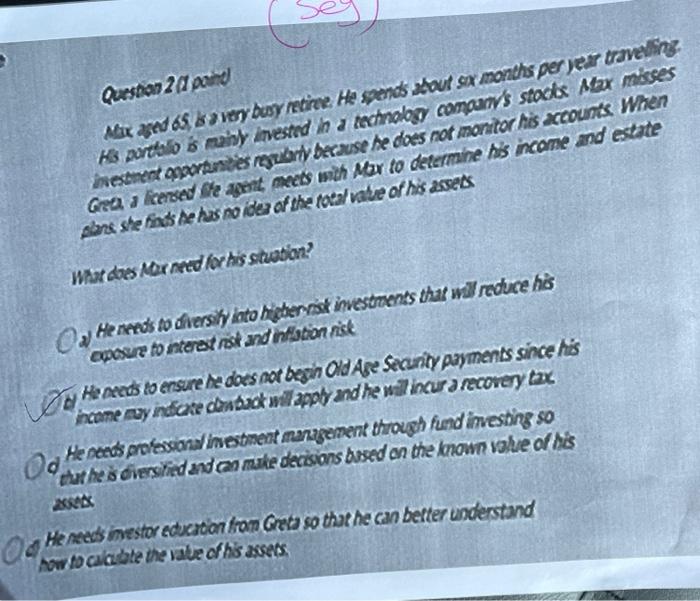

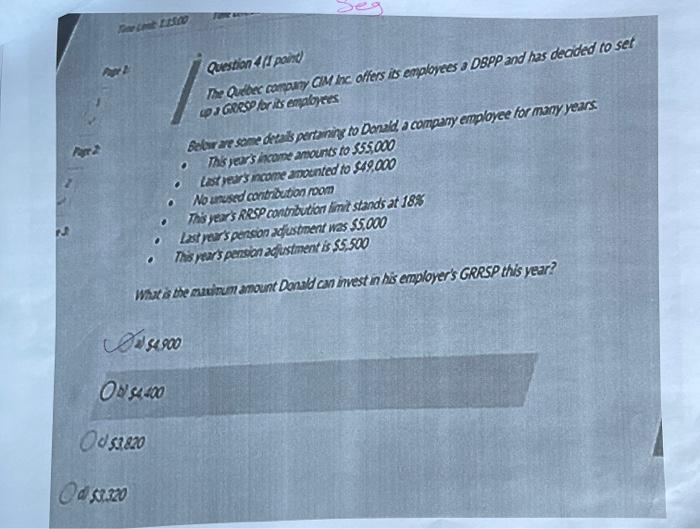

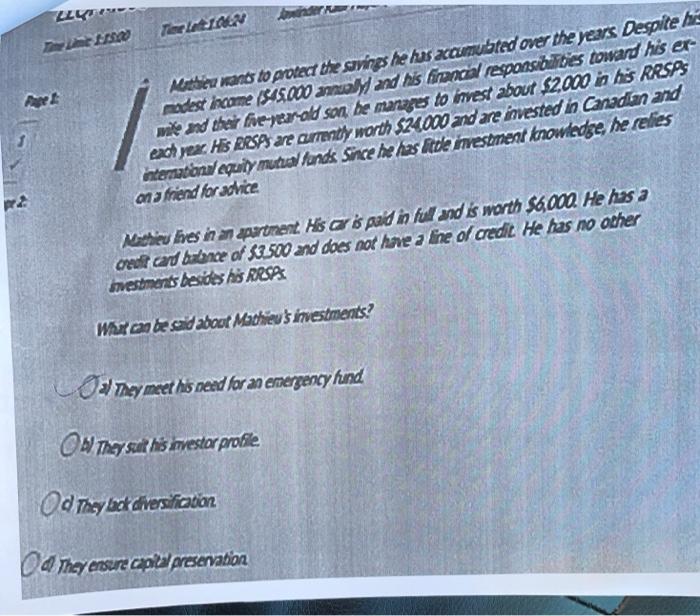

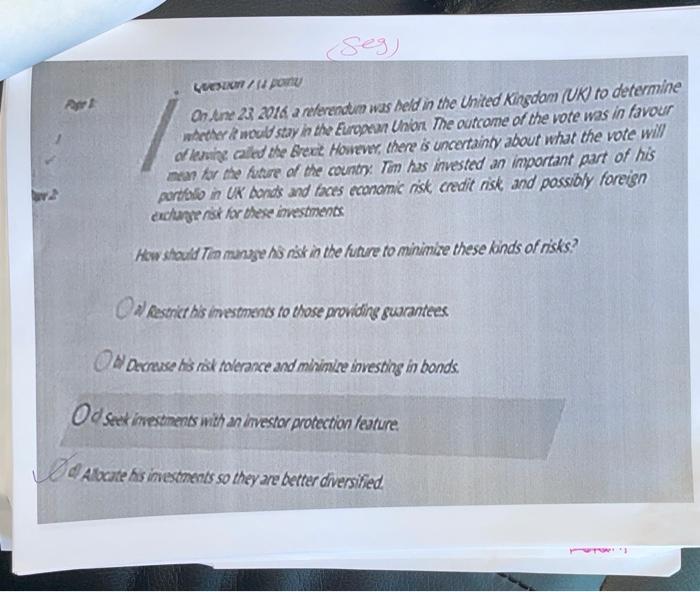

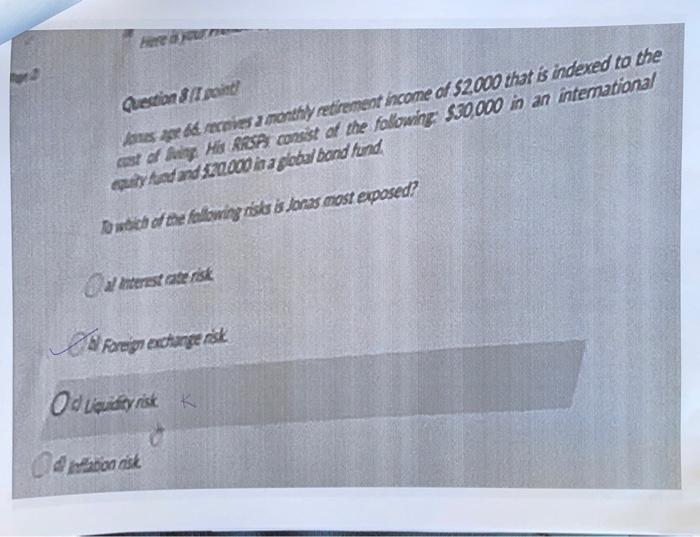

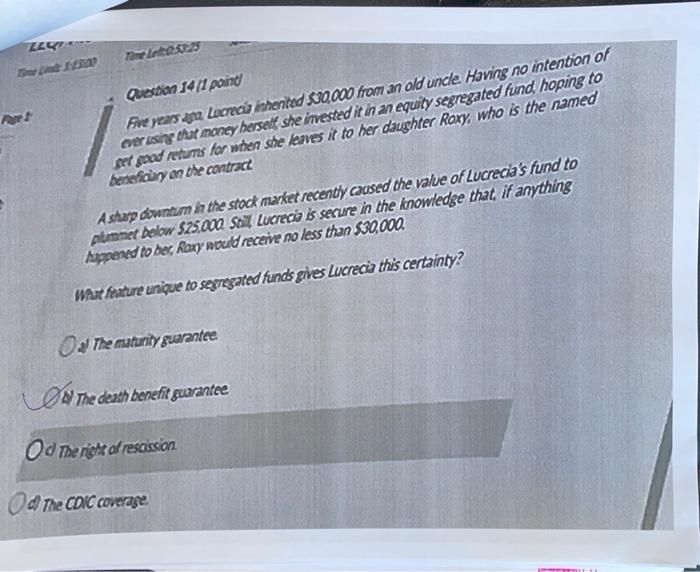

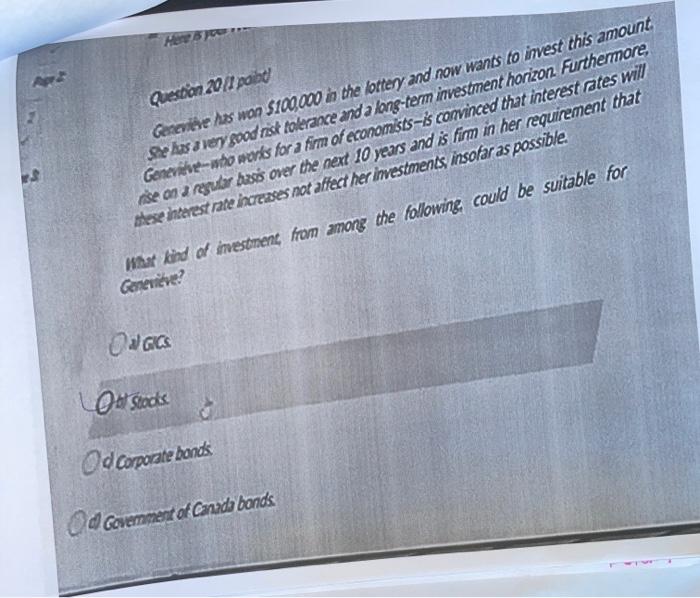

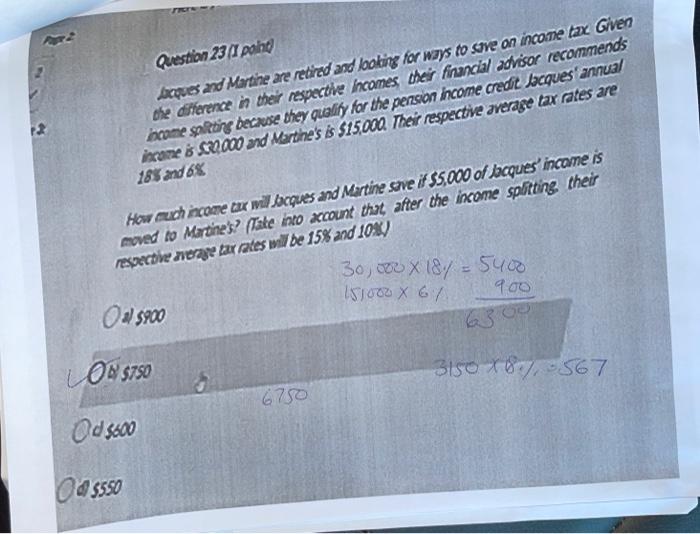

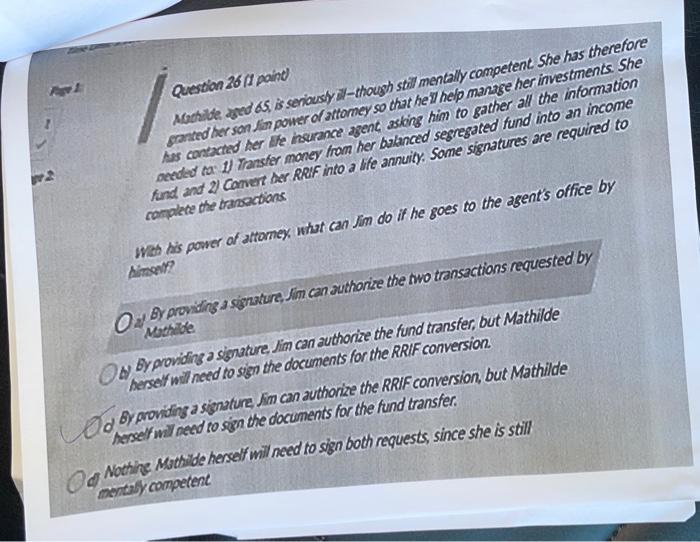

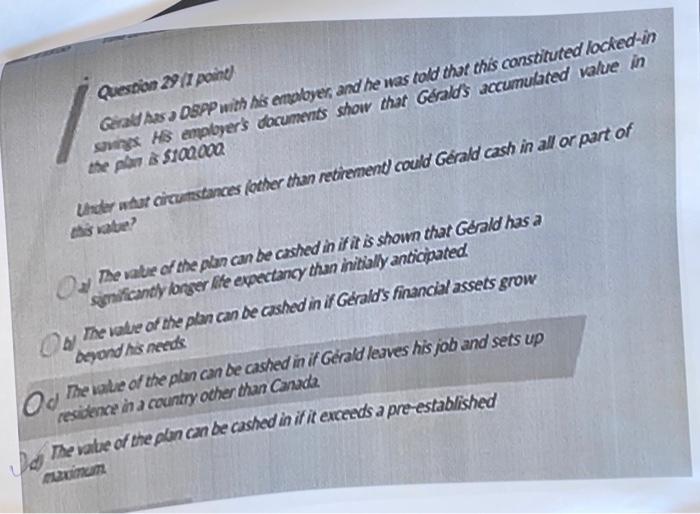

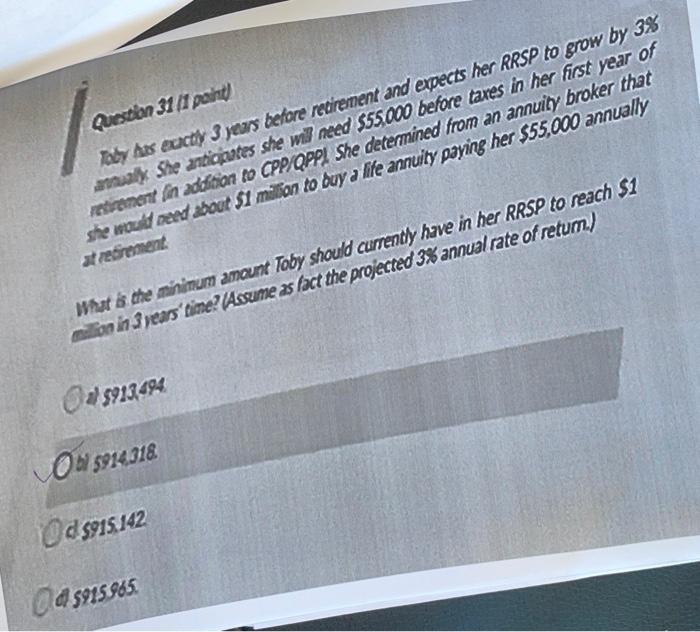

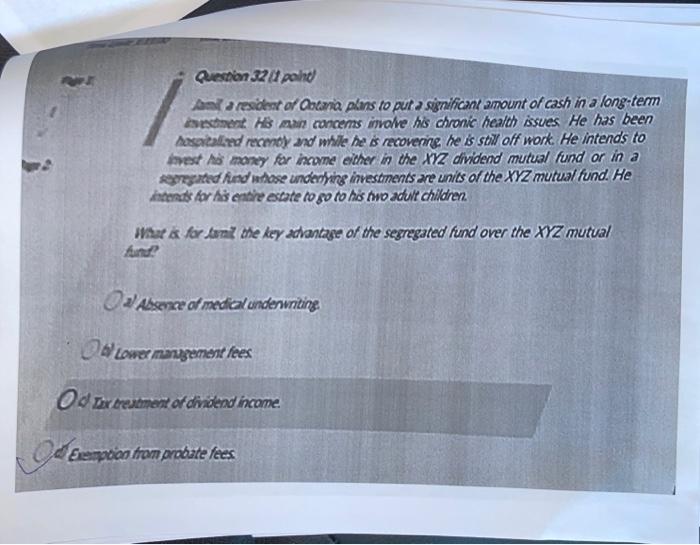

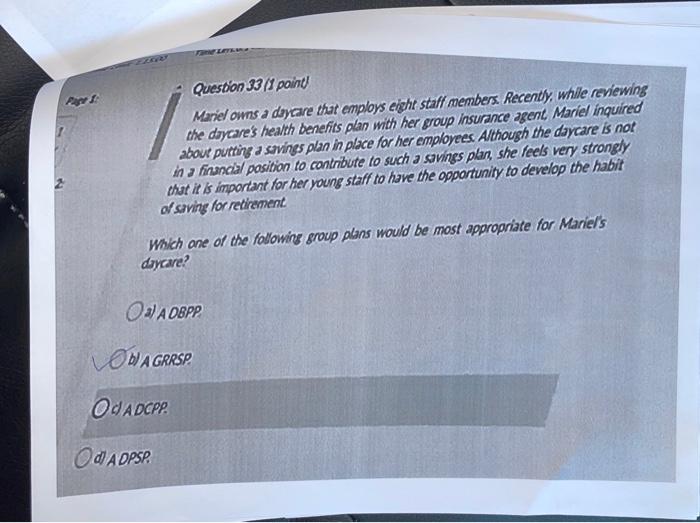

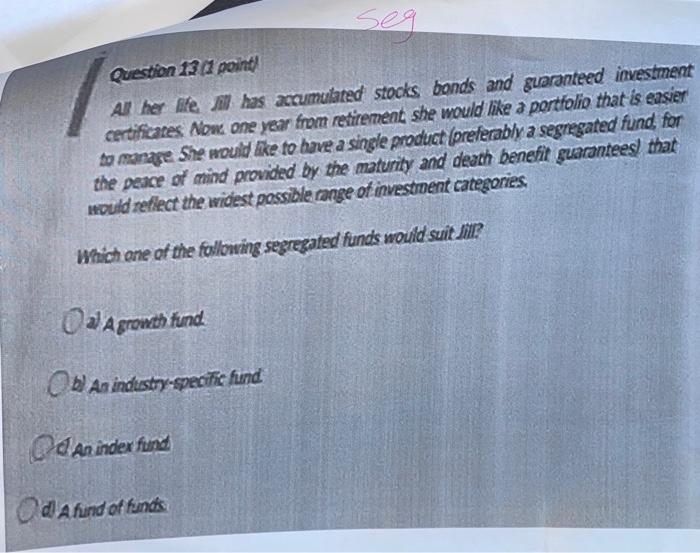

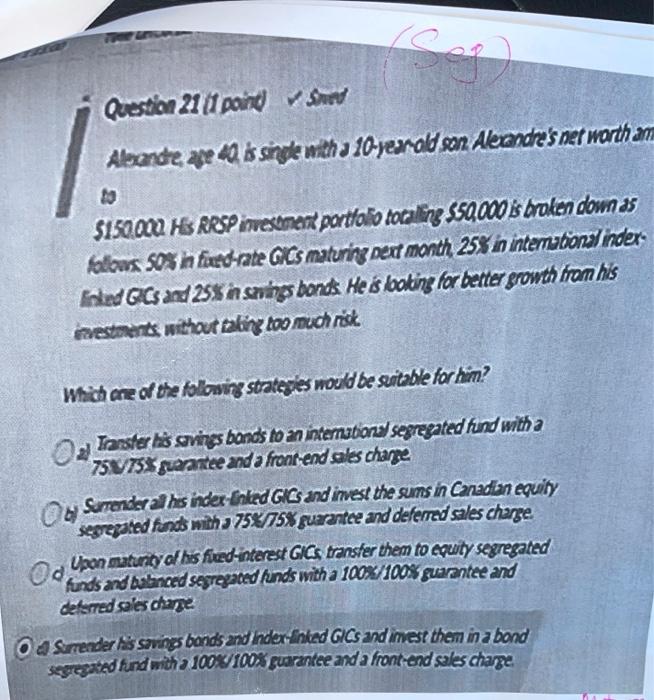

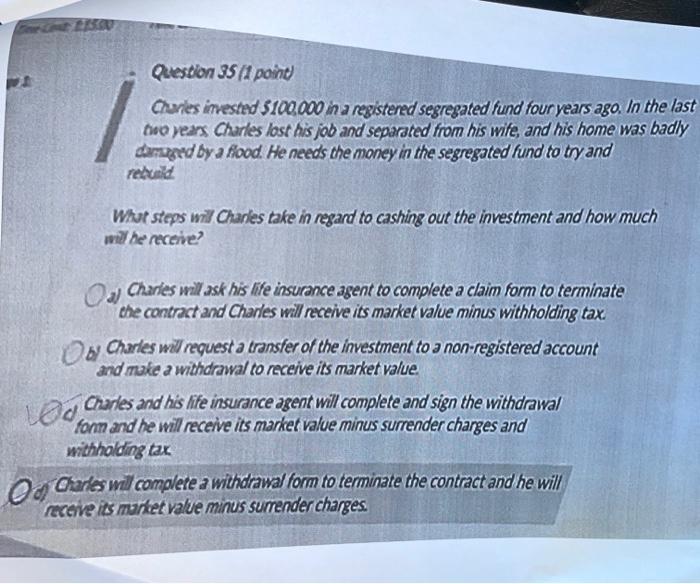

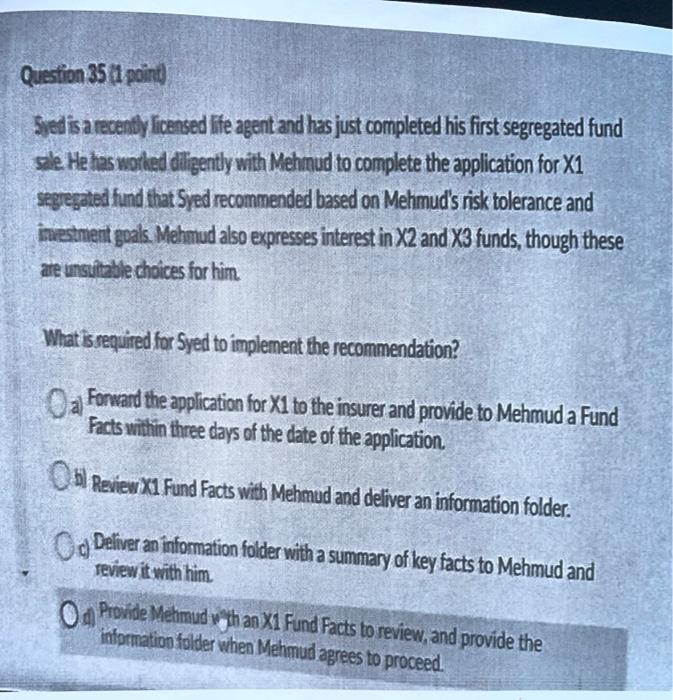

Questar 2 and Mae and 65 very busy retree. He spends out sx months per yer travelling His porttalos mainly invested in a technology coman's stocks Abox messes investment ses rury because pe does not monitor his accounts When Gea a kezed ite ant meets with Mar to determine is income ad estate Akane she finden wides of the total vale of his assets What does normed for his swort? Os He meds to diversity lato bicherst investments that will reduce his epose tonterat risk and naton ist Heres to ensure te does not bear Old Age Security payments since his income way intake dowback wit apply and he will incur a recovery tax Od He recs professional investment management through fund investing so tutes diversified and make decisions based on the known value of ne He needs mestor edukatan tron Greta so that he can better understand now to acate the vaue his sets Question pand I Qudder comany GM be offers its employees a DBPP and has decided to set RESP lor is enabres Bobrze same as pertaining to Donald, a company employee for many years This year's ikan amants to $55.000 Letyear's come an unted to 49.000 Nourused contribution room This year's RRSS contribution limit stands at 18% Last year's person adjustment was 55.000 This year's person aquestment is $5.500 . . What is the main amount Donald can invest in his employer's GRRSP this year? Sus4.900 053820 TETAN LEI Mote wants to protect the savings he has acumubted over the years. Despite his madest come 1545.000 amaly and his financial responsibilities toward his er make and the foe-parald son, be manages to invest about $2.000 in his RRSPS each year. His RRSA are currently worth $24000 and are invested in Canadian and intematond equiy mutual funds since he has itdle investment knowledge, he relies on a friend for advice 12 Matheu bes in an apartment . His cris paid in ful and is worth $6,000. He has a credit card balance of 53,500 and does not have a fine of credit. He has no other investments besides his RRSS. What can be said about Matheus investments? cool they meet his need for an emergency hund O Thay sulit his novestor profile Od They lac diversification a Mey ensure capital preservation Seg) QUONI pony On terre 23 2018 a referendum was Deld in the United Kingdom (UK) to determine whether would stay in the Euroxan Union The outcome of the vote was in favour of lente called the Brext However, there is uncertainty about what the vote will man for the future of the country: Tin has invested an important part of his portfolio in UK donds and faces economic risk credit risk and possibly foreign excluent for hexe investments How should Tia mange s nisk in the future to minimize these kinds of risks? Restrict his mestments to those providing guwantees Decreuse dos risk tolerance and minimile dovesting in bonds. Od seek investments with an investor protection feature Albcate his investments so