Answered step by step

Verified Expert Solution

Question

1 Approved Answer

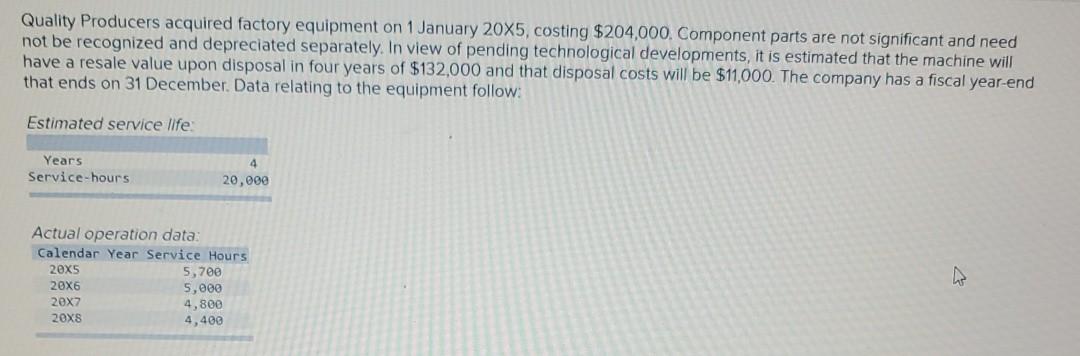

Quality Producers acquired factory equipment on 1 January 20X5, costing $204,000. Component parts are not significant and need not be recognized and depreciated separately. In

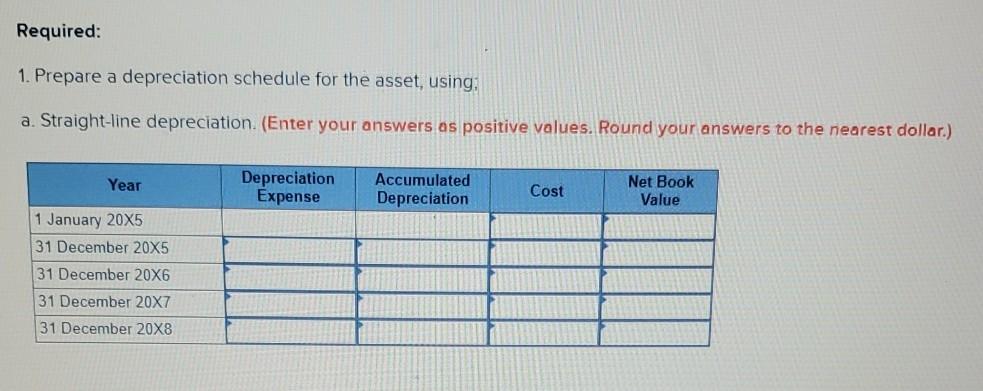

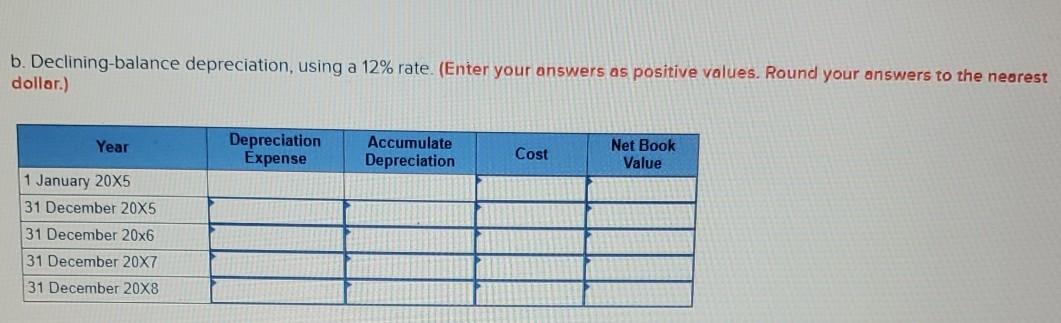

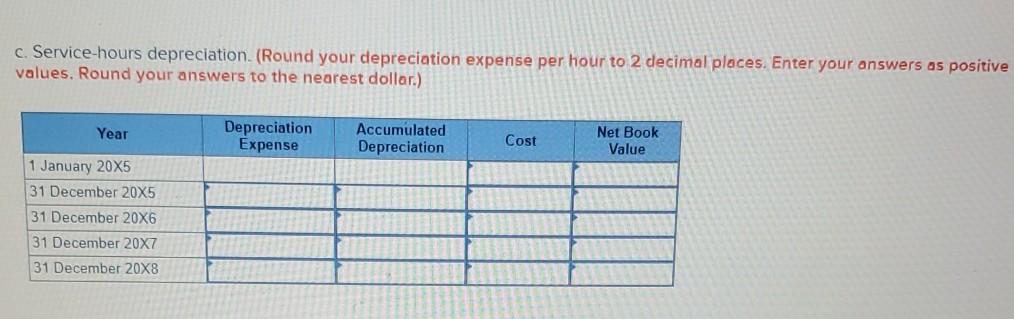

Quality Producers acquired factory equipment on 1 January 20X5, costing $204,000. Component parts are not significant and need not be recognized and depreciated separately. In view of pending technological developments, it is estimated that the machine will have a resale value upon disposal in four years of $132,000 and that disposal costs will be $11,000. The company has a fiscal year-end that ends on 31 December. Data relating to the equipment follow: Estimated service life. Years Service-hours 4 20,000 Actual operation data: Calendar Year Service Hours 20X5 5,700 20X6 5,000 20x2 4,800 20x8 4,400 A Required: 1. Prepare a depreciation schedule for the asset, using, a. Straight-line depreciation. (Enter your answers as positive values. Round your answers to the nearest dollar.) Year Depreciation Expense Net Book Accumulated Depreciation Cost Value 1 January 20X5 31 December 20X5 31 December 20X6 31 December 20X7 31 December 20X8 b. Declining-balance depreciation, using a 12% rate. (Enter your answers as positive values. Round your answers to the nearest dollar.) Year Depreciation Expense Accumulate Depreciation Cost Net Book Value 1 January 20X5 31 December 20X5 31 December 20x6 31 December 20X7 31 December 20X8 c. Service-hours depreciation (Round your depreciation expense per hour to 2 decimal places. Enter your answers as positive values. Round your answers to the nearest dollar.) Year Depreciation Expense Accumulated Depreciation Cost Net Book Value 1 January 20X5 31 December 20X5 31 December 20X6 31 December 20X7 31 December 20X8 2. Express straight-line depreciation as a percentage of original cost (Round your percentage answer to nearest whole number (i. 0.12 should be considered as 12%).) Percentage of original cost %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started