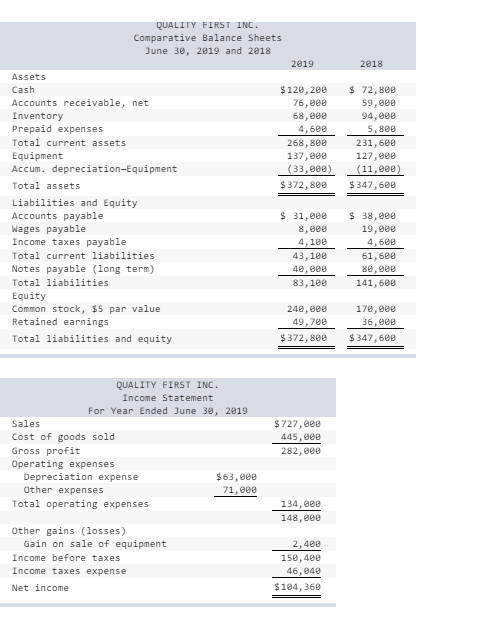

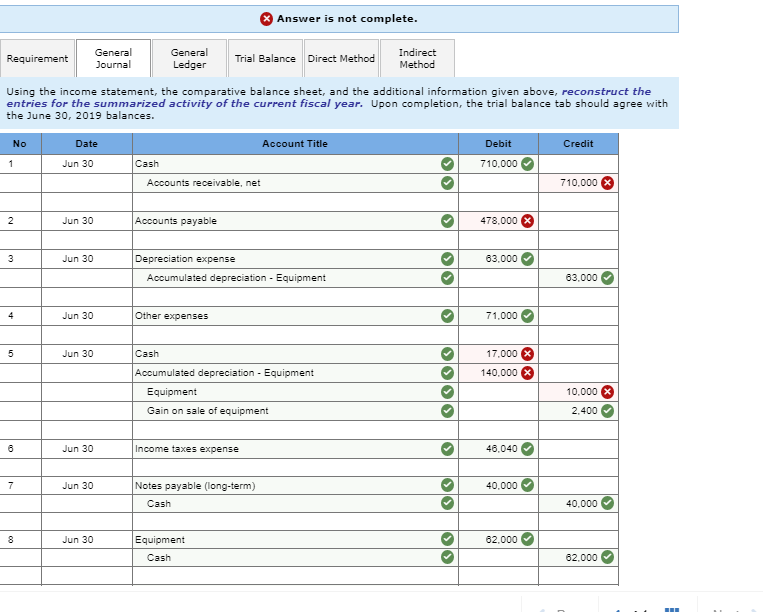

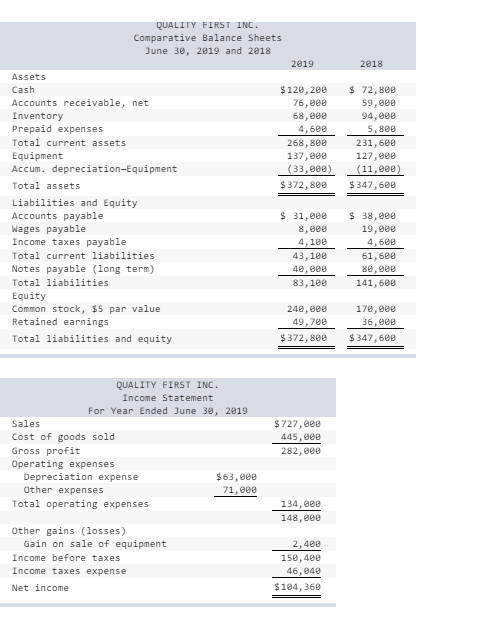

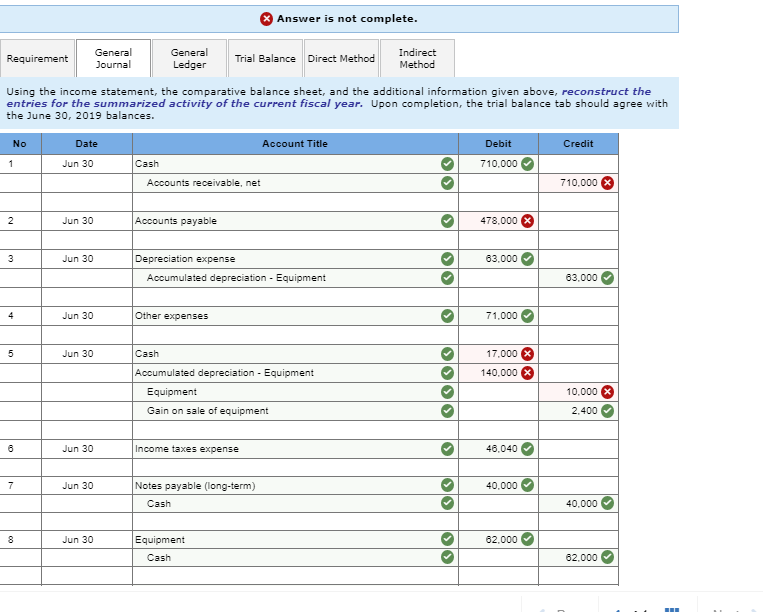

QUALITY FIRST INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $120, 200 76, eee 68,000 4,682 268,800 137, eee (33,000) $372,800 $ 72,800 59,00 94,000 5,800 231,600 127,000 (11,280) $347,600 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity $ 31,200 8, eee 4.100 43,100 40,000 83. 109 $ 38,00 19,00 4.600 61,600 80,000 141,600 240,000 49,700 $372,800 170,000 36.999 $347,600 QUALITY FIRST INC. Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $63, eee Other expenses 71, eee Total operating expenses $ 727,000 445,00 282, eee 134, 148, eee Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 2, 4ee 150, 409 46.840 $184,360 Answer is not complete. Requirement General Journal General Ledger Trial Balance Direct Method Indirect Method Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the June 30, 2019 balances. Date Credit No 1 Account Title Cash Accounts receivable, net Debit 710.000 Jun 30 710,000 X Jun 30 Accounts payable 478,000 > Jun 30 63.000 Depreciation expense Accumulated depreciation - Equipment O O O O 63.000 Jun 30 Other expenses 71.000 5 Jun 30 17.000 140.000 X Cash Accumulated depreciation - Equipment Equipment Gain on sale of equipment 10.000 X 2.400 Jun 30 Income taxes expense 46,040 Jun 30 