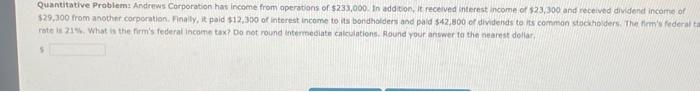

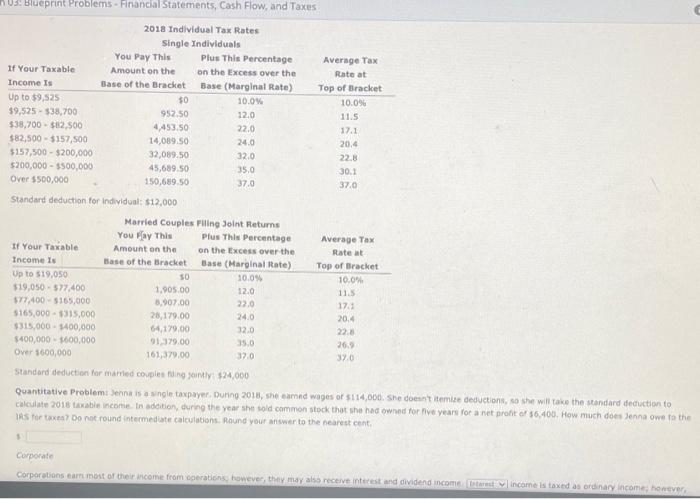

Quantitative Problem: Andrews Corporation has income from operations of $23,000. In addition, it received interest income of $23,300 and received dividend income of $29,100 from another corporation. Finally, it paid $12,300 of interest income to its bondholders and paid $42,800 of dividends to its common stockholders. The federal rate is 1 What is the firm's federal income tax? Do not round Intermediate calculations. Round your answer to the nearest dollar 03. Blueprint Problems - Financial Statements, Cash Flow, and Taxes 2018 Individual Tax Rates Single Individuals You Pay This Plus This Percentage Average Tax If Your Taxable Amount on the on the Excess over the Rate at Income Is Base of the Bracket Base (Marginal Rate) Top of Bracket Up to $9,525 $0 10.06 10.09 39,525 - $38,700 952.50 12.0 11.5 $38,700 - $12.500 4,453.50 22.0 17.1 $82,500 - $157,500 14.089.50 24.0 20.4 $157,500 - $200,000 32,089.50 32.0 22.8 $200,000 - $500,000 45,689.50 35.0 30.1 Over 5500,000 150,689.50 37.0 37.0 Standard deduction for Individual: $12,000 Married couples Filing Joint Returns You Fay This Plus This Percentage Average Tax If Your Taxable Amount on the on the Excess over the Rate at Income Is Base of the Bracket Base (Harginal Rate) Top of Bracket Up to 519,050 50 10.0% 10.0% $19,050 - 577,400 1.905.00 12.0 11.5 577.400 - 5165,000 3,907.00 22.0 17.1 $165,000 - $315.000 28,179.00 24.0 20.4 $315.000 - $400,000 64,179.00 12.0 22.0 $400,000 $600,000 0379.00 35.0 26. Over 1600,000 161,379,00 32.0 320 Standard deduction for married couples ting only $24,000 Quantitative Problem: Jennais angle taxpayer. During 2018, she same wages of $114,000. She doesn't itemize deductions, so she will take the standard deduction to calculate 2018 taxable income in addition, during the year she sold common stock that she had owned for five years for a net profit of $6,400. How much does Jenna owe to the IRS for taxta Do not round intermediate calculations. Round your answer to the nearestent Corporate Corporations can most of their income from cerationshowever they may also receive interest and dividend income income is taxed as ordinary income, however Quantitative Problem: Andrews Corporation has income from operations of $23,000. In addition, it received interest income of $23,300 and received dividend income of $29,100 from another corporation. Finally, it paid $12,300 of interest income to its bondholders and paid $42,800 of dividends to its common stockholders. The federal rate is 1 What is the firm's federal income tax? Do not round Intermediate calculations. Round your answer to the nearest dollar 03. Blueprint Problems - Financial Statements, Cash Flow, and Taxes 2018 Individual Tax Rates Single Individuals You Pay This Plus This Percentage Average Tax If Your Taxable Amount on the on the Excess over the Rate at Income Is Base of the Bracket Base (Marginal Rate) Top of Bracket Up to $9,525 $0 10.06 10.09 39,525 - $38,700 952.50 12.0 11.5 $38,700 - $12.500 4,453.50 22.0 17.1 $82,500 - $157,500 14.089.50 24.0 20.4 $157,500 - $200,000 32,089.50 32.0 22.8 $200,000 - $500,000 45,689.50 35.0 30.1 Over 5500,000 150,689.50 37.0 37.0 Standard deduction for Individual: $12,000 Married couples Filing Joint Returns You Fay This Plus This Percentage Average Tax If Your Taxable Amount on the on the Excess over the Rate at Income Is Base of the Bracket Base (Harginal Rate) Top of Bracket Up to 519,050 50 10.0% 10.0% $19,050 - 577,400 1.905.00 12.0 11.5 577.400 - 5165,000 3,907.00 22.0 17.1 $165,000 - $315.000 28,179.00 24.0 20.4 $315.000 - $400,000 64,179.00 12.0 22.0 $400,000 $600,000 0379.00 35.0 26. Over 1600,000 161,379,00 32.0 320 Standard deduction for married couples ting only $24,000 Quantitative Problem: Jennais angle taxpayer. During 2018, she same wages of $114,000. She doesn't itemize deductions, so she will take the standard deduction to calculate 2018 taxable income in addition, during the year she sold common stock that she had owned for five years for a net profit of $6,400. How much does Jenna owe to the IRS for taxta Do not round intermediate calculations. Round your answer to the nearestent Corporate Corporations can most of their income from cerationshowever they may also receive interest and dividend income income is taxed as ordinary income, however