Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 03 15 MARKS (a) NZ IAS 38 provides different reporting requirements for intangible assets as compared to the reporting requirements for PPE provided by

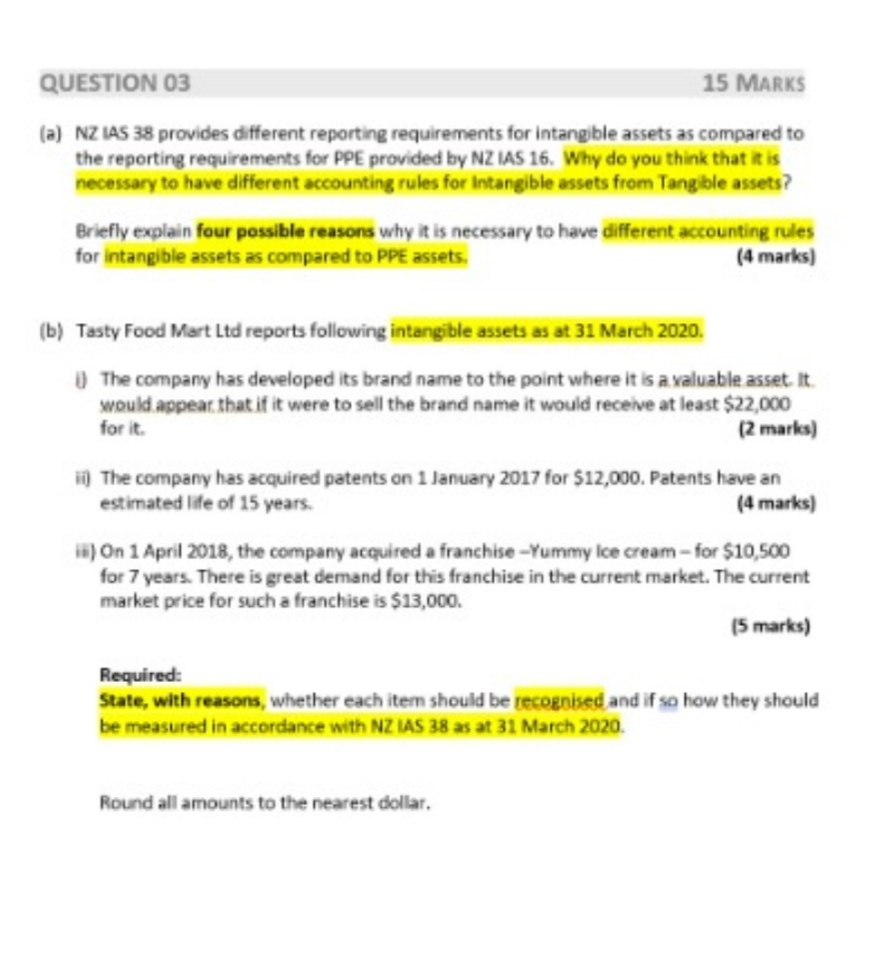

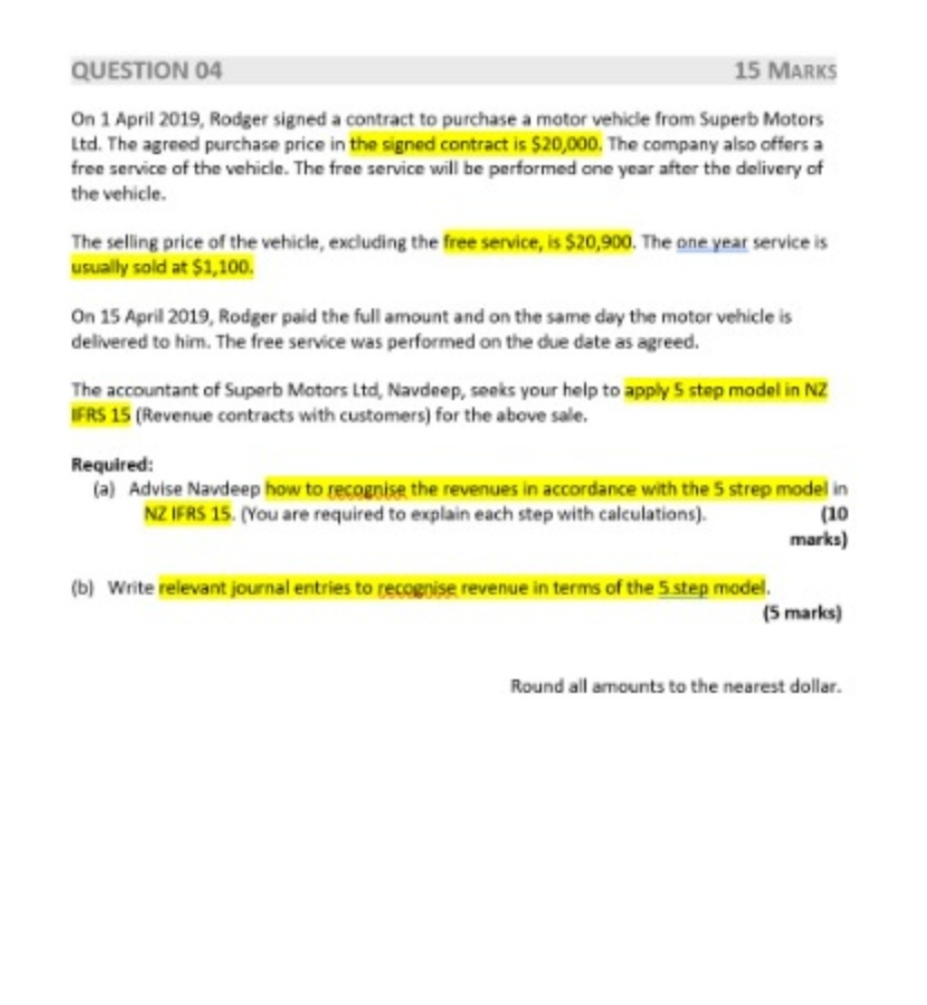

QUESTION 03 15 MARKS (a) NZ IAS 38 provides different reporting requirements for intangible assets as compared to the reporting requirements for PPE provided by NZ IAS 16. Why do you think that it is necessary to have different accounting rules for Intangible assets from Tangible assets? Briefly explain four possible reasons why it is necessary to have different accounting rules for intangible assets as compared to PPE assets. (4 marks) (b) Tasty Food Mart Ltd reports following intangible assets as at 31 March 2020. The company has developed its brand name to the point where it is a valuable asset. It would appear. that if it were to sell the brand name it would receive at least $22,000 for it. (2 marks) 1) The company has acquired patents on 1 January 2017 for $12,000. Patents have an estimated life of 15 years. (4 marks) 1) On 1 April 2018, the company acquired a franchise -Yummy ice cream for $10,500 for 7 years. There is great demand for this franchise in the current market. The current market price for such a franchise is $13,000 15 marks) Required: State, with reasons, whether each item should be recognised and if so how they should be measured in accordance with NZ IAS 38 as at 31 March 2020 Round all amounts to the nearest dollar. QUESTION 04 15 MARKS On 1 April 2019, Rodger signed a contract to purchase a motor vehicle from Superb Motors Ltd. The agreed purchase price in the signed contract is $20,000. The company also offers a free service of the vehicle. The free service will be performed one year after the delivery of the vehicle. The selling price of the vehicle,excluding the free service, is $20,900. The one year service is usually sold at $1,100. On 15 April 2019, Rodger paid the full amount and on the same day the motor vehicle is delivered to him. The free service was performed on the due date as agreed. The accountant of Superb Motors Ltd, Navdeep, seeks your help to apply step model in NZ IFRS 15 (Revenue contracts with customers) for the above sale. Required: (a) Advise Navdeep how to recognise the revenues in accordance with the 5 strep model in NZ IFRS 15. (You are required to explain each step with calculations). (10 marks) (b) Write