Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION # 03 Unilever Inc. is considering the manufacture of new small Power Generators which would involve use of both new machinery (costing $160,000) and

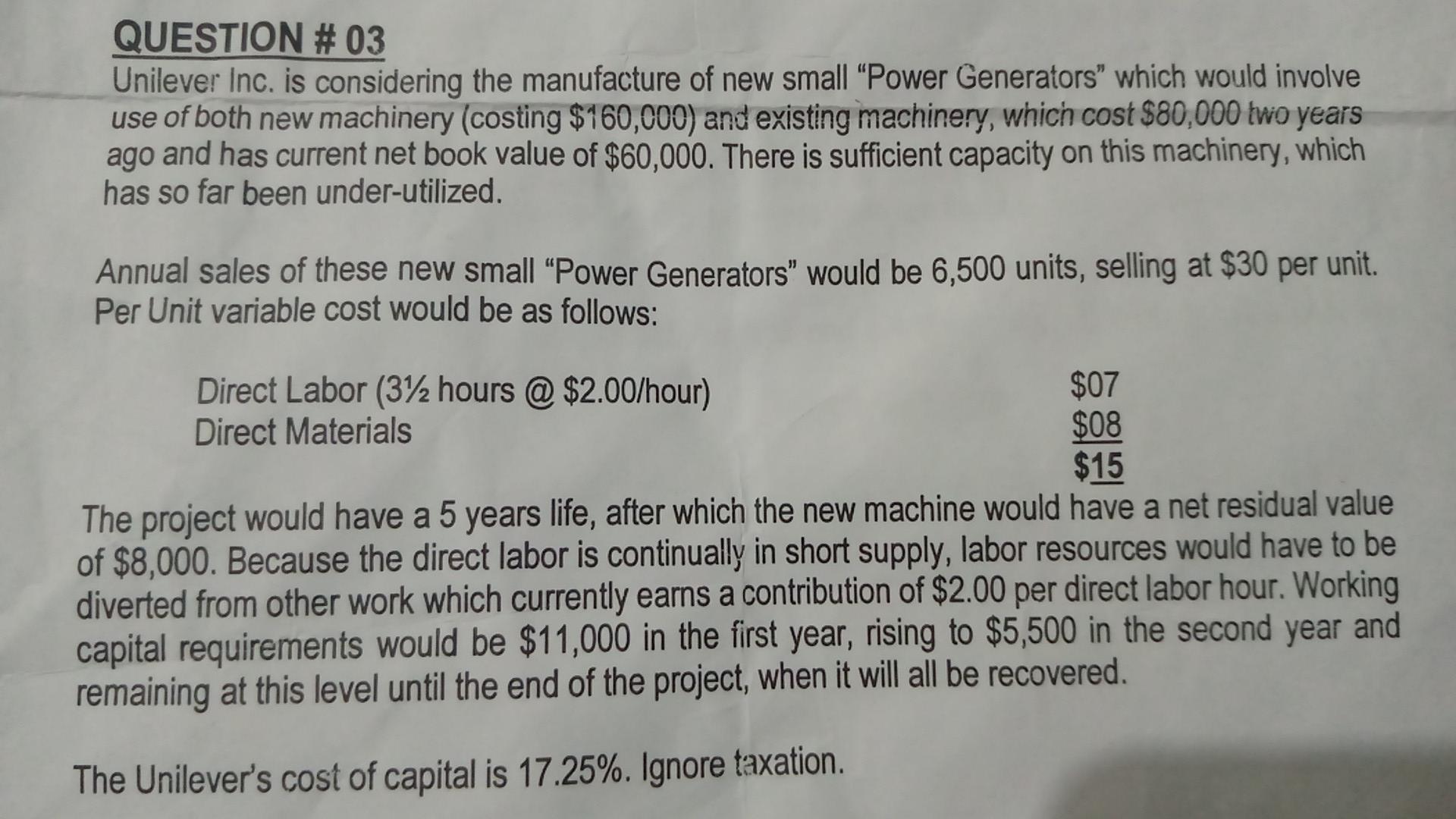

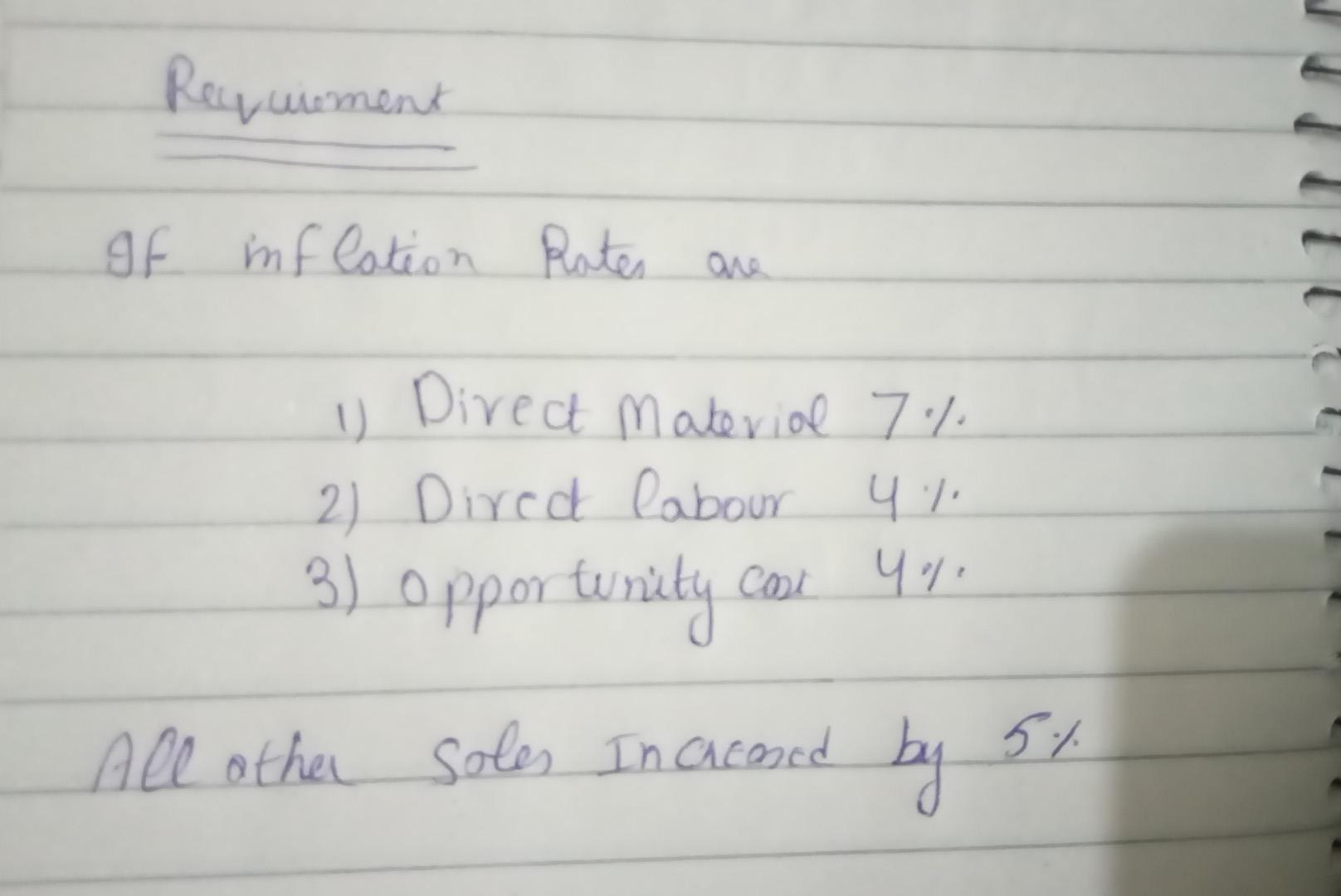

QUESTION # 03 Unilever Inc. is considering the manufacture of new small "Power Generators" which would involve use of both new machinery (costing $160,000) and existing machinery, which cost $80,000 two years ago and has current net book value of $60,000. There is sufficient capacity on this machinery, which has so far been under-utilized. Annual sales of these new small "Power Generators" would be 6,500 units, selling at $30 per unit. Per Unit variable cost would be as follows: Direct Labor (372 hours @ $2.00/hour) $07 Direct Materials $08 $15 The project would have a 5 years life, after which the new machine would have a net residual value of $8,000. Because the direct labor is continually in short supply, labor resources would have to be diverted from other work which currently earns a contribution of $2.00 per direct labor hour. Working capital requirements would be $11,000 in the first year, rising to $5,500 in the second year and remaining at this level until the end of the project, when it will all be recovered. The Unilever's cost of capital is 17.25%. Ignore taxation. Requement IF inflation Rates are u Direct Material 7% 2) Dired labour 4% 3) 3) opportunity could you All other soles Increased by 5% QUESTION # 03 Unilever Inc. is considering the manufacture of new small "Power Generators" which would involve use of both new machinery (costing $160,000) and existing machinery, which cost $80,000 two years ago and has current net book value of $60,000. There is sufficient capacity on this machinery, which has so far been under-utilized. Annual sales of these new small "Power Generators" would be 6,500 units, selling at $30 per unit. Per Unit variable cost would be as follows: Direct Labor (372 hours @ $2.00/hour) $07 Direct Materials $08 $15 The project would have a 5 years life, after which the new machine would have a net residual value of $8,000. Because the direct labor is continually in short supply, labor resources would have to be diverted from other work which currently earns a contribution of $2.00 per direct labor hour. Working capital requirements would be $11,000 in the first year, rising to $5,500 in the second year and remaining at this level until the end of the project, when it will all be recovered. The Unilever's cost of capital is 17.25%. Ignore taxation. Requement IF inflation Rates are u Direct Material 7% 2) Dired labour 4% 3) 3) opportunity could you All other soles Increased by 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started