Question

Quarles Industries had the following operating results for 2015: sales = $27,660; cost of goods sold = $19,310; depreciation expense = $4,900; interest expense =

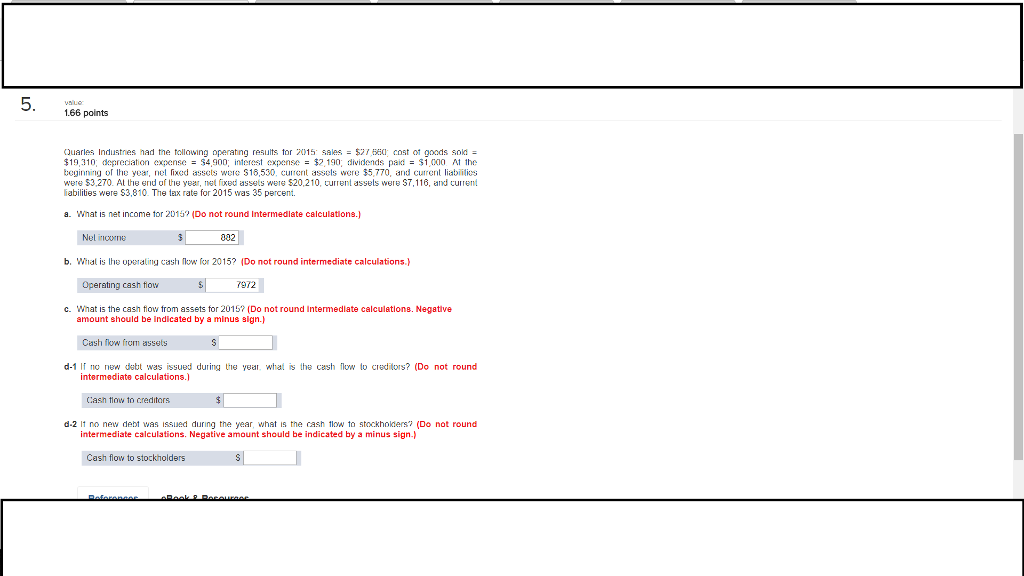

| Quarles Industries had the following operating results for 2015: sales = $27,660; cost of goods sold = $19,310; depreciation expense = $4,900; interest expense = $2,190; dividends paid = $1,000. At the beginning of the year, net fixed assets were $16,530, current assets were $5,770, and current liabilities were $3,270. At the end of the year, net fixed assets were $20,210, current assets were $7,116, and current liabilities were $3,810. The tax rate for 2015 was 35 percent. |

| a. | What is net income for 2015? (Do not round intermediate calculations.) |

| Net income | $ |

| b. | What is the operating cash flow for 2015? (Do not round intermediate calculations |

| Operating cash flow | $

|

| c. | What is the cash flow from assets for 2015? (Do not round intermediate calculations. Negative amount should be indicated by a minus sign.) |

| Cash flow from assets | $ |

| d-1 | If no new debt was issued during the year, what is the cash flow to creditors? (Do not round intermediate calculations.) |

| Cash flow to creditors | $ |

| d-2 | If no new debt was issued during the year, what is the cash flow to stockholders? (Do not round intermediate calculations. Negative amount should be indicated by a minus sign.) |

| Cash flow to stockholders | $ |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started