relevant journal entries to recognise revenue in terms of the 5 step model (5 marks) Round all amounts to the nearest dollar. QUESTION 03 15 MARKS (a) NZ IAS 38 provides different reporting requirements for intangible assets as compared to the reporting requirements for PPE provided by NZ IAS 16. Why do you think that it is necessary to have different accounting rules for Intangible assets from Tangible assets? Briefly explain four possible reasons why it is necessary to have different accounting rules for intangible assets as compared to PPE assets. (4 marks) (b) Tasty Food Mart Ltd reports following intangible assets as at 31 March 2020. The company has developed its brand name to the point where it is a valuable asset. It would appear. that if it were to sell the brand name it would receive at least $22,000 for it. (2 marks) 1) The company has acquired patents on 1 January 2017 for $12,000. Patents have an estimated life of 15 years. (4 marks) 1) On 1 April 2018, the company acquired a franchise -Yummy ice cream for $10,500 for 7 years. There is great demand for this franchise in the current market. The current market price for such a franchise is $13,000 15 marks) Required: State, with reasons, whether each item should be recognised and if so how they should be measured in accordance with NZ IAS 38 as at 31 March 2020 Round all amounts to the nearest dollar. QUESTION 04 15 MARKS On 1 April 2019, Rodger signed a contract to purchase a motor vehicle from Superb Motors Ltd. The agreed purchase price in the signed contract is $20,000. The company also offers a free service of the vehicle. The free service will be performed one year after the delivery of the vehicle. The selling price of the vehicle,excluding the free service, is $20,900. The one year service is usually sold at $1,100. On 15 April 2019, Rodger paid the full amount and on the same day the motor vehicle is delivered to him. The free service was performed on the due date as agreed. The accountant of Superb Motors Ltd, Navdeep, seeks your help to apply step model in NZ IFRS 15 (Revenue contracts with customers) for the above sale. Required: (a) Advise Navdeep how to recognise the revenues in accordance with the 5 strep model in NZ IFRS 15. (You are required to explain each step with calculations). (10 marks) (b) Write relevant journal entries to recognise revenue in terms of the 5 step model (5 marks) Round all amounts to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started