Answered step by step

Verified Expert Solution

Question

1 Approved Answer

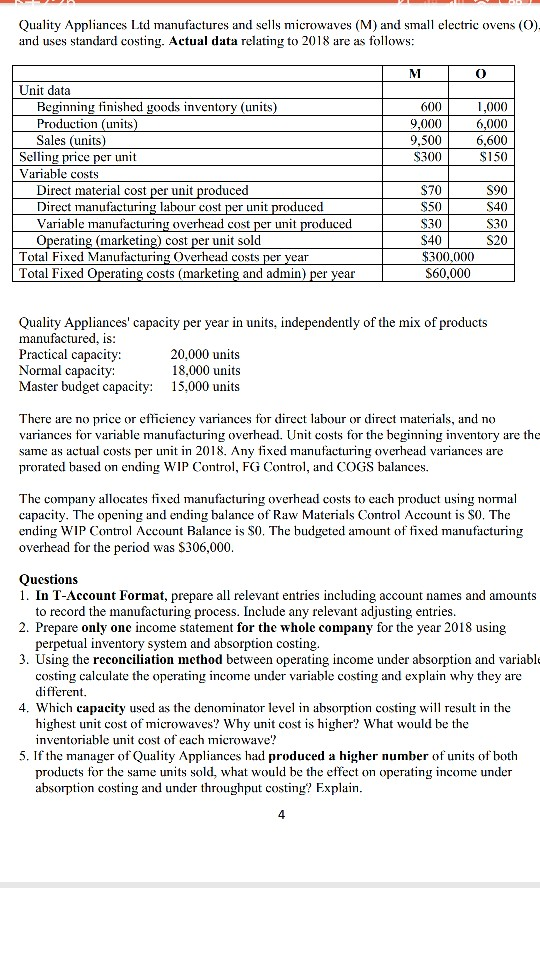

Quality Appliances Ltd manufactures and sells microwaves (M) and small electric ovens (O) and uses standard costing. Actual data relating to 2018 are as follows

Quality Appliances Ltd manufactures and sells microwaves (M) and small electric ovens (O) and uses standard costing. Actual data relating to 2018 are as follows Unit data Beginning tinished goods inventory (units) Production (units Sales (units) 600 9,000 9,500 $300 1,000 6,000 6,600 $150 Selling price per unit Variable costs Direct material cost per unit produced Direct manufacturing labour cost per unit produced Variable manufacturing overhead cost per unit produced Operating (marketing) cost per unit sold S90 S40 S30 S30 S40 $300,000 S60,000 Total Fixed Manufacturing Overhead costs per vear Total Fixed Operating costs (marketing and admin) per year Quality Appliances' capacity per year in units, independently of the mix of products manufactured, is Practical capacity: Normal capacity: Master budget capacity: 15,000 units 20,000 units 18,000 units There are no price or efficiency variances for direct labour or direct materials, and no variances for variable manufacturing overhead. Unit costs for the beginning inventory are the same as actual costs per unit in 2018. Any tixed manufacturing overhead variances are prorated based on ending WIP Control, FG Contro, and COGS balances. The company allocates tixed manufacturing overhead costs to each product using normal capacity. The opening and ending balance of Raw Materials Control Account is S0. The ending WIP Control Account Balance is $0. The budgeted amount of tixed manufacturing overhead for the period was $306,000 Qucstions 1. In T-Account Format, prepare all relevant entries including account names and amounts to record the manufacturing process. Include any relevant adjusting entries. perpetual inventory system and absorption costing. costing calculate the operating income under variable costing and explain why they are 2. Prepare only one income statement for the whole company for the year 2018 using 3. Using the reconciliation method between operating income under absorption and variable different 4. Which capacity used as the denominator level in absorption costing wl result in the highest unit cost of microwaves? Why unit cost is higher? What would be the inventoriable unit cost of each microwave? 5. If the manager of Quality Appliances had produced a higher number of units of both products for the same unts sold, what would be the effect on operating income under absorption costing and under throughput costing FExplain. 4 Quality Appliances Ltd manufactures and sells microwaves (M) and small electric ovens (O) and uses standard costing. Actual data relating to 2018 are as follows Unit data Beginning tinished goods inventory (units) Production (units Sales (units) 600 9,000 9,500 $300 1,000 6,000 6,600 $150 Selling price per unit Variable costs Direct material cost per unit produced Direct manufacturing labour cost per unit produced Variable manufacturing overhead cost per unit produced Operating (marketing) cost per unit sold S90 S40 S30 S30 S40 $300,000 S60,000 Total Fixed Manufacturing Overhead costs per vear Total Fixed Operating costs (marketing and admin) per year Quality Appliances' capacity per year in units, independently of the mix of products manufactured, is Practical capacity: Normal capacity: Master budget capacity: 15,000 units 20,000 units 18,000 units There are no price or efficiency variances for direct labour or direct materials, and no variances for variable manufacturing overhead. Unit costs for the beginning inventory are the same as actual costs per unit in 2018. Any tixed manufacturing overhead variances are prorated based on ending WIP Control, FG Contro, and COGS balances. The company allocates tixed manufacturing overhead costs to each product using normal capacity. The opening and ending balance of Raw Materials Control Account is S0. The ending WIP Control Account Balance is $0. The budgeted amount of tixed manufacturing overhead for the period was $306,000 Qucstions 1. In T-Account Format, prepare all relevant entries including account names and amounts to record the manufacturing process. Include any relevant adjusting entries. perpetual inventory system and absorption costing. costing calculate the operating income under variable costing and explain why they are 2. Prepare only one income statement for the whole company for the year 2018 using 3. Using the reconciliation method between operating income under absorption and variable different 4. Which capacity used as the denominator level in absorption costing wl result in the highest unit cost of microwaves? Why unit cost is higher? What would be the inventoriable unit cost of each microwave? 5. If the manager of Quality Appliances had produced a higher number of units of both products for the same unts sold, what would be the effect on operating income under absorption costing and under throughput costing FExplain. 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started