Quessstion 1

Question 2

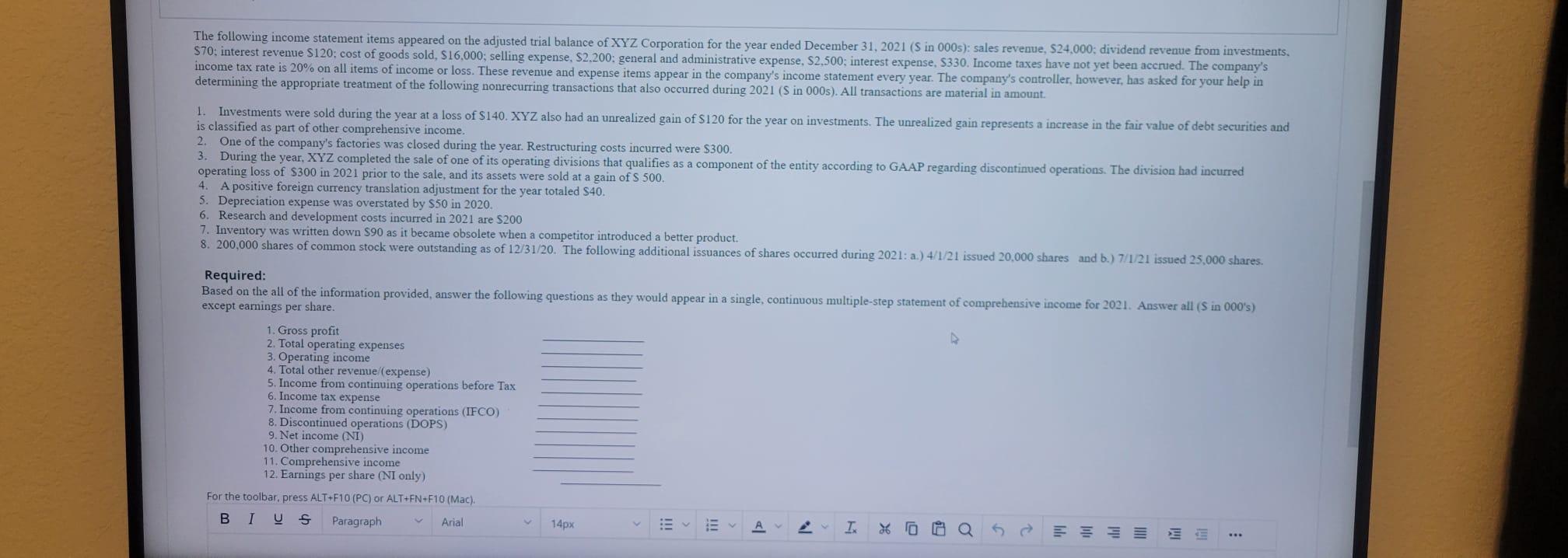

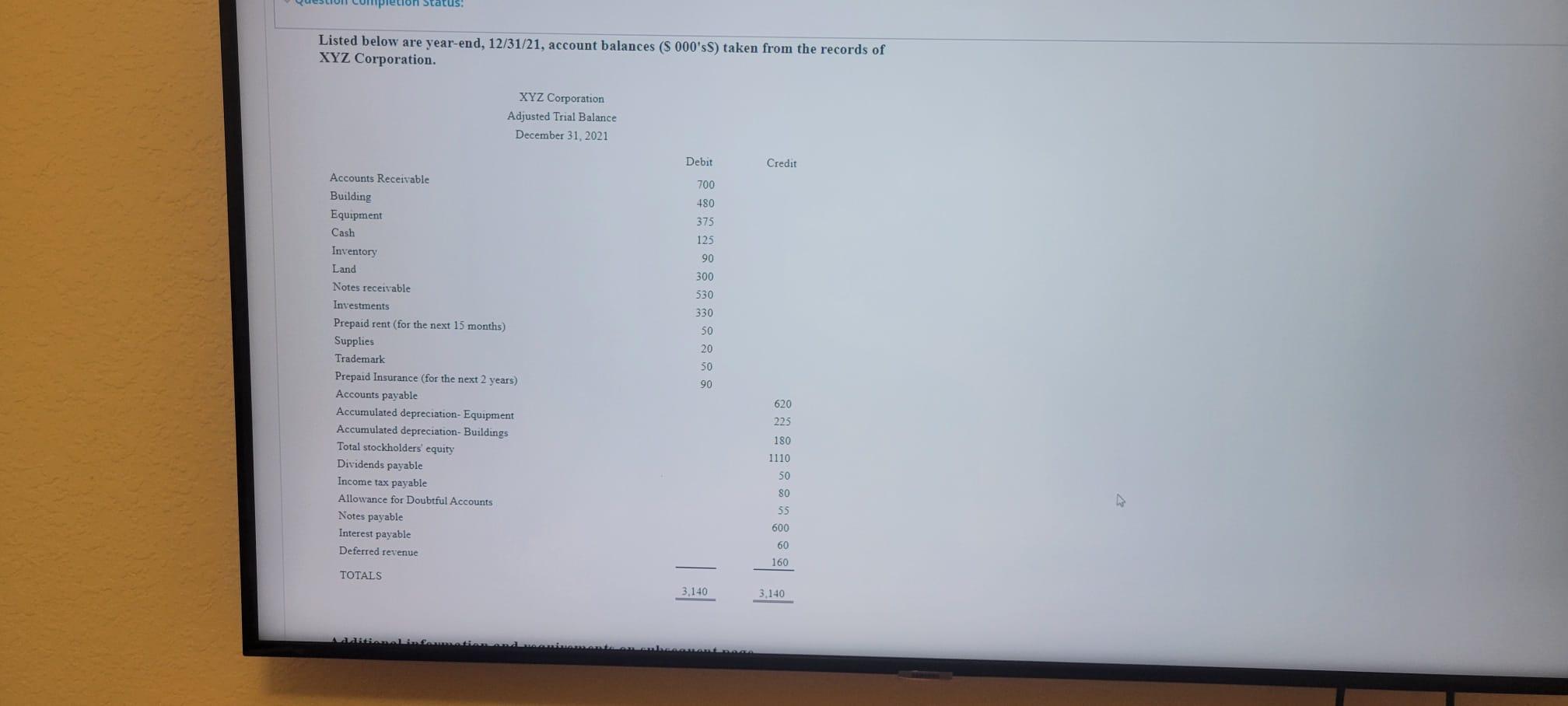

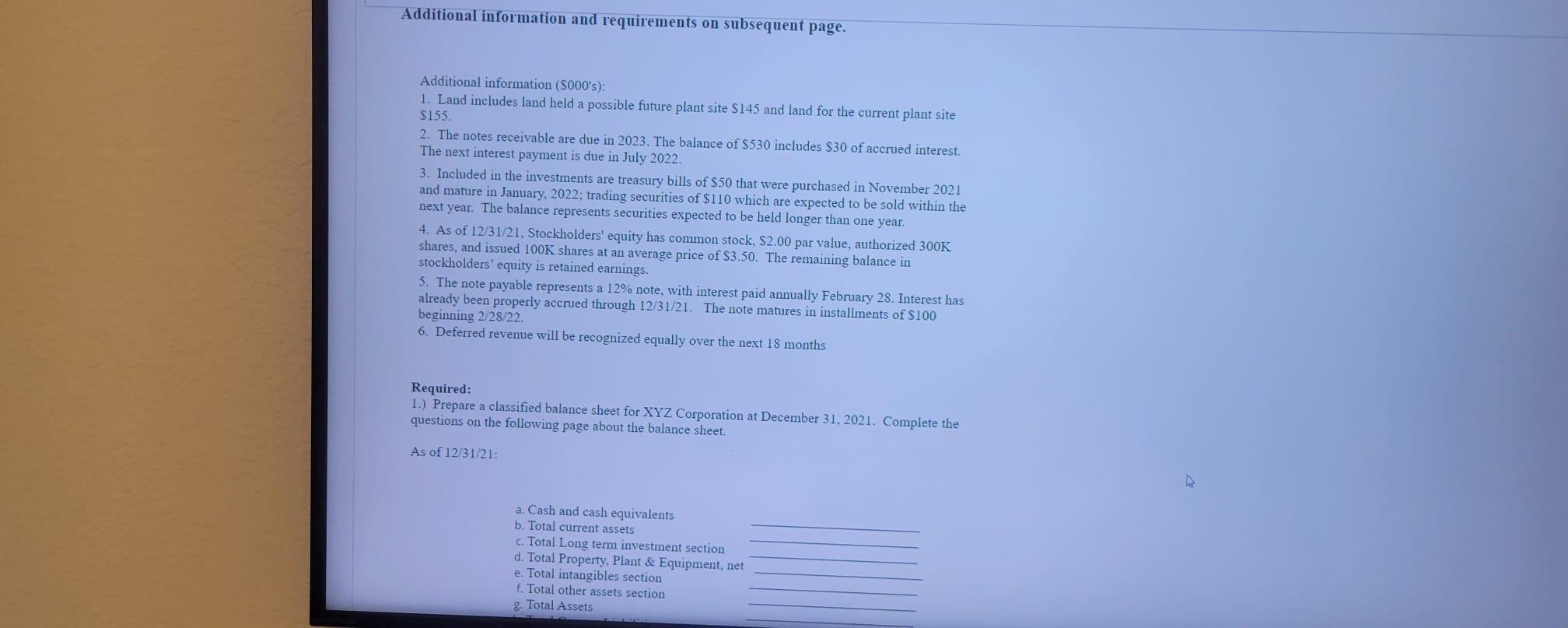

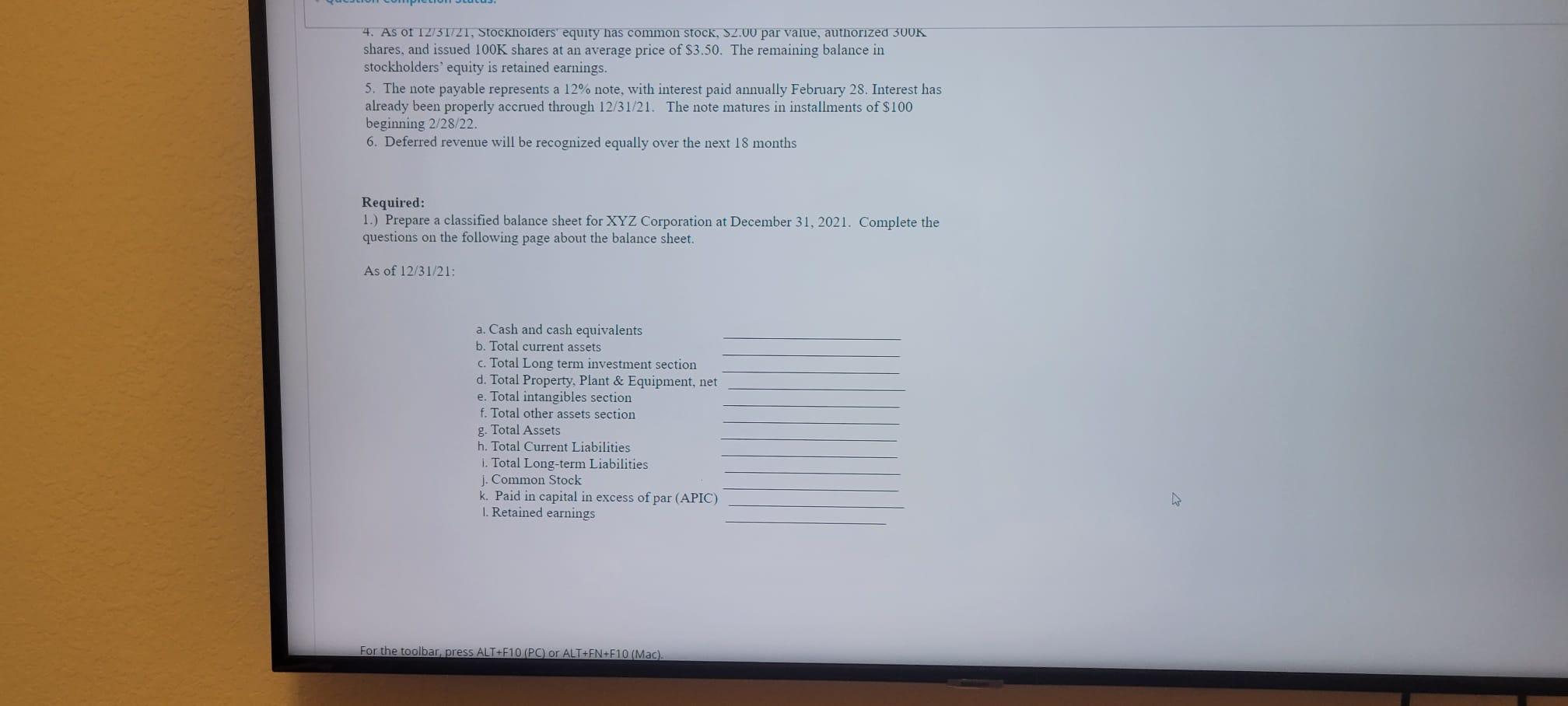

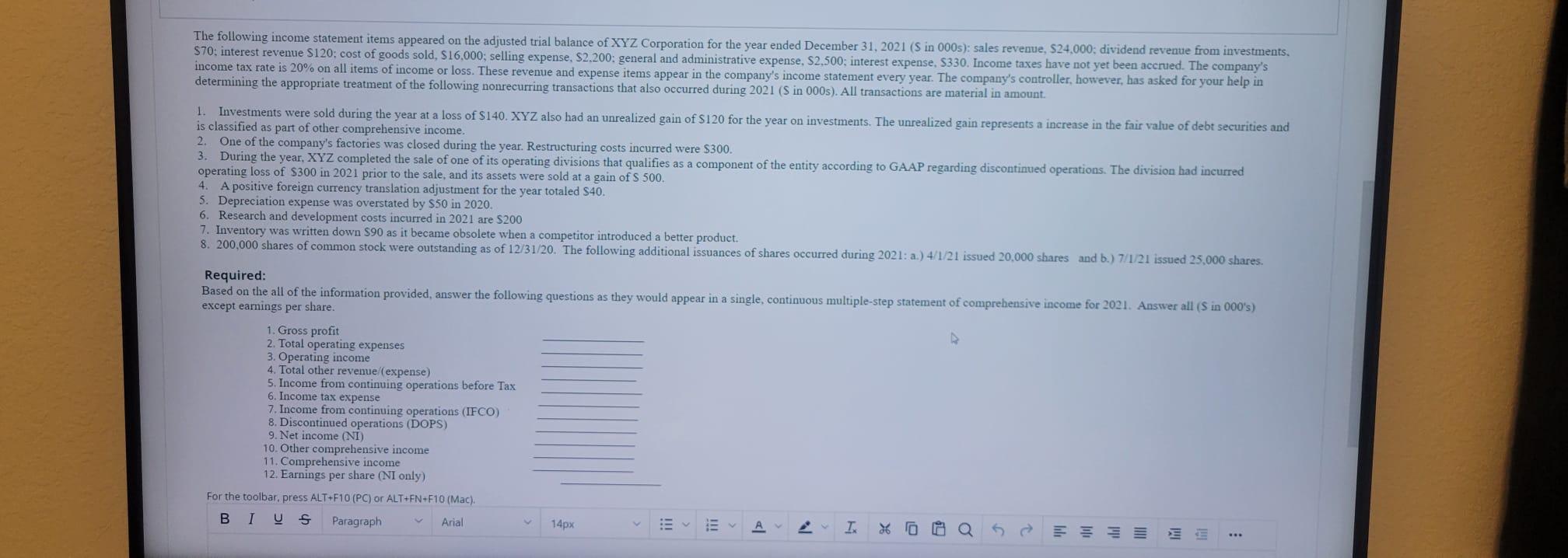

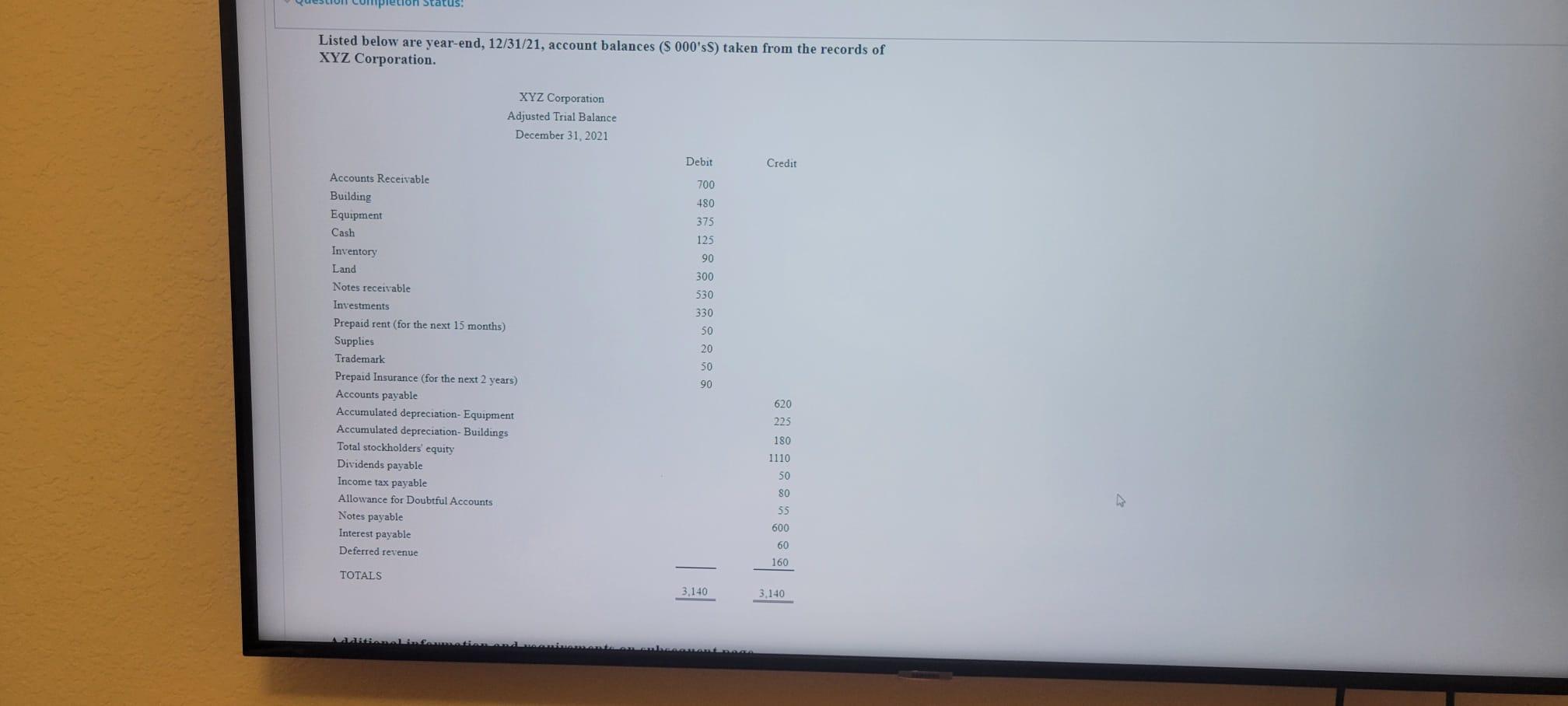

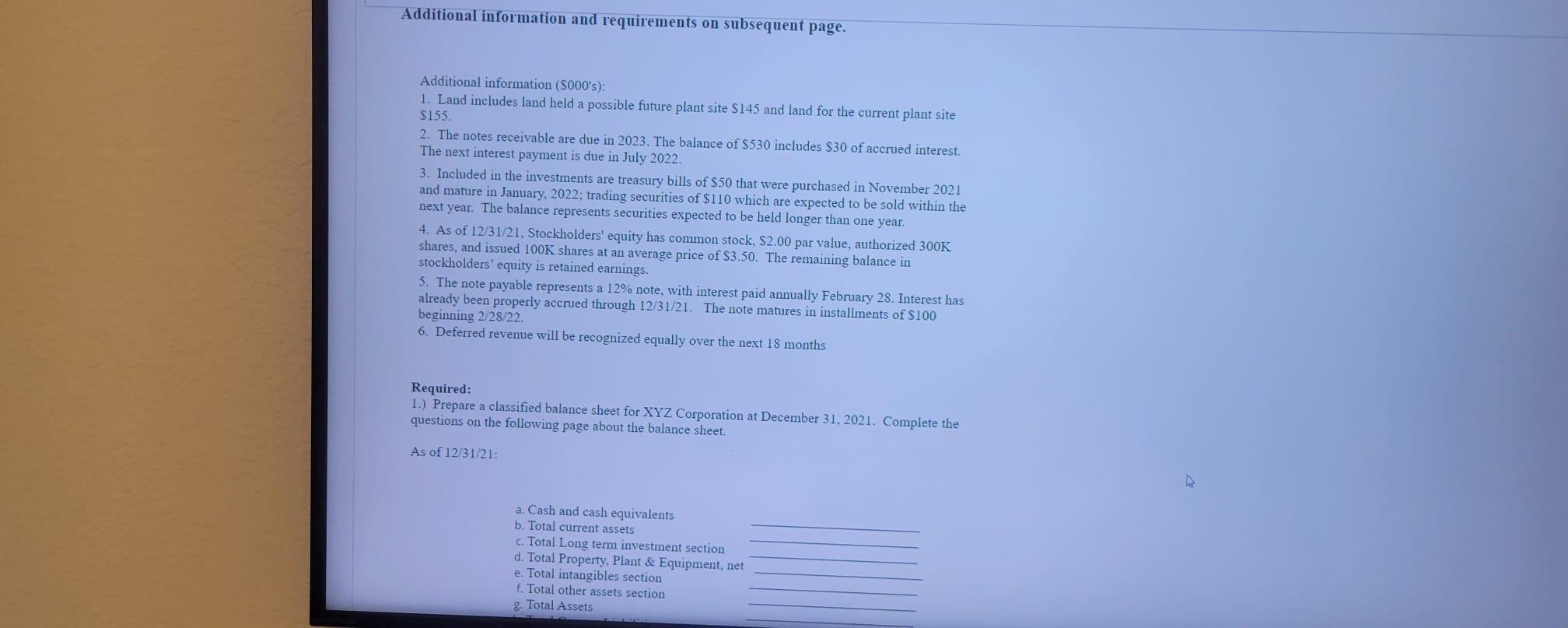

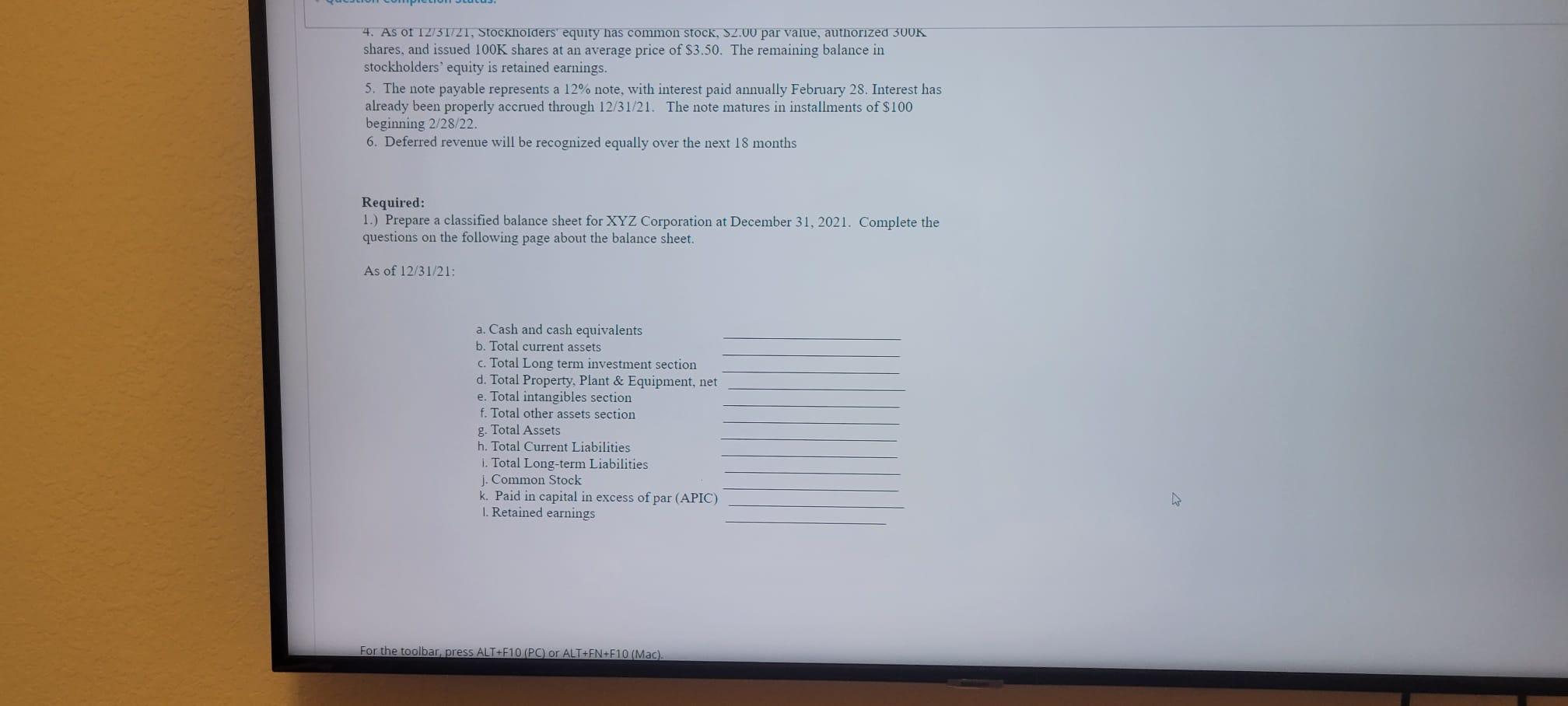

The following income statement items appeared on the adjusted trial balance of XYZ Corporation for the year ended December 31, 2021 (S in 000s): sales revenue, $24,000: dividend revenue from investments. $70: interest revenue $120: cost of goods sold, S16,000; selling expense, $2,200: general and administrative expense, $2,500; interest expense, S330. Income taxes have not yet been accrued. The company's income tax rate is 20% on all items of income or loss. These revenue and expense items appear in the company's income statement every year. The company's controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2021 (S in 000s). All transactions are material in amount. 1. Investments were sold during the year at a loss of $140.XYZ also had an unrealized gain of S120 for the year on investments. The unrealized gain represents a increase in the fair value of debt securities and is classified as part of other comprehensive income. 2. One of the company's factories was closed during the year. Restructuring costs incurred were $300. 