Answered step by step

Verified Expert Solution

Question

1 Approved Answer

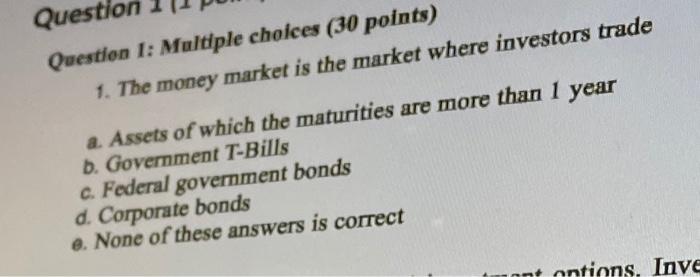

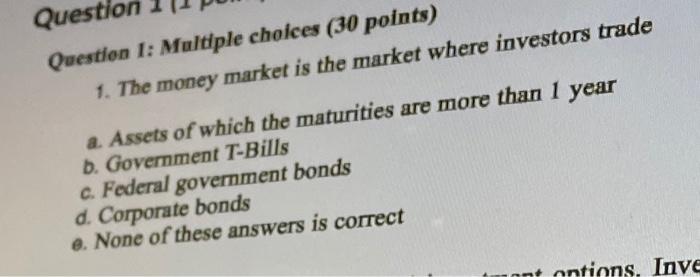

Questi Question 1: Multiple choices (30 points) 1. The money market is the market where investors trade a. Assets of which the maturities are more

