Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ques 3 Question 3 Tiger is a cleaning and packaging supplies company. It started its business on 1 July 2015. The income statement for the

ques 3

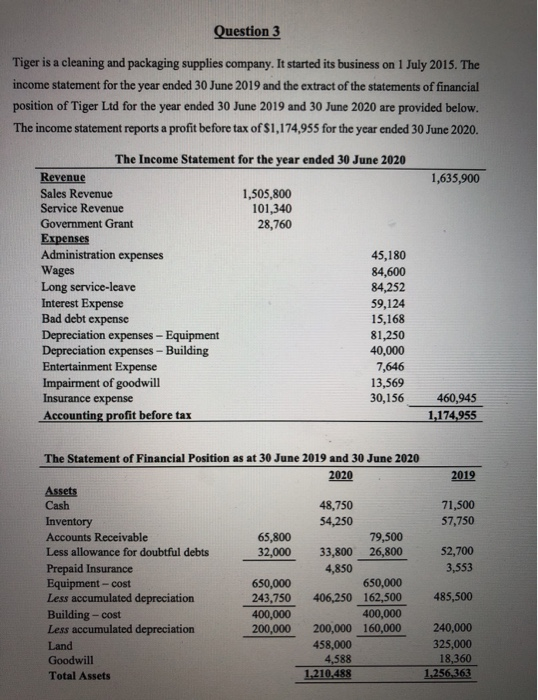

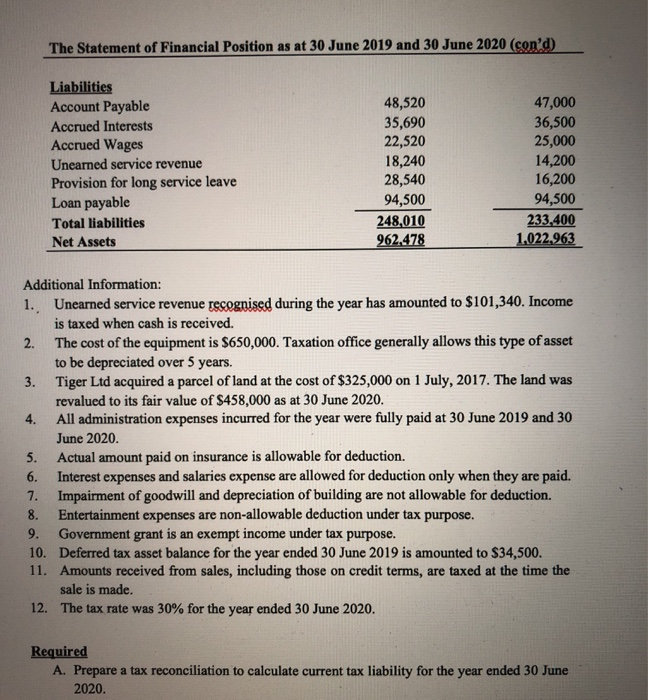

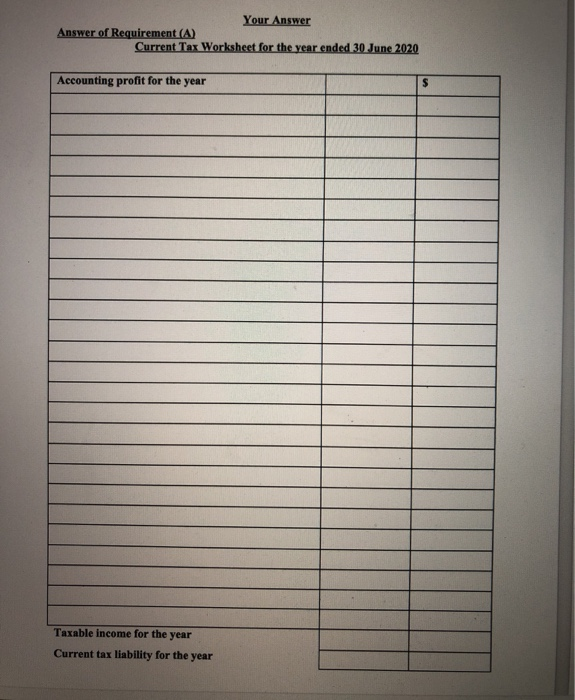

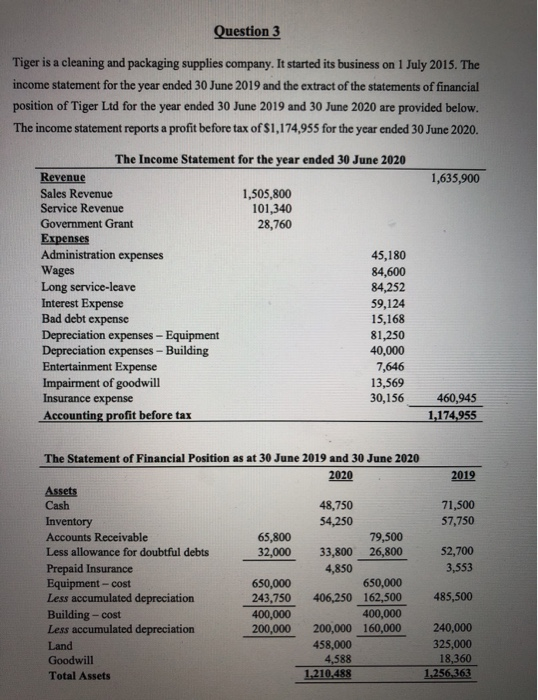

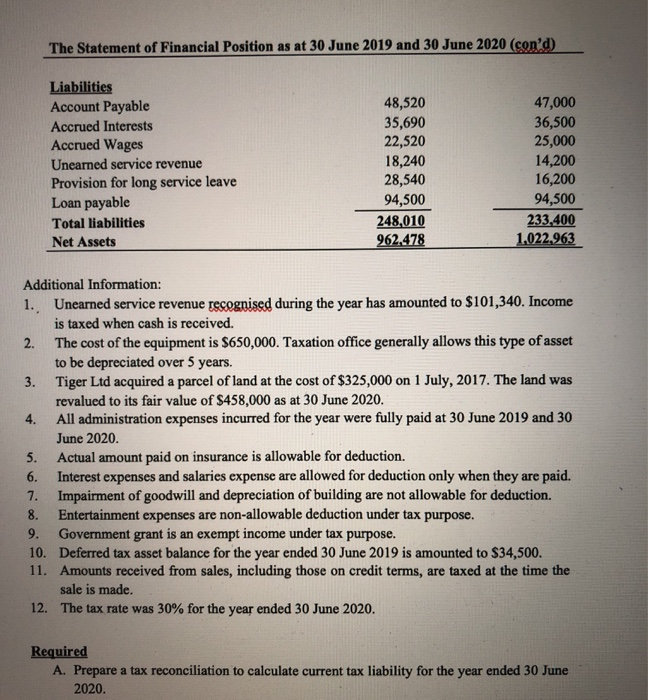

Question 3 Tiger is a cleaning and packaging supplies company. It started its business on 1 July 2015. The income statement for the year ended 30 June 2019 and the extract of the statements of financial position of Tiger Ltd for the year ended 30 June 2019 and 30 June 2020 are provided below. The income statement reports a profit before tax of $1,174,955 for the year ended 30 June 2020. 1,635,900 The Income Statement for the year ended 30 June 2020 Revenue Sales Revenue 1,505,800 Service Revenue 101,340 Government Grant 28,760 Expenses Administration expenses 45,180 Wages 84,600 Long service-leave 84,252 Interest Expense 59,124 Bad debt expense 15,168 Depreciation expenses - Equipment 81,250 Depreciation expenses - Building 40,000 Entertainment Expense 7,646 Impairment of goodwill 13,569 Insurance expense 30,156 Accounting profit before tax 460,945 1,174,955 The Statement of Financial Position as at 30 June 2019 and 30 June 2020 2020 2019 Assets Cash 48,750 71,500 Inventory 54,250 57,750 Accounts Receivable 65,800 79,500 Less allowance for doubtful debts 32,000 33,800 26,800 52,700 Prepaid Insurance 4,850 3,553 Equipment -cost 650,000 650,000 Less accumulated depreciation 243,750 406,250 162,500 485,500 Building - cost 400,000 400,000 Less accumulated depreciation 200,000 200,000 160,000 240,000 Land 458,000 325,000 Goodwill 4,588 18,360 Total Assets 1.210.488 1.256,363 The Statement of Financial