3. During the year, XYZ completed the sale of one of its operating divisions that qualifies as a component of the entity according to GAAP regarding discontinued operations. The division had incurred operating loss of $300 in 2021 prior to the sale, and its assets were sold at a gain of S 500. 4. A positive foreign currency translation adjustment for the year totaled $40. 5. Depreciation expense was overstated by S50 in 2020. 6. Research and development costs incurred in 2021 are $200 7. Inventory was written down S90 as it became obsolete when a competitor introduced a better product. 8. 200,000 shares of common stock were outstanding as of 12/31/20. The following additional issuances of shares occurred during 2021: a.) 4/1/21 issued 20,000 shares and b.) 7/1/21 issued 25,000 shares. Required: Based on the all of the information provided, answer the following questions as they would appear in a single, continuous multiple-step statement of comprehensive income for 2021. Answer all (S in 000's) except earnings per share. 1. Gross profit 2. Total operating expenses 3. Operating income 4. Total other revenue/expense) 5. Income from continuing operations before Tax 6. Income tax expense 7. Income from continuing operations (IFCO) 8. Discontinued operations (DOPS) 9. Net income (NI) 10. Other comprehensive income 11. Comprehensive income 12. Earnings per share (NI only) For the toolbar, press ALT+F10 (PC) or ALT+FN-F10 (Mac). BI V S Paragraph Arial 14px . I % di Q5 piedion Status: Listed below are year-end, 12/31/21, account balances ($ 000's) taken from