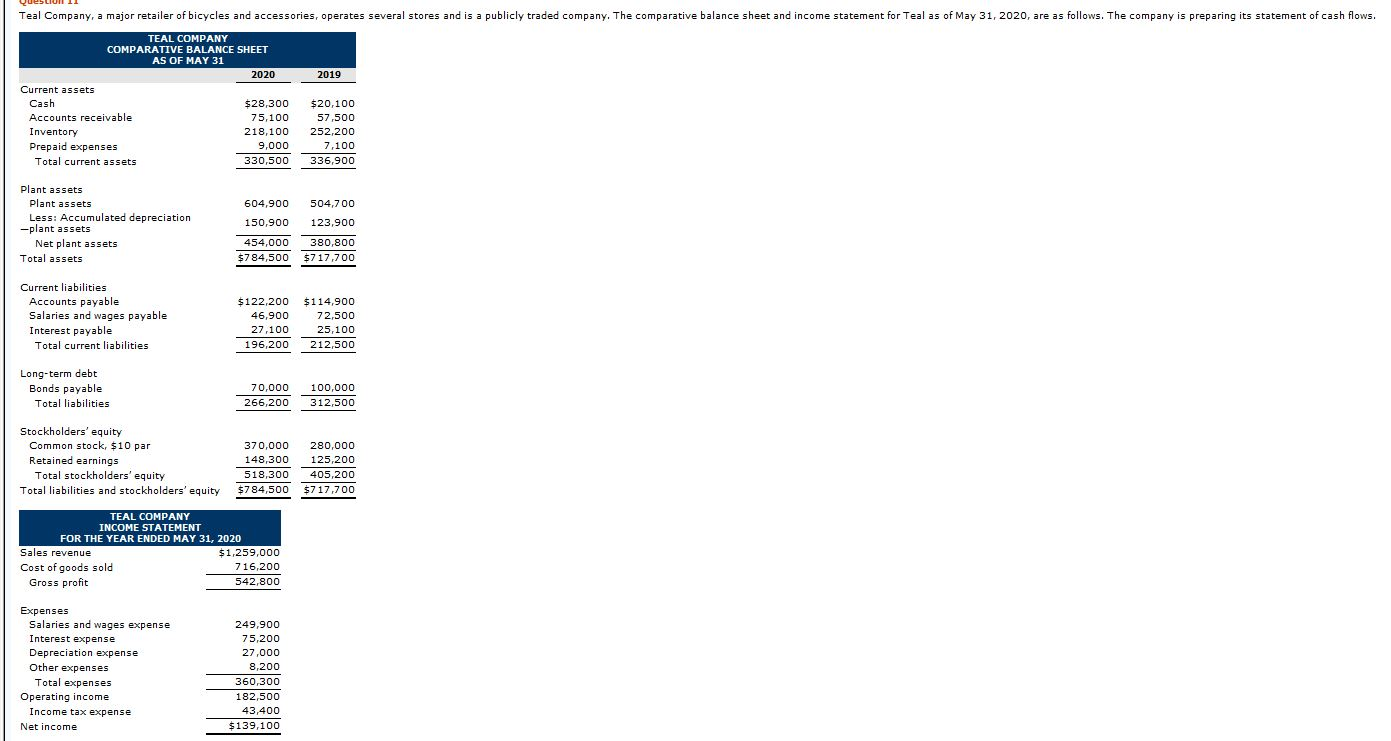

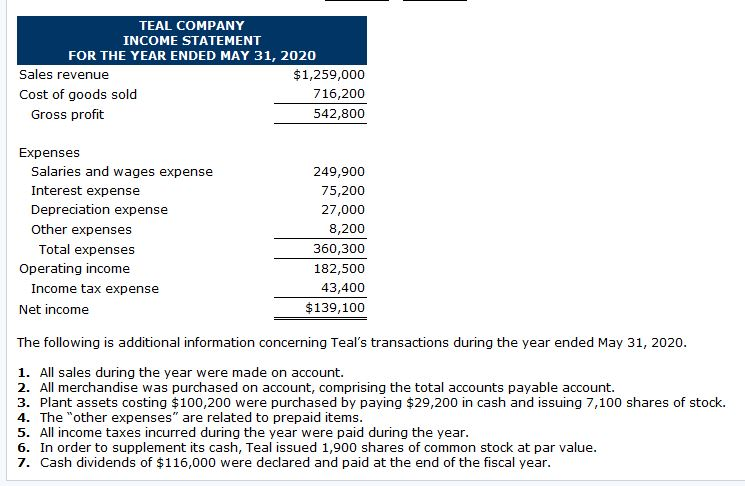

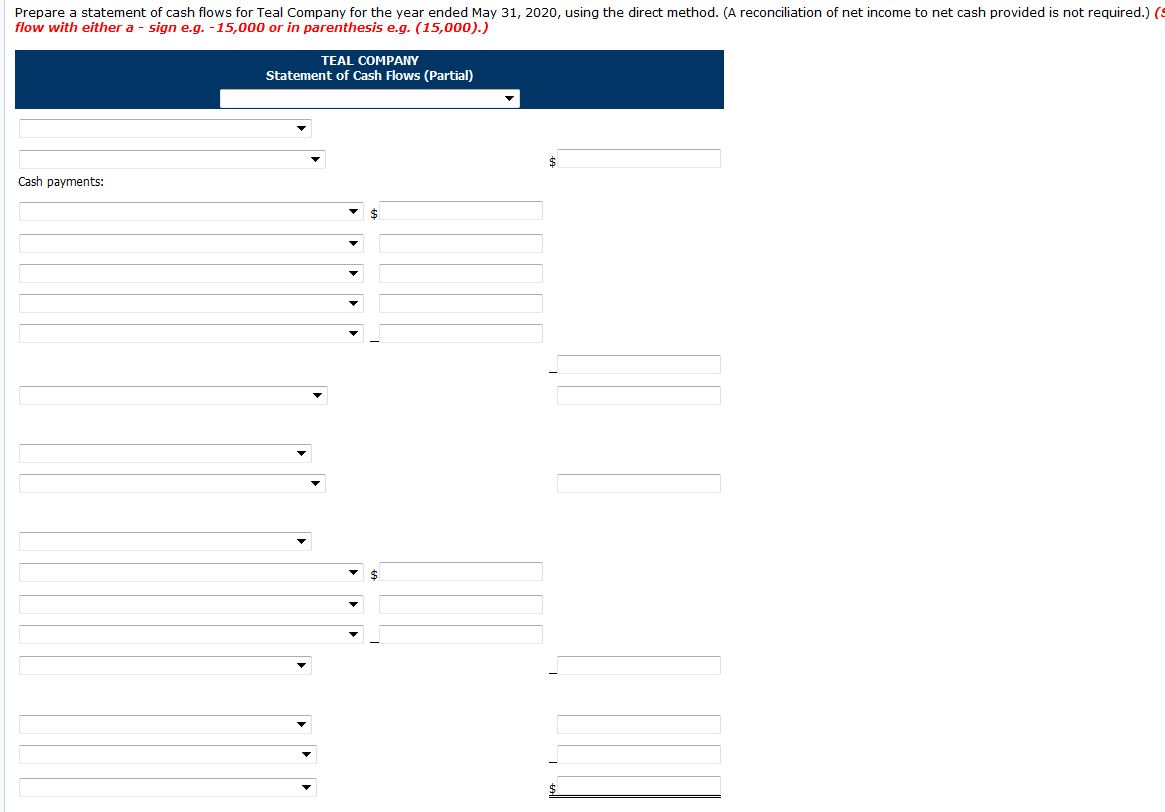

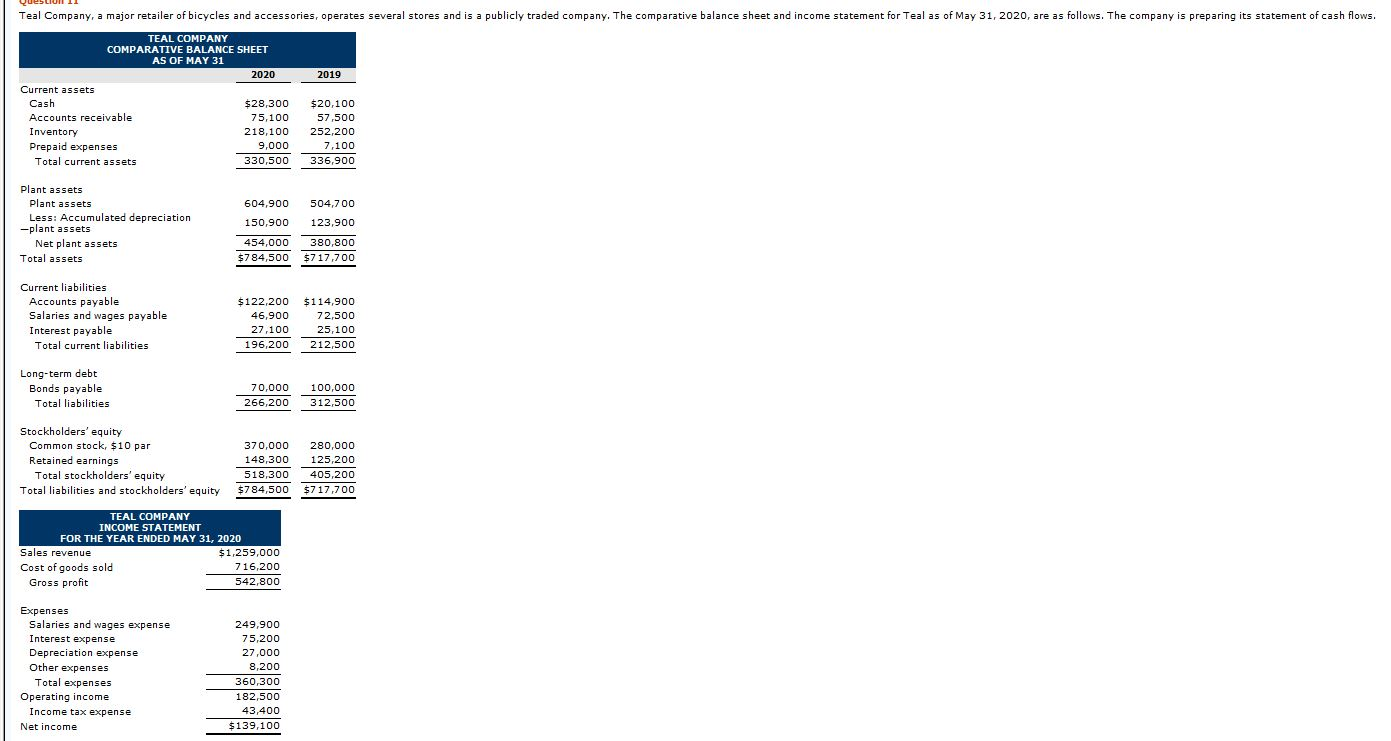

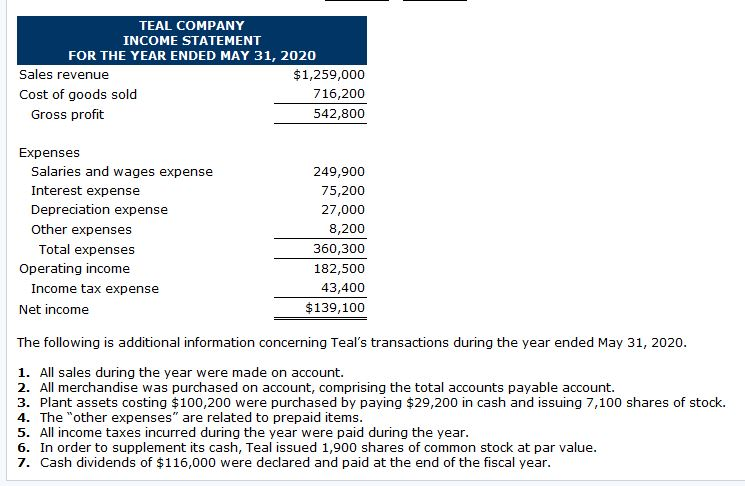

quesLIUI 11 Teal Company, a major retailer of bicycles and accessories, operates several stores and is a publicly traded company. The comparative balance sheet and income statement for Teal as of May 31, 2020, are as follows. The company is preparing its statement of cash flows. 2019 TEAL COMPANY COMPARATIVE BALANCE SHEET AS OF MAY 31 2020 Current assets Cash $28,300 Accounts receivable 75,100 Inventory 218,100 Prepaid expenses 9,000 Total current assets 330,500 $20,100 57,500 252,200 7,100 336,900 Plant assets Plant assets Less: Accumulated depreciation -plant assets Net plant assets Total assets 604,900 150,900 454,000 $784,500 504,700 123,900 380,800 $717,700 Current liabilities Accounts payable Salaries and wages payable Interest payable Total current