Luna Company is an IFRS reporter. Luna Company acquired 100% of the voting stock of the AutoMania Group on January 1 of the current year

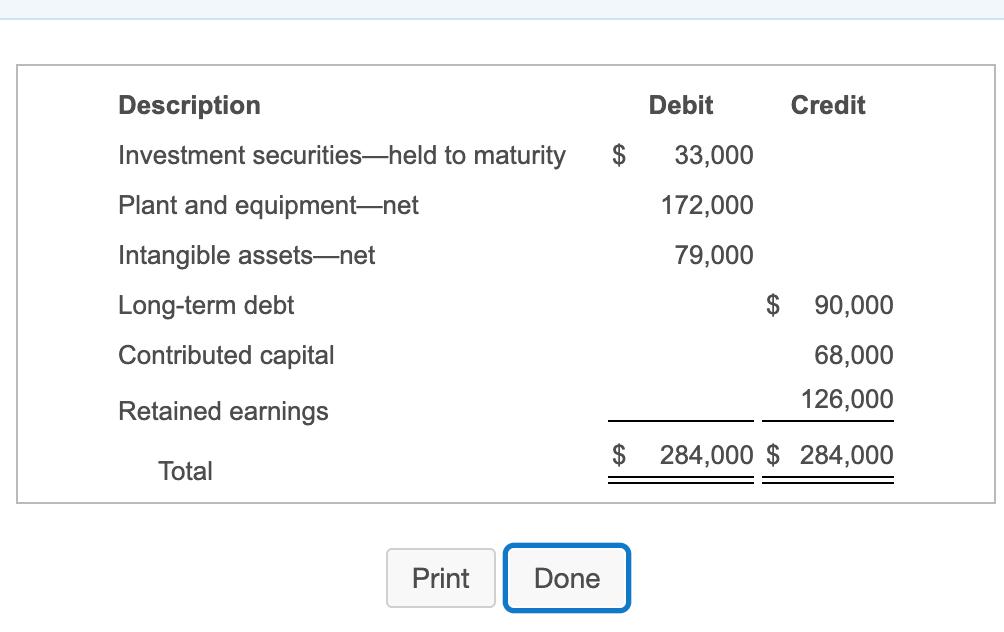

Luna Company is an IFRS reporter. Luna Company acquired 100% of the voting stock of the AutoMania Group on January 1 of the current year for a total acquisition cost of $251,000. The trial balance of AutoMania on the date of acquisition follows.

