Question

Quesions: Paraphrase the below answers please: 5) Because the accountants primary goal is to measure earnings, not cash generated. She sees earnings as a fundamental

Quesions:

Paraphrase the below answers please:

5) Because the accountants primary goal is to measure earnings, not cash generated. She sees earnings as a fundamental indicator of viability, not cash generation. A more balanced perspective is that, over the long run, successful companies must be both profitable and solvent, that is, they must be profitable and have cash in the bank to pay their bills when due. This means that you should pay attention to both earnings and cash flows.

7) The General Secretary has confused accounting profit with economic profits. Earning $300 million on a $7.5 billion equity investment is a return of only four percent. This is poor performance and is too low for the company to continue attracting new investment necessary for growth. The company is certainly not covering its cost of equity.

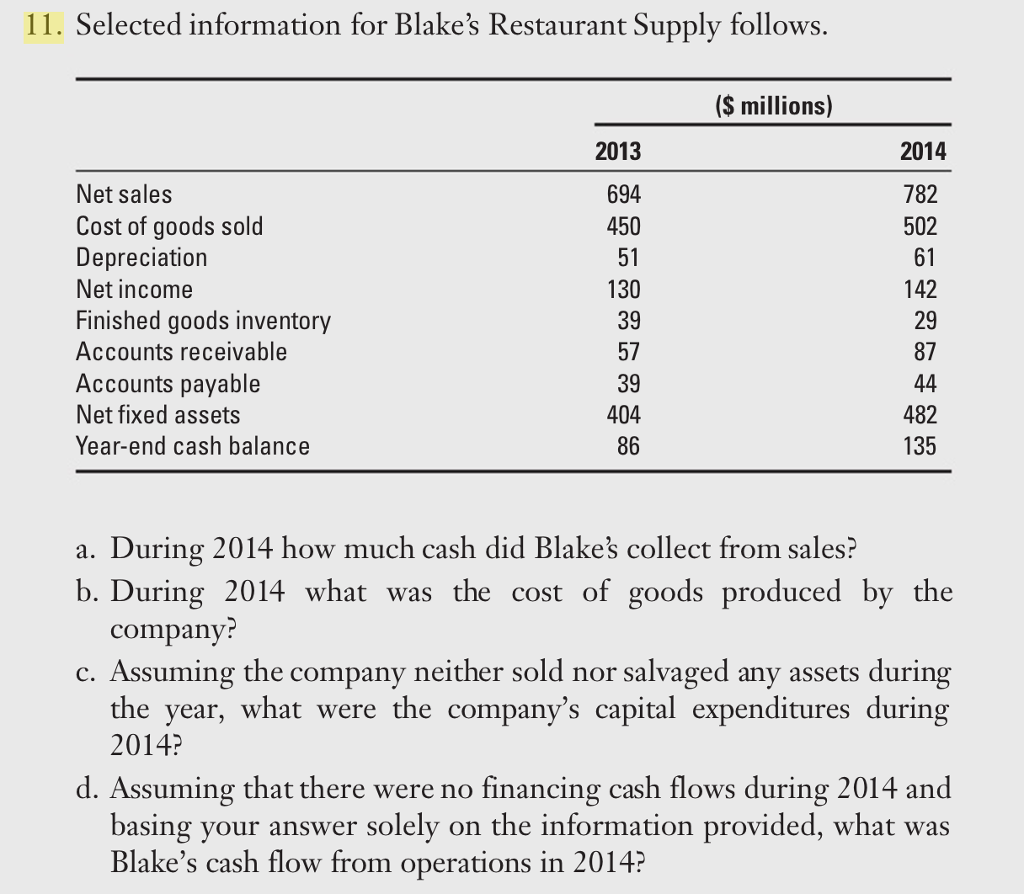

11)

a- In 2014, company sales were $782 million, but accounts receivable rose $30 million, meaning the company received only $752 million in cash (this ignores possible changes in bad debt reserves.) letting bob stand for beginning of pre period, and eop for end of period, the relevant equation is

Accounts receivable eop = Accounts receivable eop + Credit sales collection

Collection = credit sales - Change in accounts receivable

$752 million = $782 million - $30 million

b- During 2014, the company sold $502 million of merchandise at cost, but finished goods inventory fell $10 million, indicating that the company produced only $492 million of merchandise. The equation is

Inventory eop = inventory bob + production - cost of sales

Production = cost of sales + change in inventory

$ 492 million = $ 502 million - $10 million

c- Net fixed assets rose $78 million, depreciation reduced net fixed assets $61 million, so capital expenditures must have been $139 million (ignoring asset sales or write- offs).

Net fixed assets eop = net fixed assets bop + capital expenditures

- Depreciation

Capital expenditures = change in net fixed assets + depreciation

$ 139 million = $78 million +$61 million

d- There are two ways to derive cash flow from operations. If there were no financing cash flows for the year then changes in the year- end cash balance must be due to cash flows from operation s and investing cash flows the firm. Thus, we can use the change in the cash balance from 2010 to 2011 ($49 million) and the cash flows from investing to obtain cash flow from operations.

Change in cash balance = CF from ops + CF investing

+ CF from financing

$49 million = CF from ops + (-$139 million) + 0

CF from operations = $49 + $139 = $188 million

Alternatively, you can calculate the cash flow from operations from the items in the table. Begin with net income, remove any non = cash items (such as depreciation) and add any cash transaction that are nit captured by the income statement (such as changes to working capital accounts). We can see the accounts receivable in-creased by $30 million, finished goods inventory decreased by $10 million and accounts payable increased by$5 million. Depreciation was $61 million.

CF from operations = Net income increase in acct. Receivable

+ Decrease in inventory + increase in

Acct. payable + Depreciation

CF from operation = 142 30 + 10 + 5 + 61 = $188 million

5. Why do you suppose financial statements are constructed on an ac crual basis rather than a cash basis when cash accounting is so much easier to understandStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started