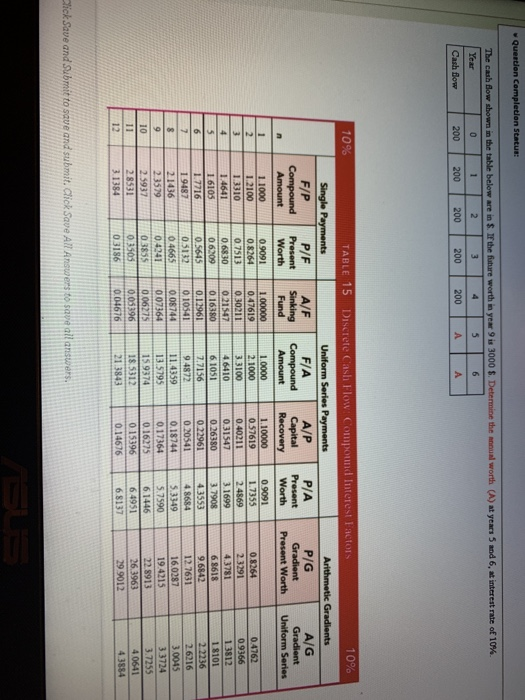

Quention Completion Status: The cash flow shown in the table below are in $. If the future worth in year 9 is 3000 $. Determine the sun worth (A) at years 5 and 6, at interest rate of 10% Year 0 1 2 3 5 6 Cash flow 200 200 200 200 200 A A 10% n 1 2 3 4 5 6 7 TABLE 15 Discrete Cash Flow. Compound Interest Factors 10% Single Payments Uniform Series Payments Arithmetic Gradients F/P P/F A/F F/A A/P P/A P/G A/G Compound Present Sinking Compound Capital Present Gradient Gradient Amount Worth Fund Amount Recovery Worth Present Worth Uniform Series 1 1000 09091 1.00000 1.0000 1. 10000 09091 1.2100 0.8264 0.47619 2.1000 0.57619 1.7355 0.8264 0.4762 1.3310 0.7513 0.30211 33100 0.40211 24869 23291 0.9366 1.4641 0.6830 021547 46410 0.31547 3.1699 4.3781 1.3812 16105 06209 0.16380 6.1051 0.26380 3.7908 6.8618 18101 1.7716 0.5645 0.12961 7.7156 0.22961 4.3553 9.6842 2.2236 1 9487 0 5132 0.10541 9.4872 0 20541 48684 12.7631 26216 21436 0.4665 0.08744 11.4359 0.18744 5.3349 160287 3.0045 23579 0.4241 0 07364 13.5795 0.17364 5.7590 19.4215 3.3724 2.5937 03855 0.06275 15 9374 0.16275 6.1446 22.8913 3.7255 2.8531 0.3503 0.05396 18.5312 0.15396 6.4951 26,3963 40641 3.1384 03186 0.04676 21 3843 0.14676 6.8137 29.9012 4.3884 8 9 10 11 12 Click Save and submit to save and submit. Click Save All Answers to save all answers, Quention Completion Status: The cash flow shown in the table below are in $. If the future worth in year 9 is 3000 $. Determine the sun worth (A) at years 5 and 6, at interest rate of 10% Year 0 1 2 3 5 6 Cash flow 200 200 200 200 200 A A 10% n 1 2 3 4 5 6 7 TABLE 15 Discrete Cash Flow. Compound Interest Factors 10% Single Payments Uniform Series Payments Arithmetic Gradients F/P P/F A/F F/A A/P P/A P/G A/G Compound Present Sinking Compound Capital Present Gradient Gradient Amount Worth Fund Amount Recovery Worth Present Worth Uniform Series 1 1000 09091 1.00000 1.0000 1. 10000 09091 1.2100 0.8264 0.47619 2.1000 0.57619 1.7355 0.8264 0.4762 1.3310 0.7513 0.30211 33100 0.40211 24869 23291 0.9366 1.4641 0.6830 021547 46410 0.31547 3.1699 4.3781 1.3812 16105 06209 0.16380 6.1051 0.26380 3.7908 6.8618 18101 1.7716 0.5645 0.12961 7.7156 0.22961 4.3553 9.6842 2.2236 1 9487 0 5132 0.10541 9.4872 0 20541 48684 12.7631 26216 21436 0.4665 0.08744 11.4359 0.18744 5.3349 160287 3.0045 23579 0.4241 0 07364 13.5795 0.17364 5.7590 19.4215 3.3724 2.5937 03855 0.06275 15 9374 0.16275 6.1446 22.8913 3.7255 2.8531 0.3503 0.05396 18.5312 0.15396 6.4951 26,3963 40641 3.1384 03186 0.04676 21 3843 0.14676 6.8137 29.9012 4.3884 8 9 10 11 12 Click Save and submit to save and submit. Click Save All Answers to save all answers