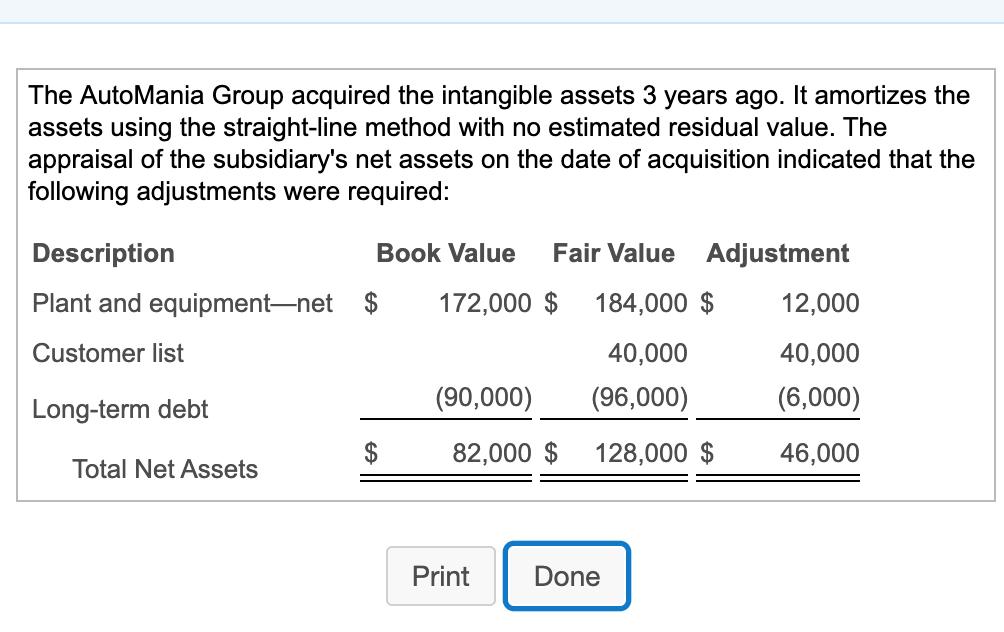

Requirement a. Compute the amount of goodwill to be recorded on the date of acquisition.

Less: | ||

Goodwill | ||

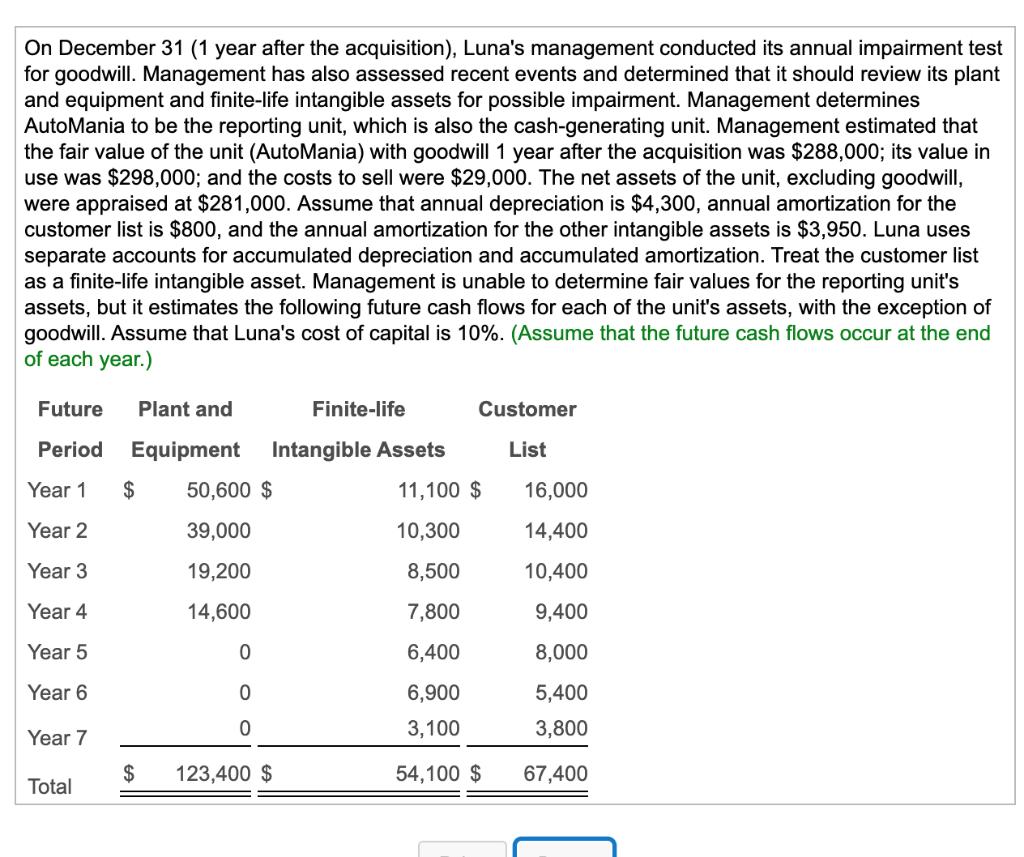

Requirement b. Conduct the impairment test for goodwill at the end of the year, one year after the acquisition. Assume no changes in the reporting unit's assets and liabilities except for depreciation and amortization. (Abbreviations used: CGU = cash-generating unit.)

Start with part 1.

Part 1: | Goodwill |

Recoverable amount of the CGU |

Now complete part 2 of the impairment test for goodwill and identify any impairment loss. (If you selected "No" that an impairment loss is not indicated, then leave the impairment loss input cell blank. Abbreviations used: CGU = cash-generatingunit.)

