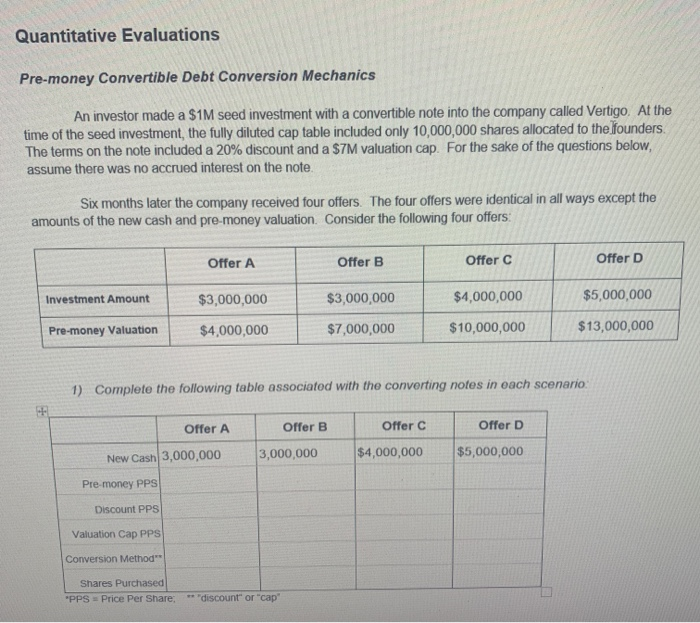

Quantitative Evaluations Pre-money Convertible Debt Conversion Mechanics An investor made a $1M seed investment with a convertible note into the company called Vertigo. At the time of the seed investment, the fully diluted cap table included only 10,000,000 shares allocated to the founders. The terms on the note included a 20% discount and a $7M valuation cap. For the sake of the questions below, assume there was no accrued interest on the note. Six months later the company received four offers. The four offers were identical in all ways except the amounts of the new cash and pre-money valuation. Consider the following four offers: Offer A Offer B Offer C Offer D Investment Amount $3,000,000 $3,000,000 $4,000,000 $5,000,000 Pre-money Valuation $4,000,000 $7,000,000 $10,000,000 $13,000,000 1) Complete the following table associated with the converting notes in each scenario. Offer A Offer B Offer C Offer D 3,000,000 $4,000,000 $5,000,000 New Cash 3,000,000 Pre-money PPS Discount PPS Valuation Cap PPS Conversion Method Shares Purchased "PPS Price Per Share: ** "discount" or "cap Quantitative Evaluations Pre-money Convertible Debt Conversion Mechanics An investor made a $1M seed investment with a convertible note into the company called Vertigo. At the time of the seed investment, the fully diluted cap table included only 10,000,000 shares allocated to the founders. The terms on the note included a 20% discount and a $7M valuation cap. For the sake of the questions below, assume there was no accrued interest on the note. Six months later the company received four offers. The four offers were identical in all ways except the amounts of the new cash and pre-money valuation. Consider the following four offers: Offer A Offer B Offer C Offer D Investment Amount $3,000,000 $3,000,000 $4,000,000 $5,000,000 Pre-money Valuation $4,000,000 $7,000,000 $10,000,000 $13,000,000 1) Complete the following table associated with the converting notes in each scenario. Offer A Offer B Offer C Offer D 3,000,000 $4,000,000 $5,000,000 New Cash 3,000,000 Pre-money PPS Discount PPS Valuation Cap PPS Conversion Method Shares Purchased "PPS Price Per Share: ** "discount" or "cap