Question 2

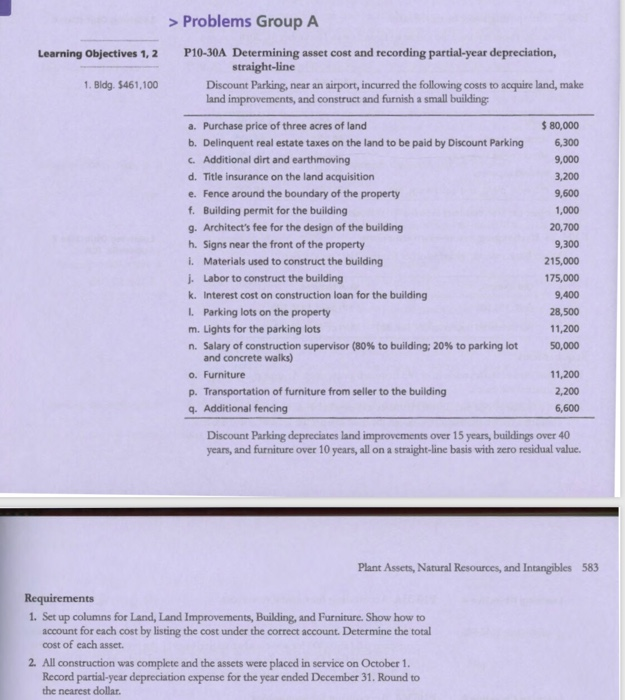

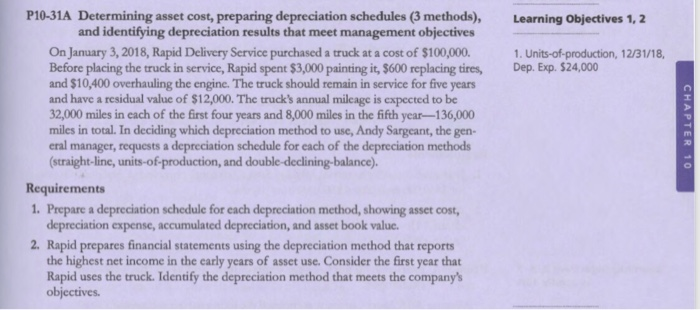

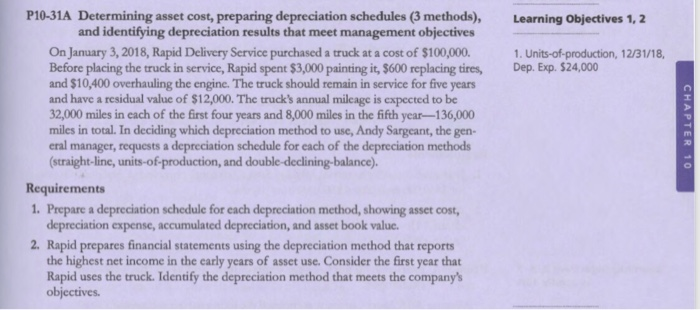

> Problems Group A Learning Objectives 1,2 P10-30A Determining asset cost and recording partial-year depreciation, straight-line Discount Parking, near an airport, incurred the following costs to acquire land, make land improvements, and construct and furnish a small building 1. Bldg. $461,100 a. Purchase price of three acres of land b. Delinquent real estate taxes on the land to be paid by Discount Parking C. Additional dirt and earthmoving d. Title insurance on the land acquisition e. Fence around the boundary of the property f. Building permit for the building g. Architect's fee for the design of the building h. Signs near the front of the property i. Materials used to construct the building j. Labor to construct the building k. Interest cost on construction loan for the building 1. Parking lots on the property m. Lights for the parking lots n. Salary of construction supervisor (80% to building: 20% to parking lot and concrete walks) o. Furniture p. Transportation of furniture from seller to the building 4. Additional fencing $ 80,000 6,300 9,000 3,200 9,600 1,000 20,700 9,300 215,000 175,000 9,400 28,500 11,200 50,000 11,200 2,200 6,600 Discount Parking depreciates land improvements over 15 years, buildings over 40 years, and furniture over 10 years, all on a straight-line basis with zero residual value. Plant Assets, Natural Resources, and Intangibles 583 Requirements 1. Set up columns for Land, Land Improvements, Building, and Furniture. Show how to account for each cost by listing the cost under the correct account. Determine the total cost of cach asset. 2. All construction was complete and the assets were placed in service on October 1. Record partial-year depreciation expense for the year ended December 31. Round to the nearest dollar. Learning Objectives 1, 2 1. Units-of-production, 12/31/18, Dep. Exp. $24,000 P10-31A Determining asset cost, preparing depreciation schedules (3 methods), and identifying depreciation results that meet management objectives On January 3, 2018, Rapid Delivery Service purchased a truck at a cost of $100,000. Before placing the truck in service, Rapid spent $3,000 painting it, $600 replacing tires, and $10,400 overhauling the engine. The truck should remain in service for five years and have a residual value of $12,000. The truck's annual mileage is expected to be 32,000 miles in each of the first four years and 8,000 miles in the fifth year-136,000 miles in total. In deciding which depreciation method to use, Andy Sargeant, the gen. eral manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of-production, and double-declining-balance). Requirements 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. Rapid prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that Rapid uses the truck. Identify the depreciation method that meets the company's objectives. CHAPTER 10