they are better diversified Question Smit Jos e de receives a monthy retirement income of $2000 that is indexed to the ast of Aung Hd RRSAconsist of the following $50,000 in an intemational uyted and $20.000 in a global band fund. Dodatne following isis lors most exposed? del Foreign exchange risk Od Liquidity risk K dation disk Time Les Question 14/1 pound Five years ago Lucreca inherited 10,000 from an old uncle. Having no intention of ever using that maney herself she invested it in an equity segregated fund, hoping to Bet med retums for when she leaves it to her daughter Roxy, who is the named beneficiary on the contract A sharp downturn in the stock market recently caused the value of Lucrecia's fund to muammet below $25.000. Still, Lucrecia is secure in the knowledge that if anything Appened to ber, Roxy would receive no less than $30,000. What feature unique to segregated funds gives Lucrecia this certainty? On The maturity guarantee of the death benefit guarantee Od the right of rescission 1d The CDIC coverage Time Les Question 14/1 pound Five years ago Lucreca inherited 10,000 from an old uncle. Having no intention of ever using that maney herself she invested it in an equity segregated fund, hoping to Bet med retums for when she leaves it to her daughter Roxy, who is the named beneficiary on the contract A sharp downturn in the stock market recently caused the value of Lucrecia's fund to muammet below $25.000. Still, Lucrecia is secure in the knowledge that if anything Appened to ber, Roxy would receive no less than $30,000. What feature unique to segregated funds gives Lucrecia this certainty? On The maturity guarantee of the death benefit guarantee Od the right of rescission 1d The CDIC coverage App Question 2011 point Genevieve has won $100,000 in the bottery and now wants to invest this amount Se has a very good risk tolerance and a long-term investment horizon. Furthermore, Genevidewho works for a firm of economists-is convinced that interest rates will nae on a regular basis over the next 10 years and is firm in her requirement that these interest rate increases not affect her investments, insofar as possible. What kind of investment from among the following could be suitable for Genevieve? Od GCS Lost Stocks Od corporate bonds Govemment of Canada bonds Question 23 point kapues and Martine are retired and looking for ways to save an income tax Given the difference in their respective Incomes their financial advisor recommends come saling because they quality for the persion hncome credit Jacques' annual income is COO and Martine's is $15,000. Their respective average tax rates are 185 and 6% How much income tax will lacques and Martine sove if $5,000 of bacques'income is moved to Martines? (Take into account that after the income splitting their respective nerave tax rates will be 15% and 103) 30,000 X 187 = 5400 S100 X 67 900 0215900 300 5750 3150 X87,567 6750 Od 5600 85550 Question 26 (paint Mathilde red 65, is seriously wl-though still mentally competent She has therefore granted her son in power of attomey so that he help mariage her investments. She has contacted her life insurance agent asking him to gather all the information needed ta 1) Transfer money from her balanced segregated fund into an income fund and 2) Convert der RRIF into a life annuity. Some signatures are required to complete the transactions Web his power of attorney, what can Jim do if he goes to the agent's office by Aimeat? 