the records of XYZ Corporation. XYZ Corporation Adjusted Trial Balance December 31, 2021 Debit Credit Accounts Receivable Building Equipment Cash Inventory 700 480 375 125 Land 90 300 530 330 50 20 50 90 Notes receivable Investments Prepaid rent (for the next 15 months) Supplies Trademark Prepaid Insurance (for the next 2 years) Accounts payable Accumulated depreciation Equipment Accumulated depreciation-Buildings Total stockholders' equity Dividends payable Income tax payable Allowance for Doubtful Accounts Notes payable Interest payable Deferred revenue 322922age TOTALS | | 3.140 3,140 Additional information and requirements on subsequent page. Additional information (S000's): 1. Land includes land held a possible future plant site $145 and land for the current plant site $155. 2. The notes receivable are due in 2023. The balance of $530 includes $30 of accrued interest. The next interest payment is due in July 2022, 3. Included in the investments are treasury bills of S50 that were purchased in November 2021 and mature in January, 2022; trading securities of $110 which are expected to be sold within the next year. The balance represents securities expected to be held longer than one year. 4. As of 12/31/21, Stockholders' equity has common stock, S2.00 par value, authorized 300K shares, and issued 100K shares at an average price of $3.50. The remaining balance in stockholders' equity is retained earnings. 