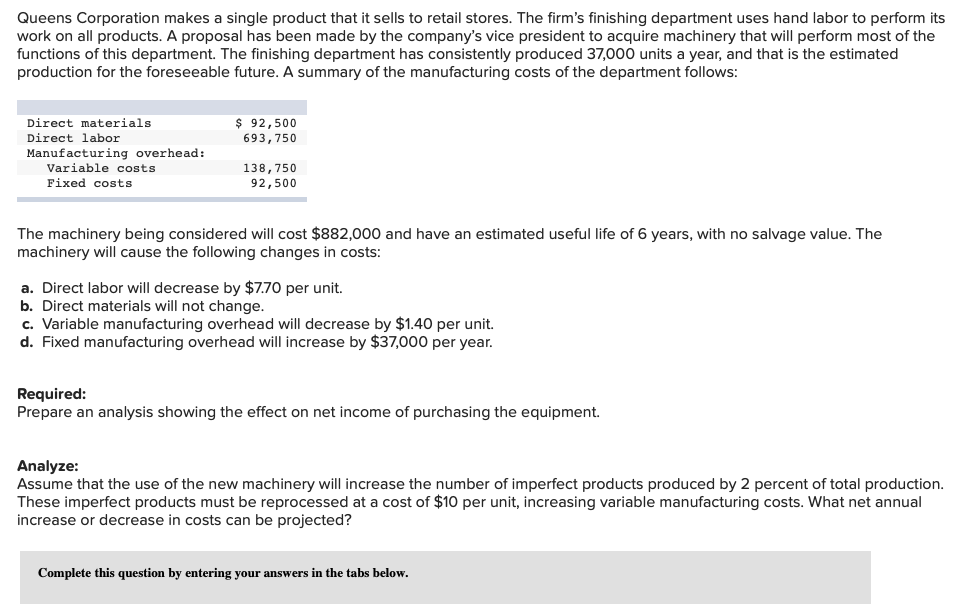

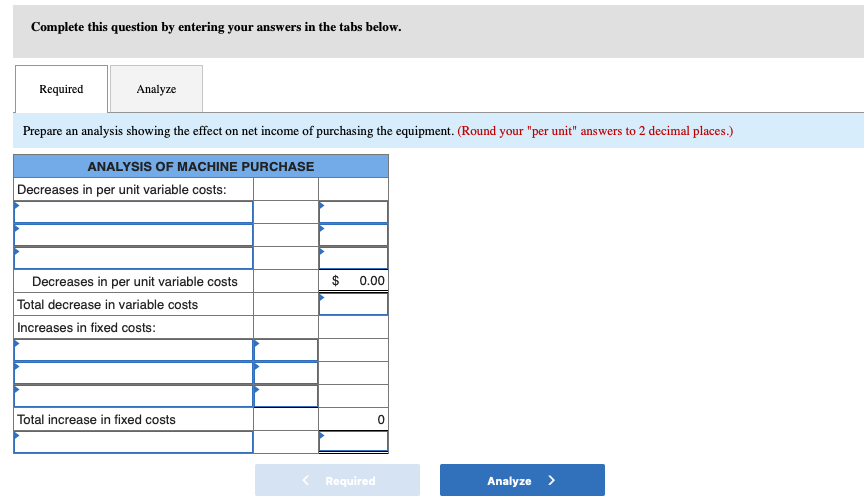

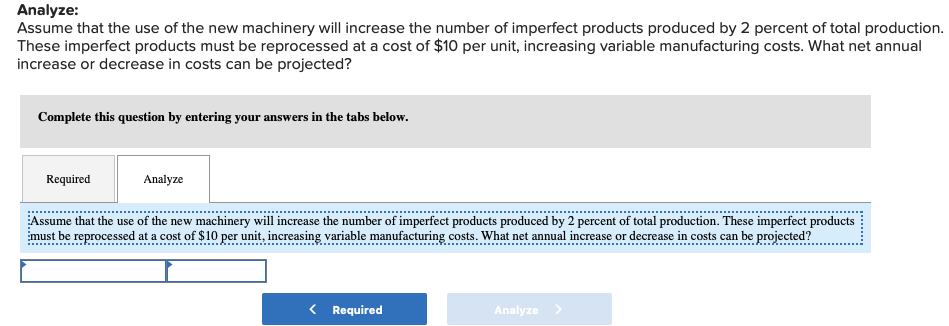

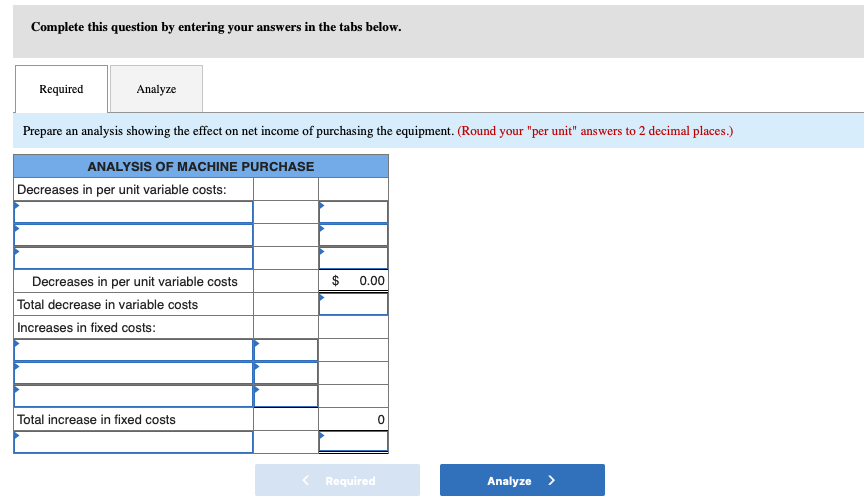

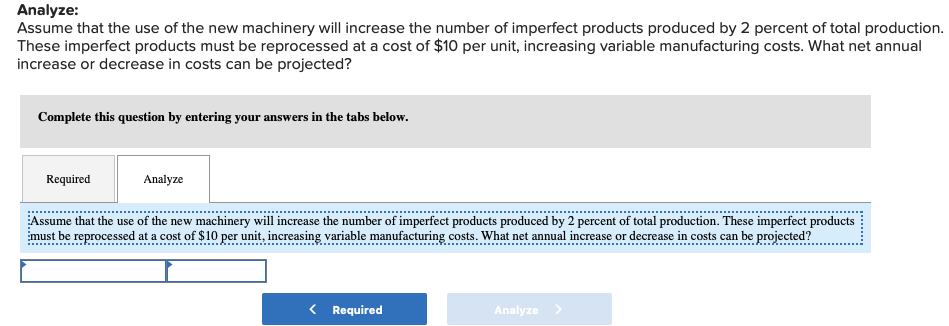

Queens Corporation makes a single product that it sells to retail stores. The firm's finishing department uses hand labor to perform its work on all products. A proposal has been made by the company's vice president to acquire machinery that will perform most of the functions of this department. The finishing department has consistently produced 37,000 units a year, and that is the estimated production for the foreseeable future. A summary of the manufacturing costs of the department follows: $ 92,500 693,750 Direct materials Direct labor Manufacturing overhead: Variable costs Fixed costs 138,750 92,500 The machinery being considered will cost $882,000 and have an estimated useful life of 6 years, with no salvage value. The machinery will cause the following changes in costs: a. Direct labor will decrease by $7.70 per unit. b. Direct materials will not change. c. Variable manufacturing overhead will decrease by $1.40 per unit. d. Fixed manufacturing overhead will increase by $37,000 per year. Required: Prepare an analysis showing the effect on net income of purchasing the equipment. Analyze: Assume that the use of the new machinery will increase the number of imperfect products produced by 2 percent of total production. These imperfect products must be reprocessed at a cost of $10 per unit, increasing variable manufacturing costs. What net annual increase or decrease in costs can be projected? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required Analyze Prepare an analysis showing the effect on net income of purchasing the equipment. (Round your "per unit" answers to 2 decimal places.) ANALYSIS OF MACHINE PURCHASE Decreases in per unit variable costs: $ 0.00 Decreases in per unit variable costs Total decrease in variable costs Increases in fixed costs: Total increase in fixed costs 0 Analyze: Assume that the use of the new machinery will increase the number of imperfect products produced by 2 percent of total production. These imperfect products must be reprocessed at a cost of $10 per unit, increasing variable manufacturing costs. What net annual increase or decrease in costs can be projected? Complete this question by entering your answers in the tabs below. Required Analyze Assume that the use of the new machinery will increase the number of imperfect products produced by 2 percent of total production. These imperfect products must be reprocessed at a cost of $10 per unit, increasing variable manufacturing costs. What net annual increase or decrease in costs can be projected?