04 By providing a sigerature, Jim can authorize the two transactions requested by Mathilde ON By providing a signature, Jim can authorize the fund transfer, but Mathilde herself wil need to sign the documents for the RRIF conversion By providing a signature, Jim can authorize the RRIF conversion, but Mathilde herself will need to sign the documents for the fund transfer. Nothine Mathilde herself will need to sign both requests, since she is still mental competent 29- LLE Question / A pound back is exoted to be joining this new employer, one that offers group medical, dental. and retirement benefits to its employeesFor his meeting with Human Resources, he briges his completed application form for medical and dental coverage and a form to contribute to the GRRSP, as his employer matches contributions. The HR representatie returns his application forms for group benefits to lack and tells him that he is not eligible unti certain conditions are met Wher might back became eligible? After the number of days required by law to contribute to his GRRSP Ar the end of his GRRSP contribution vesting perlod. Od on the group plan's renewal date Led As the end of a standard waiting period Question 28/1 poiad Josean as a mully from a locked-in pension. While his spouse was originally named primary revocable beneficiary, Joseph realizes that his son from a previous are would derive greater benefit from it. Joseph contacts his life insurance rent to change beneficiary. How should Joseph's life insurance agent advise him? ay loseah, les spouse and his son must sign a change of beneficiary form and a change of contact information form O Joseph and his son must sign a change of beneficiary and a spousal waiver form to change the beneficiary Od Joseph must signa change of beneficiary form and his spouse must sign a Sausal waiver form Josera cennot change the beneficiary because his spouse was named as revocable beneficiary Question 29 (1 pune) Gead As a OSPP with his emabyer, and he was told that this constituted locked-in X HS emobyer's documents show that Gralds accumulated value in the plans S00200 Under what circumstances (other than retirement could Gerald cash in all or part of water The value of the plan can be cashed in if it is shown that Grald has a sinificantly longer life expectancy than initially anticipated. On the value of the plan can be ashed in if Gerald's financial assets grow Ayond his need The wake of the plan can be cashed in it Gerald leaves his job and sets up residence in a country other than Canada The value of the plan can be cashed in if it exceeds a pre-established Jd Question 31 part aby Ass exactly 3 years before retirement and expects her RRSP to grow by 3% amaly She antiquantes she will need $55.000 before taxes in her first year of restrament in delitian to CPPQPPI She determined from an annuity broker that she would be about $1 million to buy a lite annuity paying her $55,000 annually at rebirement What is the minimum amount Toby should currently have in her RRSP to reach $1 on in 3 years time? Asume as fact the projected 3% annual rate of retum) 215913,494 0 5914318 Od 8915142 Ca 5915965 Question 321 pohd and a resident of Ontaria plans to put a significant amount of cash in a long-term isediment. His an concens involve his chronic health issues. He has been Asaliedrecendy and while he is recovering he is still off work. He intends to vest As many kar income either in the XYZ dividend mutual fund or in a sergated had eesse underlying investments are units of the XYZ mutual fund. He entered for his entre estate to go to his two aduve children Mara fortart the key advantage of the segregated fund over the XYZ mutual 1) Assence of