, three events affect both the net pension liability and pension expense: current-period service cost, interest on the total pension liability, and the projected level of earning on plan investments. The projected level of earning on the plan investments is $490,000 for the year, the service cost component is $250,000 and the interest on the pension liability is $500,000 for the year.

3) Changes in the Net Pension Liability may occur because of differences between the projected and actual returns on pension plan investments. Changes in the net pension liability resulting from such differences are required to be deferred and recognized in pension expense over a five-year period. Record these journal entries

City Water Department Employee Pension Trust Fund Schedule of Changes in Net Pension Liability and Related Ratios For the Year Ended December 31, 2017 2017 2016 $ 250,000 500.000 $ 240,000 490,000 Total Pension Liability Service cost Interest Change in benefit terms Changes of assumptions Benefit payments (including refunds) Net change in total pension liability Total pension liability-beginning of year Total pension liability-end of year (a) Additional columns would appear for a total of (170,000) 50,000 (100,000) 620,000 6,380,000 $7,000,000 580,000 7,000,000 $7,580,000 10 years. Plan Fiduciary Net Position Contributions--Employer Contributions-Plan members Net investment earnings Benefit payments (including refunds) Net increase in fiduciary net position Fiduciary net position-beginning of year Fiduciary net position-end of year (b) $150,000 150,000 520,000 (170,000) 650.000 6,200,000 $6,850,000 $ 140,000 140,000 500,000 (160,000) 620,000 5,580,000 $6,200,000 Pension plan net pension liability-ending (a) - (b) $ 730,000 $ 800,000 Additional rows would appear for financial ratios. City Water Department Employee Pension Trust Fund Schedule of Changes in Net Pension Liability and Related Ratios For the Year Ended December 31, 2017 2017 2016 $ 250,000 500.000 $ 240,000 490,000 Total Pension Liability Service cost Interest Change in benefit terms Changes of assumptions Benefit payments (including refunds) Net change in total pension liability Total pension liability-beginning of year Total pension liability-end of year (a) Additional columns would appear for a total of (170,000) 50,000 (100,000) 620,000 6,380,000 $7,000,000 580,000 7,000,000 $7,580,000 10 years. Plan Fiduciary Net Position Contributions--Employer Contributions-Plan members Net investment earnings Benefit payments (including refunds) Net increase in fiduciary net position Fiduciary net position-beginning of year Fiduciary net position-end of year (b) $150,000 150,000 520,000 (170,000) 650.000 6,200,000 $6,850,000 $ 140,000 140,000 500,000 (160,000) 620,000 5,580,000 $6,200,000 Pension plan net pension liability-ending (a) - (b) $ 730,000 $ 800,000 Additional rows would appear for financial ratiosStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started