Part 2: | Goodwill |

Impairment loss indicated | |

Impairment loss, if any |

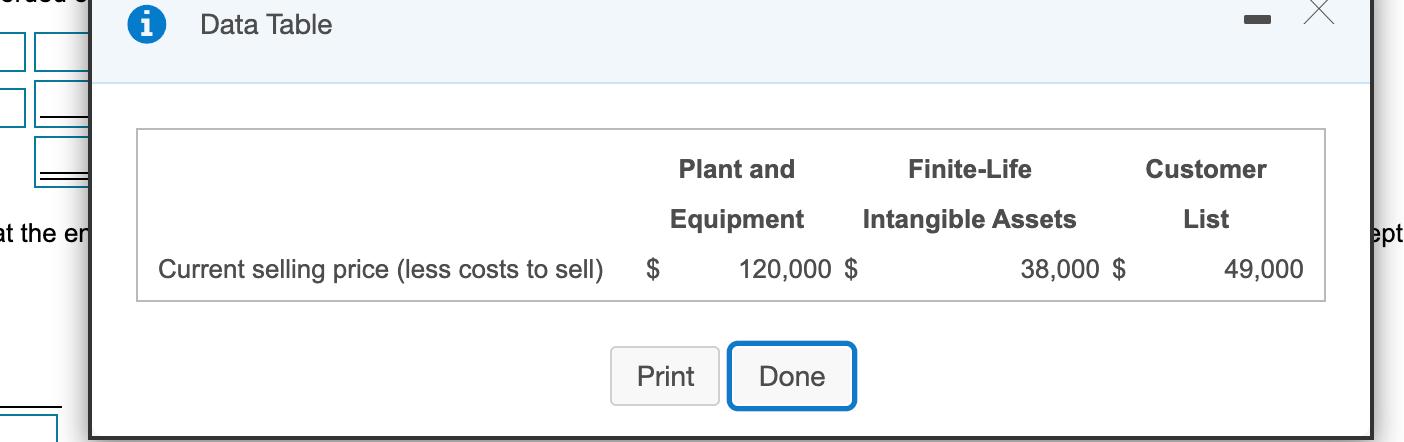

Requirement c. Conduct the impairment tests indicated for assets other than goodwill at the end of the year, one year after the acquisition. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimalplaces, X.XXXXX. Round intermediary calculations for each year and your final answers to the nearest whole dollar.)

Start with part 1.

Plant and | Finite-life | Customer | |

Part 1: | Equipment | Intangible Assets | List |

Recoverable amount |

Now complete part 2 of the impairment test for assets other than goodwill. For each asset group, complete the test and then select on the third line whether an impairment is indicated. If impairment is not indicated, leave the impairment loss cell blank. (If a box is not used in the table, leave the box empty; do not enter a zero. Round your final answer for each asset group to the nearest whole dollar.)

Plant and | Finite-life | Customer | |

Part 2: | Equipment | Intangible Assets | List |

Impairment indicated | |||

Impairment loss, if any |

Requirement d. Prepare the journal entries required to record any impairment losses computed in parts (b) and (c). (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.)

First record any impairment loss on goodwill calculated in Requirement b.

Account | Date of impairment | |

Record any impairment loss on plant and equipment calculated in Requirement c.

Account | Date of impairment | |

Record any impairment loss on finite-life intangibles calculated in Requirement c. (Assume

Luna

Company makes amortization entries to the applicable accumulated amortization account.)

Account | Date of impairment | |

Record any impairment loss on the customer list calculated in Requirement c.

Account | Date of impairment | |

Description Investment securities-held to maturity Plant and equipment-net Intangible assets-net Long-term debt Contributed capital Retained earnings Total Print Done Debit 33,000 172,000 79,000 Credit $ 90,000 68,000 126,000 $ 284,000 $284,000

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Required Prepare journal entri...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started