5. The note payable represents a 12% note, with interest paid annually February 28. Interest has already been properly accrued through 12/31/21. The note matures in installments of $100 beginning 2/28/22 6. Deferred revenue will be recognized equally over the next 18 months Required: 1.) Prepare a classified balance sheet for XYZ Corporation at December 31, 2021. Complete the questions on the following page about the balance sheet. As of 12/31/21: a. Cash and cash equivalents b. Total current assets c. Total Long term investment section d. Total Property, Plant & Equipment, net e. Total intangibles section f. Total other assets section g. Total Assets 4. As of 12/31/21, Stockholders equity has common stock, S2.00 par value, authorized 300K shares, and issued 100K shares at an average price of $3.50. The remaining balance in stockholders' equity is retained earnings. 5. The note payable represents a 12% note, with interest paid annually February 28. Interest has already been properly accrued through 12/31/21. The note matures in installments of $100 beginning 2/28/22. 6. Deferred revenue will be recognized equally over the next 18 months Required: 1.) Prepare a classified balance sheet for XYZ Corporation at December 31, 2021. Complete the questions on the following page about the balance sheet. As of 12/31/21: a. Cash and cash equivalents b. Total current assets c. Total Long term investment section d. Total Property, Plant & Equipment, net e. Total intangibles section f. Total other assets section g. Total Assets h. Total Current