Answered step by step

Verified Expert Solution

Question

1 Approved Answer

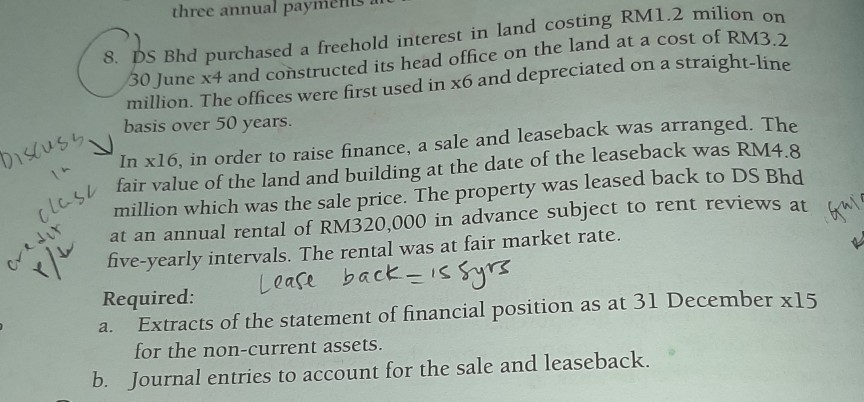

ques number 8 Discuss clast three annual payments a 8. DS Bhd purchased a freehold interest in land costing RM1.2 milion 30 June x4 and

ques number 8

Discuss clast three annual payments a 8. DS Bhd purchased a freehold interest in land costing RM1.2 milion 30 June x4 and constructed its head office on the land at a cost of RM33 miton. The offices were first used in x6 and depreciated on a straight-line basis over 50 years. In x16, in order to raise finance, a sale and leaseback was arranged. The fair value of the land and building at the date of the leaseback was RM48 million which was the sale price. The property was leased back to DS Bhd at an annual rental of RM320,000 in advance subject to rent reviews at five-yearly intervals. The rental was at fair market rate. Required Lease back = is hyrs a. Extracts of the statement of financial position as at 31 December xl5 for the non-current assets. b. Journal entries to account for the sale and leaseback. veduStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started