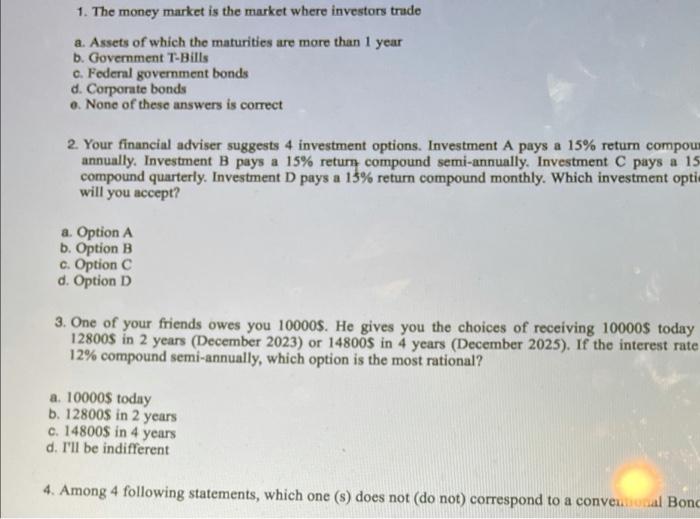

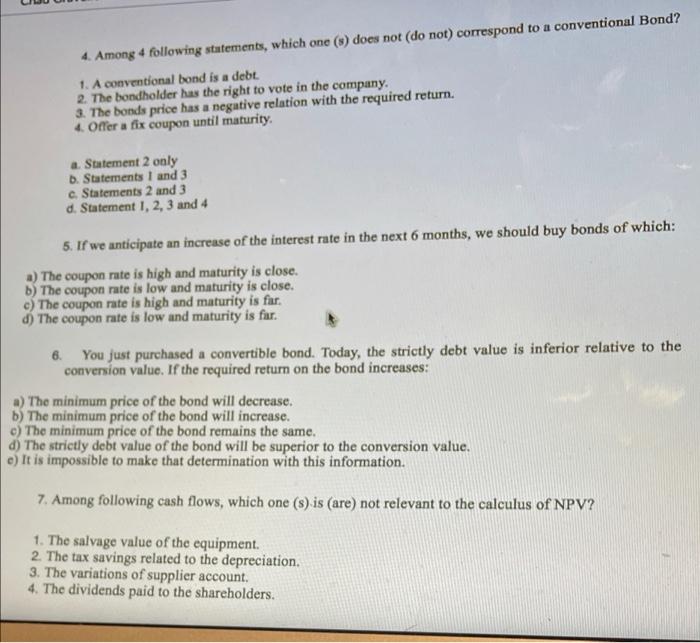

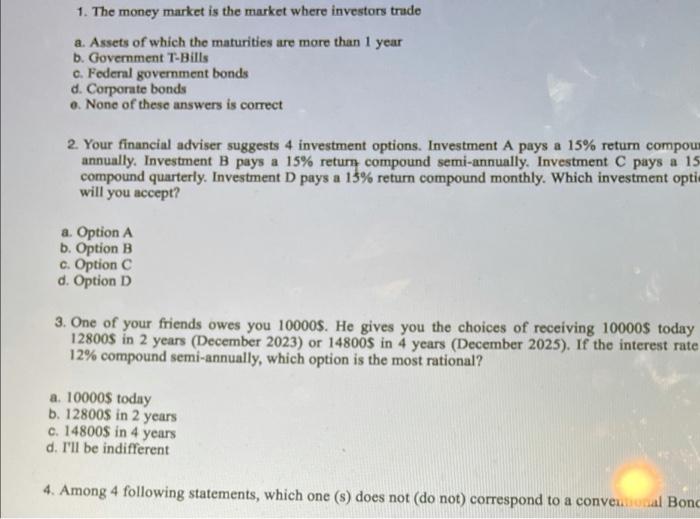

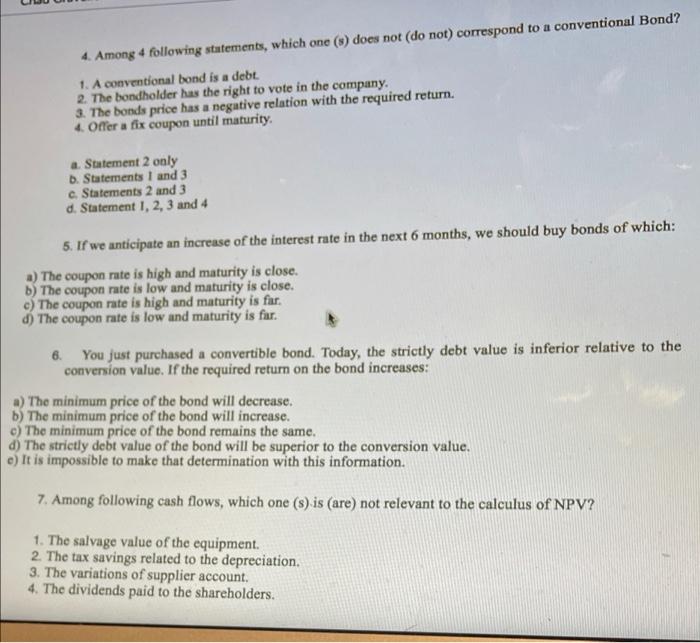

Questi Question 1: Multiple choices (30 points) 1. The money market is the market where investors trade a. Assets of which the maturities are more than 1 year b. Government T-Bills c. Federal government bonds d. Corporate bonds e. None of these answers is correct ont antions. Inve 1. The money market is the market where investors trade a. Assets of which the maturities are more than 1 year b. Government T-Bills c. Federal government bonds d. Corporate bonds a. None of these answers is correct 2. Your financial adviser suggests 4 investment options. Investment A pays a 15% return compou annually. Investment B pays a 15% return compound semi-annually. Investment C pays a 15 compound quarterly. Investment D pays a 15% return compound monthly. Which investment opti will you accept? a. Option A b. Option B c. Option C d. Option D 3. One of your friends owes you 10000s. He gives you the choices of receiving 10000$ today 128008 in 2 years (December 2023) or 14800S in 4 years (December 2025). If the interest rate 12% compound semi-annually, which option is the most rational? a. 10000$ today b. 128008 in 2 years c. 148005 in 4 years d. I'll be indifferent 4. Among 4 following statements, which one (s) does not (do not) correspond to a conventional Bond 4. Among 4 following statements, which one (s) does not (do not) correspond to a conventional Bond? 1. A conventional bond is a debt. 2. The bondholder has the right to vote in the company. 3. The bonds price has a negative relation with the required return. 4. Offer a fix coupon until maturity. a. Statement 2 only b. Statements 1 and 3 c. Statements 2 and 3 d. Statement 1, 2, 3 and 4 5. If we anticipate an increase of the interest rate in the next 6 months, we should buy bonds of which: a) The coupon rate is high and maturity is close. b) The coupon rate is low and maturity is close. c) The coupon rate is high and maturity is fur. d) The coupon rate is low and maturity is far. 6. You just purchased a convertible bond. Today, the strictly debt value is inferior relative to the conversion value. If the required return on the bond increases: a) The minimum price of the bond will decrease. b) The minimum price of the bond will increase. c) The minimum price of the bond remains the same. d) The strictly debt value of the bond will be superior to the conversion value. e) It is impossible to make that determination with this information. 7. Among following cash flows, which one (s) is (are) not relevant to the calculus of NPV? 1. The salvage value of the equipment. 2. The tax savings related to the depreciation. 3. The variations of supplier account. 4. The dividends paid to the shareholders

Questi Question 1: Multiple choices (30 points) 1. The money market is the market where investors trade a. Assets of which the maturities are more than 1 year b. Government T-Bills c. Federal government bonds d. Corporate bonds e. None of these answers is correct ont antions. Inve 1. The money market is the market where investors trade a. Assets of which the maturities are more than 1 year b. Government T-Bills c. Federal government bonds d. Corporate bonds a. None of these answers is correct 2. Your financial adviser suggests 4 investment options. Investment A pays a 15% return compou annually. Investment B pays a 15% return compound semi-annually. Investment C pays a 15 compound quarterly. Investment D pays a 15% return compound monthly. Which investment opti will you accept? a. Option A b. Option B c. Option C d. Option D 3. One of your friends owes you 10000s. He gives you the choices of receiving 10000$ today 128008 in 2 years (December 2023) or 14800S in 4 years (December 2025). If the interest rate 12% compound semi-annually, which option is the most rational? a. 10000$ today b. 128008 in 2 years c. 148005 in 4 years d. I'll be indifferent 4. Among 4 following statements, which one (s) does not (do not) correspond to a conventional Bond 4. Among 4 following statements, which one (s) does not (do not) correspond to a conventional Bond? 1. A conventional bond is a debt. 2. The bondholder has the right to vote in the company. 3. The bonds price has a negative relation with the required return. 4. Offer a fix coupon until maturity. a. Statement 2 only b. Statements 1 and 3 c. Statements 2 and 3 d. Statement 1, 2, 3 and 4 5. If we anticipate an increase of the interest rate in the next 6 months, we should buy bonds of which: a) The coupon rate is high and maturity is close. b) The coupon rate is low and maturity is close. c) The coupon rate is high and maturity is fur. d) The coupon rate is low and maturity is far. 6. You just purchased a convertible bond. Today, the strictly debt value is inferior relative to the conversion value. If the required return on the bond increases: a) The minimum price of the bond will decrease. b) The minimum price of the bond will increase. c) The minimum price of the bond remains the same. d) The strictly debt value of the bond will be superior to the conversion value. e) It is impossible to make that determination with this information. 7. Among following cash flows, which one (s) is (are) not relevant to the calculus of NPV? 1. The salvage value of the equipment. 2. The tax savings related to the depreciation. 3. The variations of supplier account. 4. The dividends paid to the shareholders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started