Liabilities 1. Total Long-term Liabilities j. Common Stock k. Paid in capital in excess of par (APIC) 1. Retained earnings For the toolbar press ALT+F10 (PC) or ALT+FN+F10 (Mac). The following income statement items appeared on the adjusted trial balance of XYZ Corporation for the year ended December 31, 2021 (S in 000s): sales revenue, $24,000: dividend revenue from investments. $70: interest revenue $120: cost of goods sold, S16,000; selling expense, $2,200: general and administrative expense, $2,500; interest expense, S330. Income taxes have not yet been accrued. The company's income tax rate is 20% on all items of income or loss. These revenue and expense items appear in the company's income statement every year. The company's controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2021 (S in 000s). All transactions are material in amount. 1. Investments were sold during the year at a loss of $140.XYZ also had an unrealized gain of S120 for the year on investments. The unrealized gain represents a increase in the fair value of debt securities and is classified as part of other comprehensive income. 2. One of the company's factories was closed during the year. Restructuring costs incurred were $300. 3. During the year, XYZ completed the sale of one of its operating divisions that qualifies as a component of the entity according to GAAP regarding discontinued operations. The division had incurred operating loss of $300 in 2021 prior to the sale, and its assets were sold at a gain of S 500. 4. A positive foreign currency translation adjustment for the year totaled $40. 5. Depreciation expense was overstated by S50 in 2020. 6. Research and development costs incurred in 2021 are $200 7. Inventory was written down S90 as it became obsolete when a competitor introduced a better product. 8. 200,000 shares of common stock were outstanding as of 12/31/20. The following additional issuances of shares occurred during 2021: a.) 4/1/21 issued 20,000 shares and b.) 7/1/21 issued 25,000 shares. Required: Based on the all of the information provided, answer the following questions as they would appear in a single, continuous multiple-step statement of comprehensive income for 2021. Answer all (S in 000's) except earnings per share. 1. Gross profit 2. Total operating expenses 3. Operating income 4. Total other revenue/expense) 5. Income from continuing operations before Tax 6. Income tax expense 7. Income from continuing operations (IFCO) 8. Discontinued operations (DOPS) 9. Net income (NI) 10. Other comprehensive income 11. Comprehensive income 12. Earnings per share (NI only) For the toolbar, press ALT+F10 (PC) or ALT+FN-F10 (Mac). BI V S Paragraph Arial 14px . I % di Q5 piedion Status: Listed below are year-end, 12/31/21, account balances ($ 000's) taken from the records of XYZ Corporation. XYZ Corporation Adjusted Trial Balance December 31, 2021 Debit Credit Accounts Receivable Building Equipment Cash Inventory 700 480 375 125 Land 90 