medical underwritime Lower margement fees Od Dox treatment of dividend income. de Ereampion from probate fees Question 33 (1 paint Mariel owns a daycare that employs eight staff members. Recently, while reviewing the daycare's health benefits plan with her group insurance agent Mariel inquired about putting a savings plan in place for her employees. Although the daycare is not in a financial position to contribute to such a savings plan, she feels very strongly that it is important for her young staff to have the opportunity to develop the habit of saving for retirement Which one of the following group plans would be most appropriate for Mariel's daycare? 3) A OBPP . OD A GRRSP Od A DCPP Od A DPSP Question 13 point Al her life has accumulated stooks bonds and gueranteed investment certificates. Now one year from retirement she would like a portfolio that is easier to manare. She would like to have a single product (preferably a segregated fund, for the peace of mind provided by the maturity and death benefit guarantees) that hould reflect the widest possible range of investment categories Which one of the following segregated funds would suit fill a) Agrowth tund b) An industry-specific fund Od An index fund Od Afund of funds Question 21 il card Sed Alexande 40 is sonde with a 10 yer old sor Aleandre's net worth an $150.000. HS RRSP investment portfolio totaling 550.000 s broken down as falons 508 n faed-rate GICs Maturing Dext month, 25% in intematonal inder- Inked GCS and 25$ a swings bonds He is looking for better growth from his investments without taking too much risk Which one of the following strategies would be suitable for him? Taster i svings bands to an internations segregated fund with a a 75V75% guarantee and a front-end sales charpe Surrendered his inder-Inked GICs and invest the sums in Canadian equity segregated funds with a 75/75% guarantee and deferred sales charge Upan maturtyol kis fixed-interest GIGS transfer them to equity segregated funds and Aalanced segregated funds with a 100%/100% guarantee and dels red sales charpe O Surrender tis savings bands and inder-inked Gics and invest them in a bond segregated and with a 100%/100% guarantee and a front-end sales charge Question 35 (1 point Curles invested $100.000 in a registered segregated fund four years ago. In the last two years Charles lost his job and separated from his wife, and his home was badly darzed by a flood. He needs the money in the segregated fund to try and red What steps wil Charles take in regard to cashing out the investment and how much will he receive? Charles will ask his life insurance agent to complete a claim form to terminate the contract and Charles will receive its market value minus withholding tax O by Charles will request a transfer of the investment to a non-registered account and make a withdrawal to receive its market value. La Charles and his wife insurance agent will complete and sign the withdrawal will withholding tax O Chades will complete a withdrawal form to terminate the contract and he will receive its market value minus surrender charges. Question 35 1 point) Syed is a recently licensed life agent and has just completed his first segregated fund sale. He has worked diligently with Mehmud to complete the application for X1 segregated fund that Syed recommended based on Mehmud's risk tolerance and investment goals Mehmud also expresses interest in X2 and X3 funds, though these are unsuitable choices for him What is required for Syed to implement the recommendation? a Forward the application for XI to the insurer and