liabilities $122,200 46,900 27,100 196,200 $114,900 72,500 25,100 212,500 Long-term debt 70,000 256,200 100,000 312,500 Total liabilities Stockholders' equity Common stock, $10 par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 370,000 148,300 518,300 $784,500 280,000 125,200 405,200 $717,700 TEAL COMPANY INCOME STATEMENT FOR THE YEAR ENDED MAY 31, 2020 Sales revenue $1,259,000 Cost of goods sold 716,200 Gross profit 542,800 Expenses Salaries and wages expense Interest expense Depreciation expense Other expenses Total expenses Operating income Income tax expense Net income 249,900 75,200 27,000 8,200 360,300 182,500 43,400 $139,100 TEAL COMPANY INCOME STATEMENT FOR THE YEAR ENDED MAY 31, 2020 Sales revenue $1,259,000 Cost of goods sold 716,200 Gross profit 542,800 Expenses Salaries and wages expense Interest expense Depreciation expense Other expenses Total expenses Operating income Income tax expense Net income 249,900 75,200 27,000 8,200 360,300 182,500 43,400 $ 139,100 The following is additional information concerning Teal's transactions during the year ended May 31, 2020. 1. All sales during the year were made on account. 2. All merchandise was purchased on account, comprising the total accounts payable account. 3. Plant assets costing $100,200 were purchased by paying $29,200 in cash and issuing 7,100 shares of stock. 4. The other expenses" are related to prepaid items. 5. All income taxes incurred during the year were paid during the year. 6. In order to supplement its cash, Teal issued 1,900 shares of common stock at par value. 7. Cash dividends of $116,000 were declared and paid at the end of the fiscal year. Prepare a statement of cash flows for Teal Company for the year ended May 31, 2020, using the direct method. (A reconciliation of net income to net cash provided is not required.) ( flow with either a - sign e.g. - 15,000 or in parenthesis e.g. (15,000).) TEAL COMPANY Statement of Cash Flows (Partial) Cash payments