300 530 330 50 20 50 90 Notes receivable Investments Prepaid rent (for the next 15 months) Supplies Trademark Prepaid Insurance (for the next 2 years) Accounts payable Accumulated depreciation Equipment Accumulated depreciation-Buildings Total stockholders' equity Dividends payable Income tax payable Allowance for Doubtful Accounts Notes payable Interest payable Deferred revenue 322922age TOTALS | | 3.140 3,140 Additional information and requirements on subsequent page. Additional information (S000's): 1. Land includes land held a possible future plant site $145 and land for the current plant site $155. 2. The notes receivable are due in 2023. The balance of $530 includes $30 of accrued interest. The next interest payment is due in July 2022, 3. Included in the investments are treasury bills of S50 that were purchased in November 2021 and mature in January, 2022; trading securities of $110 which are expected to be sold within the next year. The balance represents securities expected to be held longer than one year. 4. As of 12/31/21, Stockholders' equity has common stock, S2.00 par value, authorized 300K shares, and issued 100K shares at an average price of $3.50. The remaining balance in stockholders' equity is retained earnings. 5. The note payable represents a 12% note, with interest paid annually February 28. Interest has already been properly accrued through 12/31/21. The note matures in installments of $100 beginning 2/28/22 6. Deferred revenue will be recognized