provide to Mehmud a Fund Facts within three days of the date of the application b) Review X1 Fund Facts with Mehmud and deliver an information folder. Og Deliver an information folder with a summary of key facts to Mehmud and review it with him. O Provide Mehmud wth an Xi Fund Facts to review, and provide the information folder when Mehmud agrees to proceed. Questar 2 and Mae and 65 very busy retree. He spends out sx months per yer travelling His porttalos mainly invested in a technology coman's stocks Abox messes investment ses rury because pe does not monitor his accounts When Gea a kezed ite ant meets with Mar to determine is income ad estate Akane she finden wides of the total vale of his assets What does normed for his swort? Os He meds to diversity lato bicherst investments that will reduce his epose tonterat risk and naton ist Heres to ensure te does not bear Old Age Security payments since his income way intake dowback wit apply and he will incur a recovery tax Od He recs professional investment management through fund investing so tutes diversified and make decisions based on the known value of ne He needs mestor edukatan tron Greta so that he can better understand now to acate the vaue his sets Question pand I Qudder comany GM be offers its employees a DBPP and has decided to set RESP lor is enabres Bobrze same as pertaining to Donald, a company employee for many years This year's ikan amants to $55.000 Letyear's come an unted to 49.000 Nourused contribution room This year's RRSS contribution limit stands at 18% Last year's person adjustment was 55.000 This year's person aquestment is $5.500 . . What is the main amount Donald can invest in his employer's GRRSP this year? Sus4.900 053820 TETAN LEI Mote wants to protect the savings he has acumubted over the years. Despite his madest come 1545.000 amaly and his financial responsibilities toward his er make and the foe-parald son, be manages to invest about $2.000 in his RRSPS each year. His RRSA are currently worth $24000 and are invested in Canadian and intematond equiy mutual funds since he has itdle investment knowledge, he relies on a friend for advice 12 Matheu bes in an apartment . His cris paid in ful and is worth $6,000. He has a credit card balance of 53,500 and does not have a fine of credit. He has no other investments besides his RRSS. What can be said about Matheus investments? cool they meet his need for an emergency hund O Thay sulit his novestor profile Od They lac diversification a Mey ensure capital preservation Seg) QUONI pony On terre 23 2018 a referendum was Deld in the United Kingdom (UK) to determine whether would stay in the Euroxan Union The outcome of the vote was in favour of lente called the Brext However, there is uncertainty about what the vote will man for the future of the country: Tin has invested an important part of his portfolio in UK donds and faces economic risk credit risk and possibly foreign excluent for hexe investments How should Tia mange s nisk in the future to minimize these kinds of risks? Restrict his mestments to those providing guwantees Decreuse dos risk tolerance and minimile dovesting in bonds. Od seek investments with an investor protection feature Albcate his investments so they are better diversified Question Smit Jos e de receives a monthy retirement income of $2000 that is indexed to the ast of Aung Hd RRSAconsist of the following $50,000 in an intemational uyted and $20.000 in a global band fund. Dodatne following isis lors most exposed? del Foreign exchange risk Od Liquidity risk K dation disk Time Les Question 14/1 