40.000 Notes payable (long-term) Cash OOO 40.000 Jun 30 62.000 Equipment Cash 62.000 QUALITY FIRST INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $120, 200 76, eee 68,000 4,682 268,800 137, eee (33,000) $372,800 $ 72,800 59,00 94,000 5,800 231,600 127,000 (11,280) $347,600 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity $ 31,200 8, eee 4.100 43,100 40,000 83. 109 $ 38,00 19,00 4.600 61,600 80,000 141,600 240,000 49,700 $372,800 170,000 36.999 $347,600 QUALITY FIRST INC. Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $63, eee Other expenses 71, eee Total operating expenses $ 727,000 445,00 282, eee 134, 148, eee Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 2, 4ee 150, 409 46.840 $184,360 Answer is not complete. Requirement General Journal General Ledger Trial Balance Direct Method Indirect Method Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the June 30, 2019 balances. Date Credit No 1 Account Title Cash Accounts receivable, net Debit 710.000 Jun 30 710,000 X Jun 30 Accounts payable 478,000 > Jun 30 63.000 Depreciation expense Accumulated depreciation - Equipment O O O O 63.000 Jun 30 Other expenses 71.000 5 Jun 30 17.000 140.000 X Cash Accumulated depreciation - Equipment Equipment Gain on sale of equipment 10.000 X 2.400 Jun 30 Income taxes expense 46,040 Jun 30 40.000 Notes payable (long-term) Cash OOO 40.000 Jun 30 62.000 Equipment Cash 62.000