equally over the next 18 months Required: 1.) Prepare a classified balance sheet for XYZ Corporation at December 31, 2021. Complete the questions on the following page about the balance sheet. As of 12/31/21: a. Cash and cash equivalents b. Total current assets c. Total Long term investment section d. Total Property, Plant & Equipment, net e. Total intangibles section f. Total other assets section g. Total Assets 4. As of 12/31/21, Stockholders equity has common stock, S2.00 par value, authorized 300K shares, and issued 100K shares at an average price of $3.50. The remaining balance in stockholders' equity is retained earnings. 5. The note payable represents a 12% note, with interest paid annually February 28. Interest has already been properly accrued through 12/31/21. The note matures in installments of $100 beginning 2/28/22. 6. Deferred revenue will be recognized equally over the next 18 months Required: 1.) Prepare a classified balance sheet for XYZ Corporation at December 31, 2021. Complete the questions on the following page about the balance sheet. As of 12/31/21: a. Cash and cash equivalents b. Total current assets c. Total Long term investment section d. Total Property, Plant & Equipment, net e. Total intangibles section f. Total other assets section g. Total Assets h. Total Current Liabilities 1. Total Long-term Liabilities j. Common Stock k. Paid in capital in excess of par (APIC) 1. Retained earnings For the toolbar press ALT+F10 (PC) or ALT+FN+F10 (Mac)