pound Five years ago Lucreca inherited 10,000 from an old uncle. Having no intention of ever using that maney herself she invested it in an equity segregated fund, hoping to Bet med retums for when she leaves it to her daughter Roxy, who is the named beneficiary on the contract A sharp downturn in the stock market recently caused the value of Lucrecia's fund to muammet below $25.000. Still, Lucrecia is secure in the knowledge that if anything Appened to ber, Roxy would receive no less than $30,000. What feature unique to segregated funds gives Lucrecia this certainty? On The maturity guarantee of the death benefit guarantee Od the right of rescission 1d The CDIC coverage Time Les Question 14/1 pound Five years ago Lucreca inherited 10,000 from an old uncle. Having no intention of ever using that maney herself she invested it in an equity segregated fund, hoping to Bet med retums for when she leaves it to her daughter Roxy, who is the named beneficiary on the contract A sharp downturn in the stock market recently caused the value of Lucrecia's fund to muammet below $25.000. Still, Lucrecia is secure in the knowledge that if anything Appened to ber, Roxy would receive no less than $30,000. What feature unique to segregated funds gives Lucrecia this certainty? On The maturity guarantee of the death benefit guarantee Od the right of rescission 1d The CDIC coverage App Question 2011 point Genevieve has won $100,000 in the bottery and now wants to invest this amount Se has a very good risk tolerance and a long-term investment horizon. Furthermore, Genevidewho works for a firm of economists-is convinced that interest rates will nae on a regular basis over the next 10 years and is firm in her requirement that these interest rate increases not affect her investments, insofar as possible. What kind of investment from among the following could be suitable for Genevieve? Od GCS Lost Stocks Od corporate bonds Govemment of Canada bonds Question 23 point kapues and Martine are retired and looking for ways to save an income tax Given the difference in their respective Incomes their financial advisor recommends come saling because they quality for the persion hncome credit Jacques' annual income is COO and Martine's is $15,000. Their respective average tax rates are 185 and 6% How much income tax will lacques and Martine sove if $5,000 of bacques'income is moved to Martines? (Take into account that after the income splitting their respective nerave tax rates will be 15% and 103) 30,000 X 187 = 5400 S100 X 67 900 0215900 300 5750 3150 X87,567 6750 Od 5600 85550 Question 26 (paint Mathilde red 65, is seriously wl-though still mentally competent She has therefore granted her son in power of attomey so that he help mariage her investments. She has contacted her life insurance agent asking him to gather all the information needed ta 1) Transfer money from her balanced segregated fund into an income fund and 2) Convert der RRIF into a life annuity. Some signatures are required to complete the transactions Web his power of attorney, what can Jim do if he goes to the agent's office by Aimeat? 