Answered step by step

Verified Expert Solution

Question

1 Approved Answer

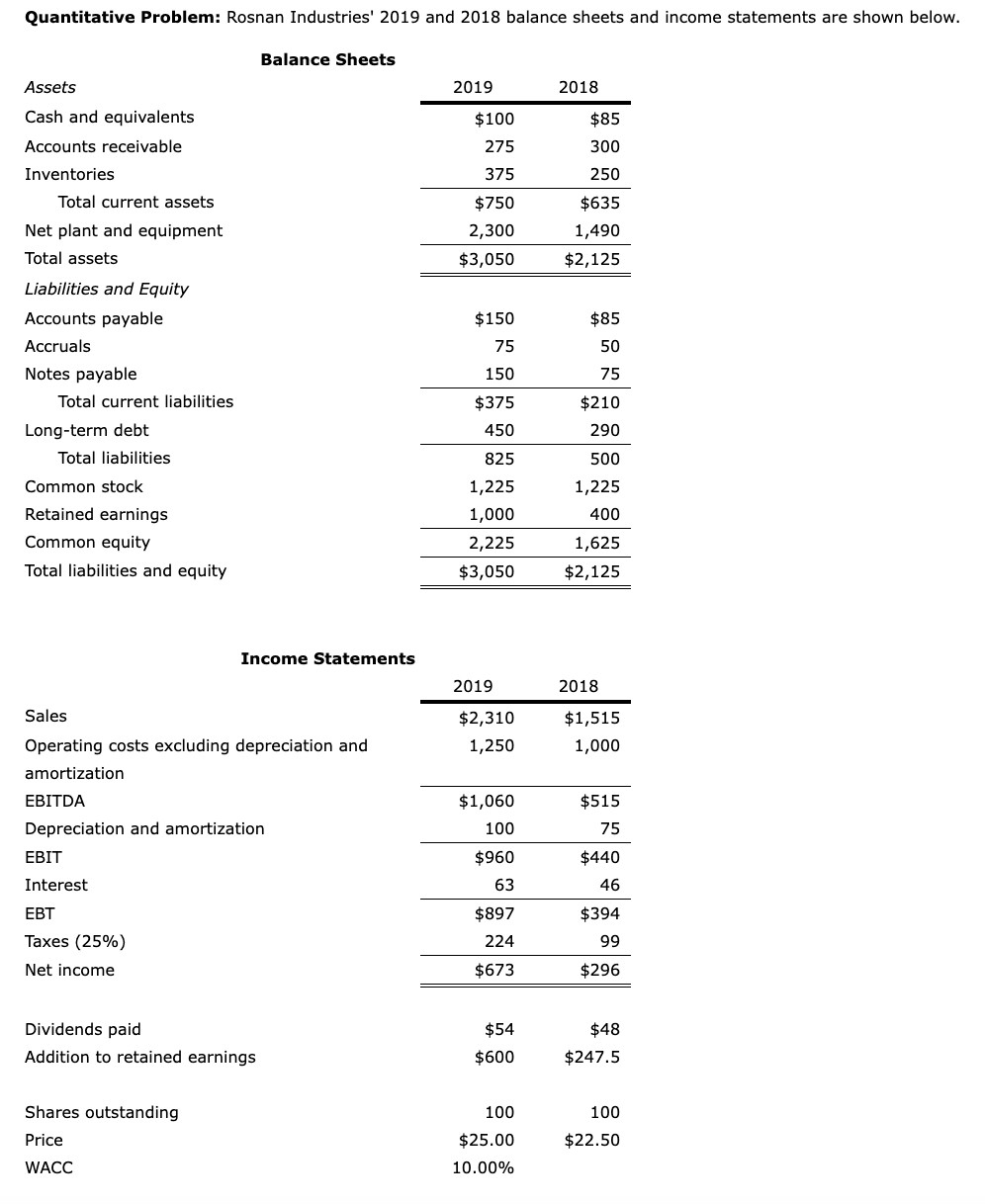

Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Balance Sheets Assets Cash and equivalents Accounts receivable Inventories Total

Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Balance Sheets Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Common equity Total liabilities and equity \begin{tabular}{rr} 2019 & \multicolumn{1}{c}{2018} \\ \hline$100 & $85 \\ 275 & 300 \\ 375 & 250 \\ \hline$750 & $635 \\ 2,300 & 1,490 \\ \hline$3,050 & $2,125 \\ \hline \hline \end{tabular} \begin{tabular}{rr} $150 & $85 \\ 75 & 50 \\ 150 & 75 \\ \hline$375 & $210 \\ 450 & 290 \\ \hline 825 & 500 \\ 1,225 & 1,225 \\ 1,000 & 400 \\ \hline 2,225 & 1,625 \\ \hline$3,050 & $2,125 \\ \hline \hline \end{tabular} Income Statements \begin{tabular}{rr} \multicolumn{1}{c}{2019} & \multicolumn{1}{c}{2018} \\ \hline$2,310 & $1,515 \\ 1,250 & 1,000 \\ & \\ \hline$1,060 & $515 \\ 100 & 75 \\ \hline$960 & $440 \\ 63 & 46 \\ \hline$897 & $394 \\ 224 & 99 \\ \hline$673 & $296 \\ \hline \hline \end{tabular} Dividends paid Addition to retained earnings $54 $48 $600 $247.5 Shares outstanding Price 100 100 $25.00 $22.50 10.00% WACC The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess" cash. Using the financial statements given above, what is Rosnan's 2019 free cash flow (FCF)? Use a minus sign to indicate a negative FCF. Round your answer to the nearest cent

Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Balance Sheets Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Common equity Total liabilities and equity \begin{tabular}{rr} 2019 & \multicolumn{1}{c}{2018} \\ \hline$100 & $85 \\ 275 & 300 \\ 375 & 250 \\ \hline$750 & $635 \\ 2,300 & 1,490 \\ \hline$3,050 & $2,125 \\ \hline \hline \end{tabular} \begin{tabular}{rr} $150 & $85 \\ 75 & 50 \\ 150 & 75 \\ \hline$375 & $210 \\ 450 & 290 \\ \hline 825 & 500 \\ 1,225 & 1,225 \\ 1,000 & 400 \\ \hline 2,225 & 1,625 \\ \hline$3,050 & $2,125 \\ \hline \hline \end{tabular} Income Statements \begin{tabular}{rr} \multicolumn{1}{c}{2019} & \multicolumn{1}{c}{2018} \\ \hline$2,310 & $1,515 \\ 1,250 & 1,000 \\ & \\ \hline$1,060 & $515 \\ 100 & 75 \\ \hline$960 & $440 \\ 63 & 46 \\ \hline$897 & $394 \\ 224 & 99 \\ \hline$673 & $296 \\ \hline \hline \end{tabular} Dividends paid Addition to retained earnings $54 $48 $600 $247.5 Shares outstanding Price 100 100 $25.00 $22.50 10.00% WACC The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess" cash. Using the financial statements given above, what is Rosnan's 2019 free cash flow (FCF)? Use a minus sign to indicate a negative FCF. Round your answer to the nearest cent Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started