Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QuESIO (40) d has recently decided to open a material outlet based in South Africa. After careful research of the current oiiet and its fluctuations

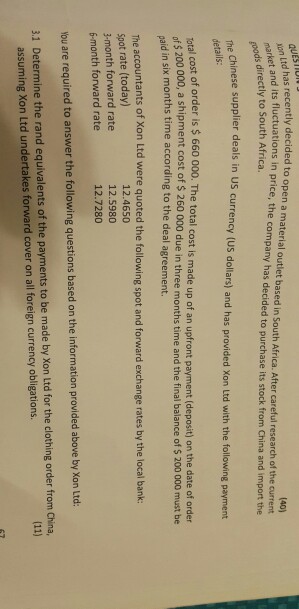

QuESIO (40) d has recently decided to open a material outlet based in South Africa. After careful research of the current oiiet and its fluctuations in price, the company has decided to purchase its stock from China and import the ds directly to South Africa. inese supplier deals in US currency (US dollars) and has provided Xon Ltd with the following payment details: ntal cost of order is $ 660 000. The total cost is made up of an upfront payment (deposit) on the date of order nf $ 200000, a shipment cost of $ 260 000 due in three months time and the final balance of $ 200 000 must be aid in six months time according to the deal agreement. The accountants of Xon Ltd were quoted the following spot and forward exchange rates by the local bank: Spot rate (today) 3-month forward rate 6-month forward rate 12.4650 12.5980 12.7280 you are required to answer the following questions based on the information provided above Determine the rand equivalents of the payments to be made by Xon Ltd for the clothing order from China, assuming Xon Ltd undertakes forward cover on all foreign currency obligations. 3.1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started