04 By providing a sigerature, Jim can authorize the two transactions requested by Mathilde ON By providing a signature, Jim can authorize the fund transfer, but Mathilde herself wil need to sign the documents for the RRIF conversion By providing a signature, Jim can authorize the RRIF conversion, but Mathilde herself will need to sign the documents for the fund transfer. Nothine Mathilde herself will need to sign both requests, since she is still mental competent 29- LLE Question / A pound back is exoted to be joining this new employer, one that offers group medical, dental. and retirement benefits to its employeesFor his meeting with Human Resources, he briges his completed application form for medical and dental coverage and a form to contribute to the GRRSP, as his employer matches contributions. The HR representatie returns his application forms for group benefits to lack and tells him that he is not eligible unti certain conditions are met Wher might back became eligible? After the number of days required by law to contribute to his GRRSP Ar the end of his GRRSP contribution vesting perlod. Od on the group plan's renewal date Led As the end of a standard waiting period Question 28/1 poiad Josean as a mully from a locked-in pension. While his spouse was originally named primary revocable beneficiary, Joseph realizes that his son from a previous are would derive greater benefit from it. Joseph contacts his life insurance rent to change beneficiary. How should Joseph's life insurance agent advise him? ay loseah, les spouse and his son must sign a change of beneficiary form and a change of contact information form O Joseph and his son must sign a change of beneficiary and a spousal waiver form to change the beneficiary Od Joseph must signa change of beneficiary form and his spouse must sign a Sausal waiver form Josera cennot change the beneficiary because his spouse was named as revocable beneficiary Question 29 (1 pune) Gead As a OSPP with his emabyer, and he was told that this constituted locked-in X HS emobyer's documents show that Gralds accumulated value in the plans S00200 Under what circumstances (other than retirement could Gerald cash in all or part of water The value of the plan can be cashed in if it is shown that Grald has a sinificantly longer life expectancy than initially anticipated. On the value of the plan can be ashed in if Gerald's financial assets grow Ayond his need The wake of the plan can be cashed in it Gerald leaves his job and sets up residence in a country other than Canada The value of the plan can be cashed in if it exceeds a pre-established Jd Question 31 part aby Ass exactly 3 years before retirement and expects her RRSP to grow by 3% amaly She antiquantes she will need $55.000 before taxes in her first year of restrament in delitian to CPPQPPI She determined from an annuity broker that she would be about $1 million to buy a lite annuity paying her $55,000 annually at rebirement What is the minimum amount Toby should currently have in her RRSP to reach $1 on in 3 years time? Asume as fact the projected 3% annual rate of retum) 215913,494 0 5914318 Od 8915142 Ca 5915965 Question 321 pohd and a resident of Ontaria plans to put a significant amount of cash in a long-term isediment. His an concens involve his chronic health issues. He has been Asaliedrecendy and while he is recovering he is still off work. He intends to vest As many kar income either in the XYZ dividend mutual fund or in a sergated had eesse underlying investments are units of the XYZ mutual fund. He entered for his entre estate to go to his two aduve children Mara fortart the key advantage of the segregated fund over the XYZ mutual 1) Assence of medical underwritime Lower margement fees Od Dox treatment of dividend income. de Ereampion from probate fees Question 33 (1 paint Mariel owns a daycare that employs eight staff members. Recently, while reviewing the daycare's health benefits plan with her group insurance agent Mariel inquired about putting a savings plan in place for her employees. Although the daycare is not in a financial position to contribute to such a savings plan, she feels very strongly that it is important for her young staff to have the opportunity to develop the habit of saving for retirement Which one of the following group plans would be most appropriate for Mariel's daycare? 