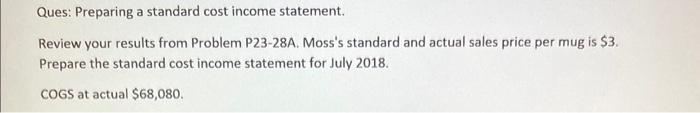

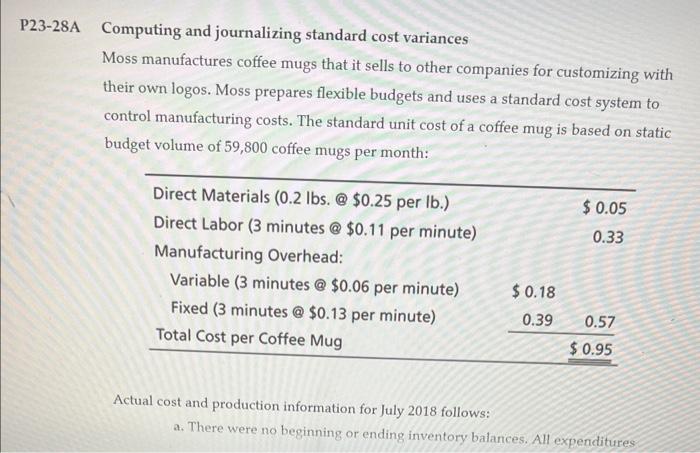

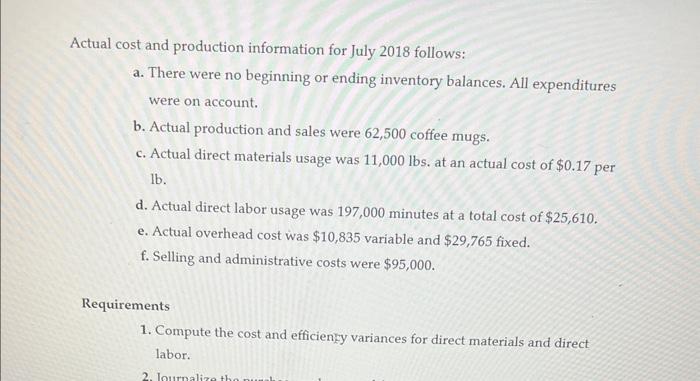

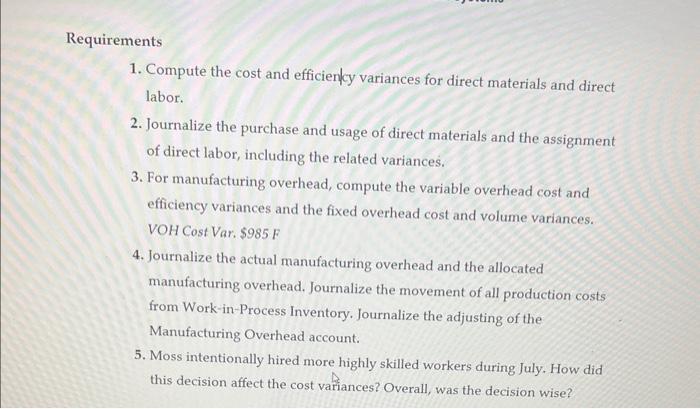

Ques: Preparing a standard cost income statement. Review your results from Problem P23-28A. Moss's standard and actual sales price per mug is $3. Prepare the standard cost income statement for July 2018. COGS at actual $68,080. 28A Computing and journalizing standard cost variances Moss manufactures coffee mugs that it sells to other companies for customizing with their own logos. Moss prepares flexible budgets and uses a standard cost system to control manufacturing costs. The standard unit cost of a coffee mug is based on static budget volume of 59,800 coffee mugs per month: Actual cost and production information for July 2018 follows: a. There were no beginning or ending inventory balances. All expenditures Actual cost and production information for July 2018 follows: a. There were no beginning or ending inventory balances. All expenditures were on account. b. Actual production and sales were 62,500 coffee mugs. c. Actual direct materials usage was 11,000lbs. at an actual cost of $0.17 per Ib. d. Actual direct labor usage was 197,000 minutes at a total cost of $25,610. e. Actual overhead cost was $10,835 variable and $29,765 fixed. f. Selling and administrative costs were $95,000. Requirements 1. Compute the cost and efficienty variances for direct materials and direct labor. 1. Compute the cost and efficienkcy variances for direct materials and direct labor. 2. Journalize the purchase and usage of direct materials and the assignment of direct labor, including the related variances. 3. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances. VOH Cost Var. $985 F 4. Journalize the actual manufacturing overhead and the allocated manufacturing overhead. Journalize the movement of all production costs from Work-in-Process Inventory. Journalize the adjusting of the Manufacturing Overhead account. 5. Moss intentionally hired more highly skilled workers during July. How did this decision affect the cost variances? Overall, was the decision wise? Note: Problem P23-28A must be completed before attempting Problem P23-29A . Learning Objective 23.6 P23-29A Preparing a standard cost income statement Review your results from Problem P23-28A10, Moss's standard and actual sales price per mug is \$3. Prepare the standard cost income statement for July 2018. COGS at actual $68,080 Ques: Preparing a standard cost income statement. Review your results from Problem P23-28A. Moss's standard and actual sales price per mug is $3. Prepare the standard cost income statement for July 2018. COGS at actual $68,080. 28A Computing and journalizing standard cost variances Moss manufactures coffee mugs that it sells to other companies for customizing with their own logos. Moss prepares flexible budgets and uses a standard cost system to control manufacturing costs. The standard unit cost of a coffee mug is based on static budget volume of 59,800 coffee mugs per month: Actual cost and production information for July 2018 follows: a. There were no beginning or ending inventory balances. All expenditures Actual cost and production information for July 2018 follows: a. There were no beginning or ending inventory balances. All expenditures were on account. b. Actual production and sales were 62,500 coffee mugs. c. Actual direct materials usage was 11,000lbs. at an actual cost of $0.17 per Ib. d. Actual direct labor usage was 197,000 minutes at a total cost of $25,610. e. Actual overhead cost was $10,835 variable and $29,765 fixed. f. Selling and administrative costs were $95,000. Requirements 1. Compute the cost and efficienty variances for direct materials and direct labor. 1. Compute the cost and efficienkcy variances for direct materials and direct labor. 2. Journalize the purchase and usage of direct materials and the assignment of direct labor, including the related variances. 3. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances. VOH Cost Var. $985 F 4. Journalize the actual manufacturing overhead and the allocated manufacturing overhead. Journalize the movement of all production costs from Work-in-Process Inventory. Journalize the adjusting of the Manufacturing Overhead account. 5. Moss intentionally hired more highly skilled workers during July. How did this decision affect the cost variances? Overall, was the decision wise? Note: Problem P23-28A must be completed before attempting Problem P23-29A . Learning Objective 23.6 P23-29A Preparing a standard cost income statement Review your results from Problem P23-28A10, Moss's standard and actual sales price per mug is \$3. Prepare the standard cost income statement for July 2018. COGS at actual $68,080