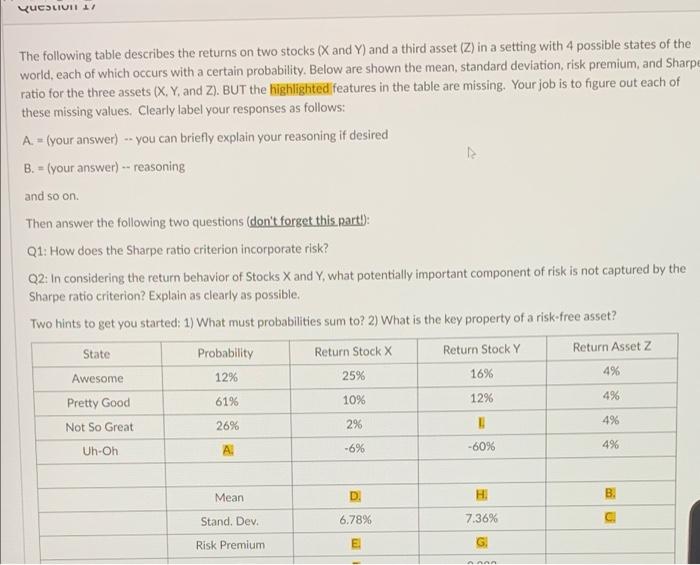

Quest The following table describes the returns on two stocks (X and Y) and a third asset (Z) in a setting with 4 possible states of the world, each of which occurs with a certain probability. Below are shown the mean, standard deviation, risk premium, and Sharpe ratio for the three assets (X, Y, and Z). BUT the highlighted features in the table are missing. Your job is to figure out each of these missing values. Clearly label your responses as follows: A. - (your answer) -- you can briefly explain your reasoning if desired B. = (your answer) -- reasoning and so on. Then answer the following two questions (don't forget this part!: Q1: How does the Sharpe ratio criterion incorporate risk? Q2: In considering the return behavior of Stocks X and Y, what potentially important component of risk is not captured by the Sharpe ratio criterion? Explain as clearly as possible. Two hints to get you started: 1) What must probabilities sum to? 2) What is the key property of a risk-free asset? State Probability Return Stock X Return Stock Y Return Assetz Awesome 12% 25% 16% Pretty Good 61% Not So Great 2% 4% Uh-Oh A -6% -60% 4% 4% 10% 12% 4% 26% Mean H B. Stand. Dev. 6.78% 7.36% C Risk Premium Quest The following table describes the returns on two stocks (X and Y) and a third asset (Z) in a setting with 4 possible states of the world, each of which occurs with a certain probability. Below are shown the mean, standard deviation, risk premium, and Sharpe ratio for the three assets (X, Y, and Z). BUT the highlighted features in the table are missing. Your job is to figure out each of these missing values. Clearly label your responses as follows: A. - (your answer) -- you can briefly explain your reasoning if desired B. = (your answer) -- reasoning and so on. Then answer the following two questions (don't forget this part!: Q1: How does the Sharpe ratio criterion incorporate risk? Q2: In considering the return behavior of Stocks X and Y, what potentially important component of risk is not captured by the Sharpe ratio criterion? Explain as clearly as possible. Two hints to get you started: 1) What must probabilities sum to? 2) What is the key property of a risk-free asset? State Probability Return Stock X Return Stock Y Return Assetz Awesome 12% 25% 16% Pretty Good 61% Not So Great 2% 4% Uh-Oh A -6% -60% 4% 4% 10% 12% 4% 26% Mean H B. Stand. Dev. 6.78% 7.36% C Risk Premium