3) A OBPP . OD A GRRSP Od A DCPP Od A DPSP Question 13 point Al her life has accumulated stooks bonds and gueranteed investment certificates. Now one year from retirement she would like a portfolio that is easier to manare. She would like to have a single product (preferably a segregated fund, for the peace of mind provided by the maturity and death benefit guarantees) that hould reflect the widest possible range of investment categories Which one of the following segregated funds would suit fill a) Agrowth tund b) An industry-specific fund Od An index fund Od Afund of funds Question 21 il card Sed Alexande 40 is sonde with a 10 yer old sor Aleandre's net worth an $150.000. HS RRSP investment portfolio totaling 550.000 s broken down as falons 508 n faed-rate GICs Maturing Dext month, 25% in intematonal inder- Inked GCS and 25$ a swings bonds He is looking for better growth from his investments without taking too much risk Which one of the following strategies would be suitable for him? Taster i svings bands to an internations segregated fund with a a 75V75% guarantee and a front-end sales charpe Surrendered his inder-Inked GICs and invest the sums in Canadian equity segregated funds with a 75/75% guarantee and deferred sales charge Upan maturtyol kis fixed-interest GIGS transfer them to equity segregated funds and Aalanced segregated funds with a 100%/100% guarantee and dels red sales charpe O Surrender tis savings bands and inder-inked Gics and invest them in a bond segregated and with a 100%/100% guarantee and a front-end sales charge Question 35 (1 point Curles invested $100.000 in a registered segregated fund four years ago. In the last two years Charles lost his job and separated from his wife, and his home was badly darzed by a flood. He needs the money in the segregated fund to try and red What steps wil Charles take in regard to cashing out the investment and how much will he receive? Charles will ask his life insurance agent to complete a claim form to terminate the contract and Charles will receive its market value minus withholding tax O by Charles will request a transfer of the investment to a non-registered account and make a withdrawal to receive its market value. La Charles and his wife insurance agent will complete and sign the withdrawal will withholding tax O Chades will complete a withdrawal form to terminate the contract and he will receive its market value minus surrender charges. Question 35 1 point) Syed is a recently licensed life agent and has just completed his first segregated fund sale. He has worked diligently with Mehmud to complete the application for X1 segregated fund that Syed recommended based on Mehmud's risk tolerance and investment goals Mehmud also expresses interest in X2 and X3 funds, though these are unsuitable choices for him What is required for Syed to implement the recommendation? a Forward the application for XI to the insurer and provide to Mehmud a Fund Facts within three days of the date of the application b) Review X1 Fund Facts with Mehmud and deliver an information folder. Og Deliver an information folder with a summary of key facts to Mehmud and review it with him. O Provide Mehmud wth an Xi Fund Facts to review, and provide the information folder when Mehmud agrees to proceed