Position as at 30 June 2019 and 30 June 2020 (cond) Liabilities Account Payable Accrued Interests Accrued Wages Unearned service revenue Provision for long service leave Loan payable Total liabilities Net Assets 48,520 35,690 22,520 18,240 28,540 94,500 248,010 962,478 47,000 36,500 25,000 14,200 16,200 94,500 233,400 1,022,963 Additional Information: 1. Unearned service revenue recognised during the year has amounted to $101,340. Income is taxed when cash is received. 2. The cost of the equipment is $650,000. Taxation office generally allows this type of asset to be depreciated over 5 years. 3. Tiger Ltd acquired a parcel of land at the cost of $325,000 on 1 July, 2017. The land was revalued to its fair value of $458,000 as at 30 June 2020. 4. All administration expenses incurred for the year were fully paid at 30 June 2019 and 30 June 2020. 5. Actual amount paid on insurance is allowable for deduction. 6. Interest expenses and salaries expense are allowed for deduction only when they are paid. 7. Impairment of goodwill and depreciation of building are not allowable for deduction. 8. Entertainment expenses are non-allowable deduction under tax purpose. 9. Government grant is an exempt income under tax purpose. 10. Deferred tax asset balance for the year ended 30 June 2019 is amounted to $34,500. 11. Amounts received from sales, including those on credit terms, are taxed at the time the sale is made. 12. The tax rate was 30% for the year ended 30 June 2020. Required A. Prepare a tax reconciliation to calculate current tax liability for the year ended 30 June 2020. Your Answer Answer of Requirement (A) Current Tax Worksheet for the year ended 30 June 2020 Accounting profit for the year $ Taxable income for the year Current tax liability for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started