Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questio Select the ratio or analysis that best fits each description. HW Score: 7 7 . 8 5 % , 3 . 8 9 of

Questio

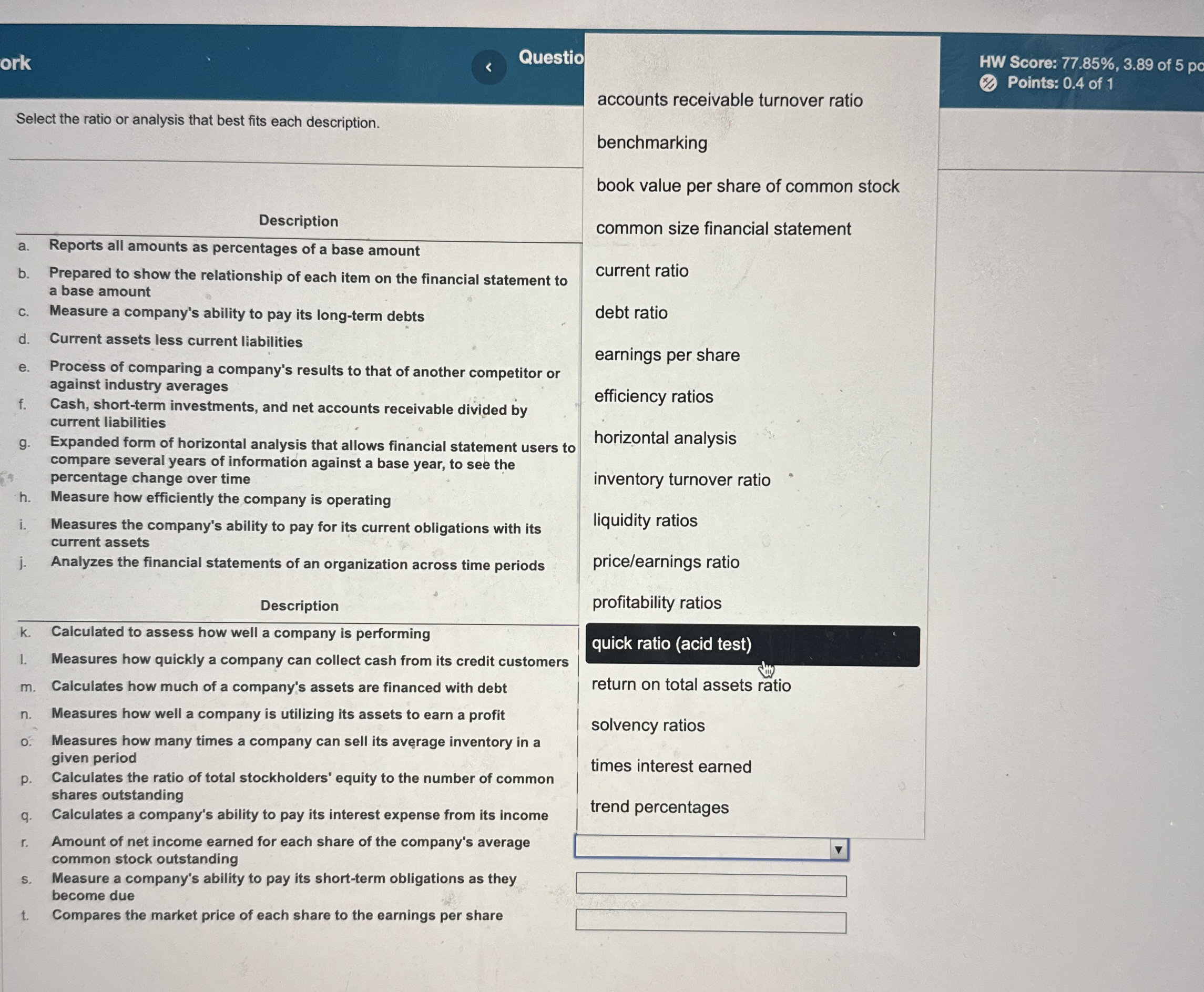

Select the ratio or analysis that best fits each description.

HW Score: of po

ork

Points: of

Description

a Reports all amounts as percentages of a base amount

b Prepared to show the relationship of each item on the financial statement to a base amount

c Measure a company's ability to pay its longterm debts

d Current assets less current liabilities

e Process of comparing a company's results to that of another competitor or against industry averages

f Cash, shortterm investments, and net accounts receivable divided by current liabilities

g Expanded form of horizontal analysis that allows financial statement users to compare several years of information against a base year, to see the percentage change over time

accounts receivable turnover ratio

benchmarking

book value per share of common stock

common size financial statement

current ratio

debt ratio

earnings per share

efficiency ratios

horizontal analysis

inventory turnover ratio

h Measure how efficiently the company is operating

i Measures the company's ability to pay for its current obligations with its current assets

j Analyzes the financial statements of an organization across time periods

Description

k Calculated to assess how well a company is performing

Measures how quickly a company can collect cash from its credit customers

m Calculates how much of a company's assets are financed with debt

n Measures how well a company is utilizing its assets to earn a profit

o Measures how many times a company can sell its avrage inventory in a given period

p Calculates the ratio of total stockholders' equity to the number of common shares outstanding

q Calculates a company's ability to pay its interest expense from its income

liquidity ratios

priceearnings ratio

profitability ratios

quick ratio acid test

r Amount of net income earned for each share of the company's average common stock outstanding

s Measure a company's ability to pay its shortterm obligations as they become due

t Compares the market price of each share to the earnings per share

JUST KT PLEASE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started