Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quality Co requires a minimum cash balance of $25,000 at the end of February of the current year. Any required borrowings take place in increments

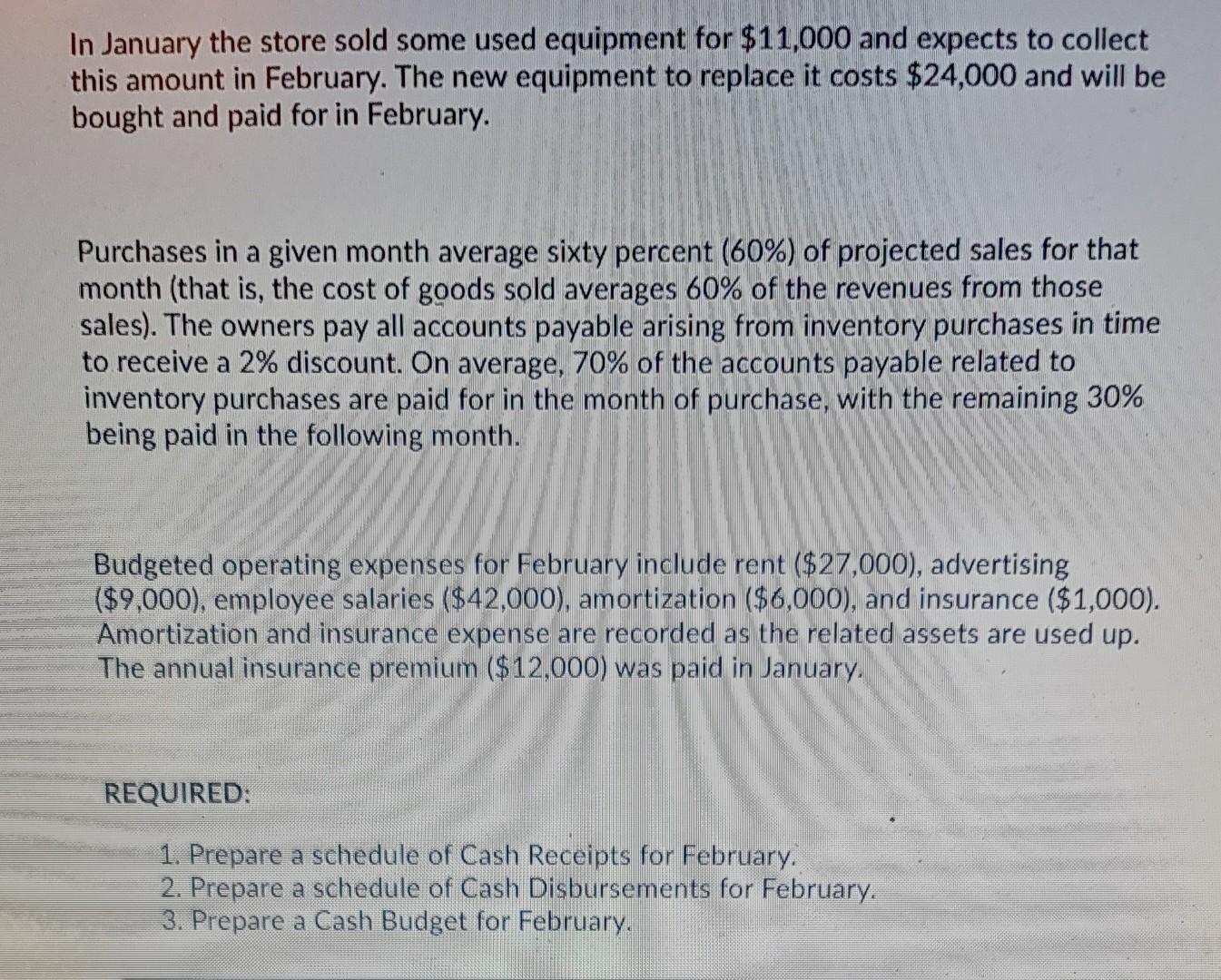

Quality Co requires a minimum cash balance of $25,000 at the end of February of the current year. Any required borrowings take place in increments of $1,000 with annual interest of 8%. Repayments of borrowed funds are also made in increments of $1,000. Assume that borrowings are made on the first day of the month in which the cash is required, and that repayments are made on the last day of a month in which excess cash is available. The cash balance at January 31 is $28,000.

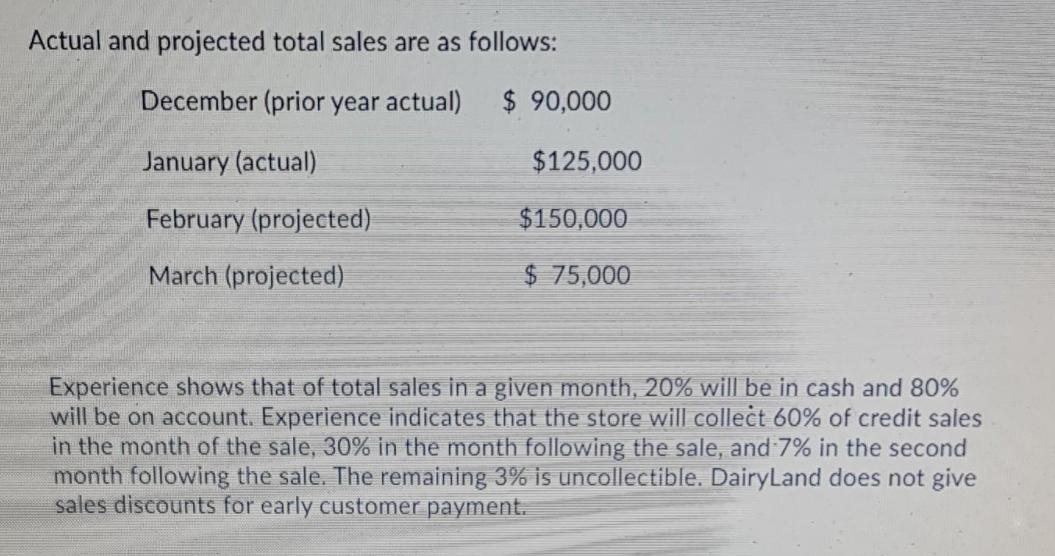

Actual and projected total sales are as follows: December (prior year actual) $ 90,000 January (actual) $125,000 February (projected) $150,000 March (projected) $ 75,000 Experience shows that of total sales in a given month, 20% will be in cash and 80% will be on account. Experience indicates that the store will collect 60% of credit sales in the month of the sale, 30% in the month following the sale, and 7% in the second month following the sale. The remaining 3% is uncollectible. DairyLand does not give sales discounts for early customer payment.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

O Schedule of Ca8h Receipts Februauy cash sales 150000 X 20 30000 Credit sales o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started